Instructions For Filing The Paper Ia 1040a Short Form

ADVERTISEMENT

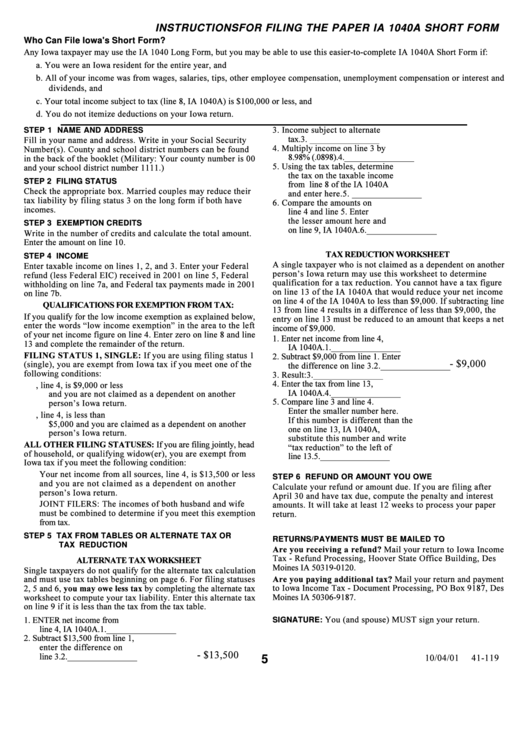

INSTRUCTIONS FOR FILING THE PAPER IA 1040A SHORT FORM

Who Can File Iowa's Short Form?

STEP 1 NAME AND ADDRESS

STEP 2 FILING STATUS

STEP 3 EXEMPTION CREDITS

TAX REDUCTION WORKSHEET

STEP 4 INCOME

QUALIFICATIONS FOR EXEMPTION FROM TAX:

FILING STATUS 1, SINGLE:

- $9,000

ALL OTHER FILING STATUSES:

STEP 6 REFUND OR AMOUNT YOU OWE

STEP 5 TAX FROM TABLES OR ALTERNATE TAX OR

RETURNS/PAYMENTS MUST BE MAILED TO

TAX REDUCTION

Are you receiving a refund?

ALTERNATE TAX WORKSHEET

Are you paying additional tax?

you may owe less tax

SIGNATURE:

- $13,500

10/04/01

41-119

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9