000101151

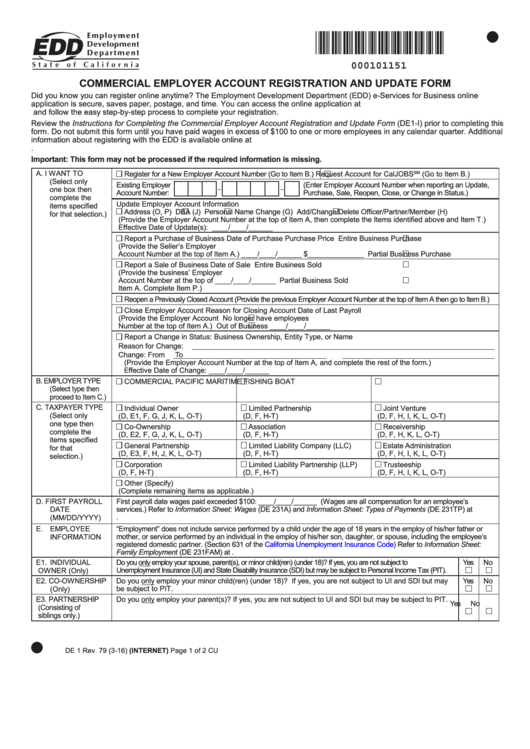

COMMERCIAL EMPLOYER ACCOUNT REGISTRATION AND UPDATE FORM

Did you know you can register online anytime? The Employment Development Department (EDD) e-Services for Business online

application is secure, saves paper, postage, and time. You can access the online application at

and follow the easy step-by-step process to complete your registration.

Review the Instructions for Completing the Commercial Employer Account Registration and Update Form (DE1-I) prior to completing this

form. Do not submit this form until you have paid wages in excess of $100 to one or more employees in any calendar quarter. Additional

information about registering with the EDD is available online at

Important: This form may not be processed if the required information is missing.

A. I WANT TO

Register for a New Employer Account Number (Go to Item B.)

Request Account for CalJOBS

(Go to Item B.)

SM

(Select only

Existing Employer

(Enter Employer Account Number when reporting an Update,

one box then

–

–

Account Number:

Purchase, Sale, Reopen, Close, or Change in Status.)

complete the

Update Employer Account Information

items specified

Address (O, P)

DBA (J)

Personal Name Change (G)

Add/Change/Delete Officer/Partner/Member (H)

for that selection.)

(Provide the Employer Account Number at the top of Item A, then complete the Items identified above and Item T.)

Effective Date of Update(s): ____/____/______

Report a Purchase of Business

Date of Purchase

Purchase Price

Entire Business Purchase

(Provide the Seller’s Employer

Account Number at the top of Item A.) ____/____/______

$______________

Partial Business Purchase

Report a Sale of Business

Date of Sale

Entire Business Sold

(Provide the business’ Employer

Account Number at the top of

____/____/______

Partial Business Sold

Item A. Complete Item P.)

Reopen a Previously Closed Account (Provide the previous Employer Account Number at the top of Item A then go to Item B.)

Close Employer Account

Reason for Closing Account

Date of Last Payroll

(Provide the Employer Account

No longer have employees

Number at the top of Item A.)

Out of Business

____/____/______

Report a Change in Status: Business Ownership, Entity Type, or Name

Reason for Change:

Change: From

To

(Provide the Employer Account Number at the top of Item A, and complete the rest of the form.)

Effective Date of Change: ____/____/______

B. EMPLOYER TYPE

COMMERCIAL

PACIFIC MARITIME

FISHING BOAT

(Select type then

proceed to Item C.)

C. TAXPAYER TYPE

Individual Owner

Limited Partnership

Joint Venture

(Select only

(D, E1, F, G, J, K, L, O-T)

(D, F, H-T)

(D, F, H, I, K, L, O-T)

one type then

Co-Ownership

Association

Receivership

complete the

(D, E2, F, G, J, K, L, O-T)

(D, F, H-T)

(D, F, H, K, L, O-T)

items specified

General Partnership

Limited Liability Company (LLC)

Estate Administration

for that

(D, E3, F, H, J, K, L, O-T)

(D, F, H-T)

(D, F, H, I, K, L, O-T)

selection.)

Corporation

Limited Liability Partnership (LLP)

Trusteeship

(D, F, H-T)

(D, F, H-T)

(D, F, H, I, K, L, O-T)

Other (Specify)

(Complete remaining items as applicable.)

D. FIRST PAYROLL

First payroll date wages paid exceeded $100: ____/____/______ (Wages are all compensation for an employee’s

services.) Refer to Information Sheet: Wages (DE 231A) and Information Sheet: Types of Payments (DE 231TP) at

DATE

(MM/DD/YYYY)

E. EMPLOYEE

“Employment” does not include service performed by a child under the age of 18 years in the employ of his/her father or

INFORMATION

mother, or service performed by an individual in the employ of his/her son, daughter, or spouse, including the employee’s

registered domestic partner. (Section 631 of the

California Unemployment Insurance

Code) Refer to Information Sheet:

Family Employment (DE 231FAM) at

E1. INDIVIDUAL

Do you only employ your spouse, parent(s), or minor child(ren) (under 18)? If yes, you are not subject to

Yes

No

OWNER (Only)

Unemployment Insurance (UI) and State Disability Insurance (SDI) but may be subject to Personal Income Tax (PIT).

E2. CO-OWNERSHIP

Do you only employ your minor child(ren) (under 18)? If yes, you are not subject to UI and SDI but may

Yes

No

(Only)

be subject to PIT.

E3. PARTNERSHIP

Do you only employ your parent(s)? If yes, you are not subject to UI and SDI but may be subject to PIT.

Yes

No

(Consisting of

siblings only.)

DE 1 Rev. 79 (3-16) (INTERNET)

Page 1 of 2

CU

1

1 2

2