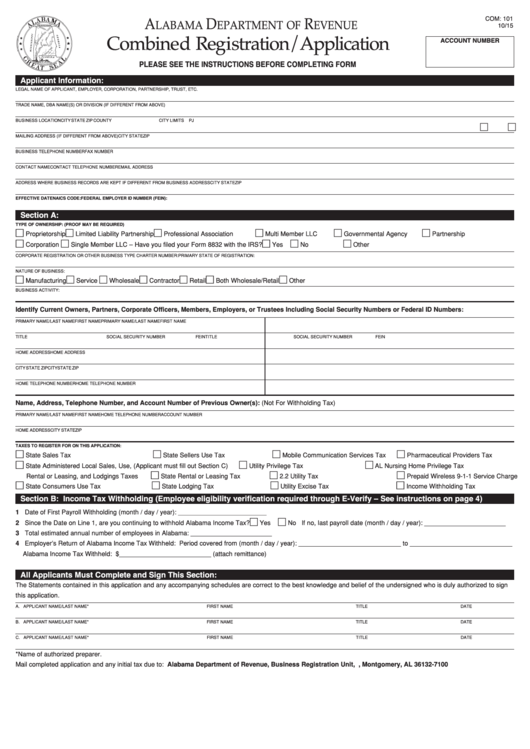

COM: 101

10/15

A

D

r

Reset

lAbAmA

epArtment of

evenue

Combined registration/ Application

ACCOUNT NUMBER

PLEASE SEE THE INSTRUCTIONS BEFORE COMPLETING FORM

Applicant Information:

LEGAL NAME OF APPLICANT, EMPLOYER, CORPORATION, PARTNERSHIP, TRUST, ETC.

TRADE NAME, DBA NAME(S) OR DIVISION (IF DIFFERENT FROM ABOVE)

BUSINESS LOCATION

CITY

STATE

ZIP

COUNTY

CITY LIMITS PJ

MAILING ADDRESS (IF DIFFERENT FROM ABOVE)

CITY

STATE

ZIP

BUSINESS TELEPHONE NUMBER

FAX NUMBER

CONTACT NAME

CONTACT TELEPHONE NUMBER

EMAIL ADDRESS

ADDRESS WHERE BUSINESS RECORDS ARE KEPT IF DIFFERENT FROM BUSINESS ADDRESS

CITY

STATE

ZIP

EFFECTIVE DATE

NAICS CODE:

FEDERAL EMPLOYER ID NUMBER (FEIN):

Section A:

TYPE OF OWNERSHIP: (PROOF MAY BE REQUIRED)

Proprietorship

Limited Liability Partnership

Professional Association

Multi Member LLC

Governmental Agency

Partnership

Corporation

Single Member LLC – Have you filed your Form 8832 with the IRS?

Yes

No

Other

CORPORATE REGISTRATION OR OTHER BUSINESS TYPE CHARTER NUMBER:

PRIMARY STATE OF REGISTRATION:

NATURE OF BUSINESS:

Manufacturing

Service

Wholesale

Contractor

Retail

Both Wholesale/Retail

Other

BUSINESS ACTIVITY:

Identify Current Owners, Partners, Corporate Officers, Members, Employers, or Trustees Including Social Security Numbers or Federal ID Numbers:

PRIMARY NAME/LAST NAME

FIRST NAME

PRIMARY NAME/LAST NAME

FIRST NAME

TITLE

SOCIAL SECURITY NUMBER

FEIN

TITLE

SOCIAL SECURITY NUMBER

FEIN

HOME ADDRESS

HOME ADDRESS

CITY

STATE

ZIP

CITY

STATE

ZIP

HOME TELEPHONE NUMBER

HOME TELEPHONE NUMBER

Name, Address, Telephone Number, and Account Number of Previous Owner(s): (Not For Withholding Tax)

PRIMARY NAME/LAST NAME

FIRST NAME

HOME TELEPHONE NUMBER

ACCOUNT NUMBER

HOME ADDRESS

CITY

STATE

ZIP

TAXES TO REGISTER FOR ON THIS APPLICATION:

State Sales Tax

State Sellers Use Tax

Mobile Communication Services Tax

Pharmaceutical Providers Tax

State Administered Local Sales, Use,

(Applicant must fill out Section C)

Utility Privilege Tax

AL Nursing Home Privilege Tax

Rental or Leasing, and Lodgings Taxes

State Rental or Leasing Tax

2.2 Utility Tax

Prepaid Wireless 9-1-1 Service Charge

State Consumers Use Tax

State Lodging Tax

Utility Excise Tax

Income Withholding Tax

Section B: Income Tax Withholding (Employee eligibility verification required through E-Verify – See instructions on page 4)

1 Date of First Payroll Withholding (month / day / year): _________________________

2 Since the Date on Line 1, are you continuing to withhold Alabama Income Tax?

Yes

No If no, last payroll date (month / day / year): _______________________

3 Total estimated annual number of employees in Alabama: _______________________

4 Employer’s Return of Alabama Income Tax Withheld: Period covered from (month / day / year): _____________________________ to _____________________________

Alabama Income Tax Withheld: $__________________________ (attach remittance)

NOTE: Individual owners and partnerships which do not have employees should not apply for an Alabama withholding tax account number.

All Applicants Must Complete and Sign This Section:

The Statements contained in this application and any accompanying schedules are correct to the best knowledge and belief of the undersigned who is duly authorized to sign

this application.

A. APPLICANT NAME/LAST NAME*

FIRST NAME

TITLE

DATE

B. APPLICANT NAME/LAST NAME*

FIRST NAME

TITLE

DATE

C. APPLICANT NAME/LAST NAME*

FIRST NAME

TITLE

DATE

*Name of authorized preparer.

Mail completed application and any initial tax due to: Alabama Department of Revenue, Business Registration Unit, P.O. Box 327100, Montgomery, AL 36132-7100

1

1 2

2