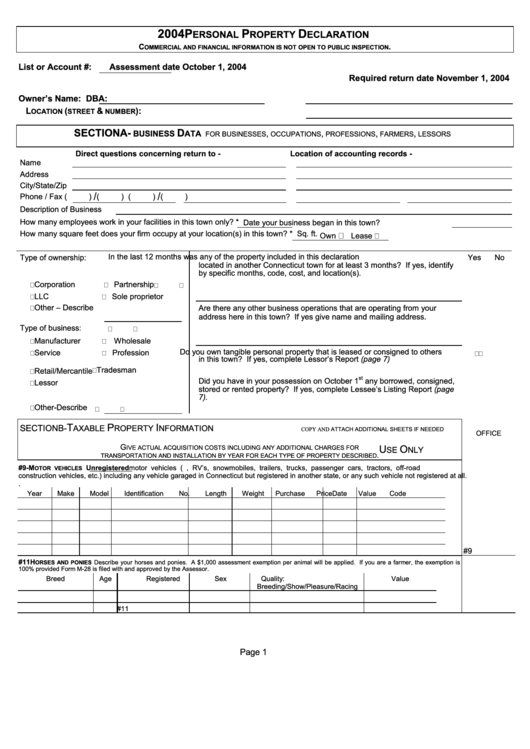

2004 Personal Property Declaration

ADVERTISEMENT

2004 P

P

D

ERSONAL

ROPERTY

ECLARATION

C

.

OMMERCIAL AND FINANCIAL INFORMATION IS NOT OPEN TO PUBLIC INSPECTION

List or Account #:

Assessment date October 1, 2004

Required return date November 1, 2004

Owner’s Name:

DBA:

L

(

&

):

OCATION

STREET

NUMBER

SECTION A -

D

,

,

,

,

BUSINESS

ATA

FOR BUSINESSES

OCCUPATIONS

PROFESSIONS

FARMERS

LESSORS

Direct questions concerning return to -

Location of accounting records -

Name

Address

City/State/Zip

/

/

Phone / Fax

(

)

(

)

(

)

(

)

Description of Business

How many employees work in your facilities in this town only?

*

Date your business began in this town?

How many square feet does your firm occupy at your location(s) in this town?

*

Sq. ft.

Own

Lease

In the last 12 months was any of the property included in this declaration

Type of ownership:

Yes

No

located in another Connecticut town for at least 3 months? If yes, identify

by specific months, code, cost, and location(s).

Corporation

Partnership

LLC

Sole proprietor

Other – Describe

Are there any other business operations that are operating from your

address here in this town? If yes give name and mailing address.

Type of business:

Manufacturer

Wholesale

Do you own tangible personal property that is leased or consigned to others

Service

Profession

in this town? If yes, complete Lessor’s Report (page 7)

Tradesman

Retail/Mercantile

st

Did you have in your possession on October 1

any borrowed, consigned,

Lessor

stored or rented property? If yes, complete Lessee’s Listing Report (page

7).

Other-Describe

T

P

I

SECTION B -

AXABLE

ROPERTY

NFORMATION

COPY AND ATTACH ADDITIONAL SHEETS IF NEEDED

OFFICE

G

U

O

IVE ACTUAL ACQUISITION COSTS INCLUDING ANY ADDITIONAL CHARGES FOR

SE

NLY

.

TRANSPORTATION AND INSTALLATION BY YEAR FOR EACH TYPE OF PROPERTY DESCRIBED

#9- M

Unregistered motor vehicles (e.g. campers, RV’s, snowmobiles, trailers, trucks, passenger cars, tractors, off-road

OTOR VEHICLES

construction vehicles, etc.) including any vehicle garaged in Connecticut but registered in another state, or any such vehicle not registered at all.

.

Year

Make

Model

Identification No.

Length

Weight

Purchase Price

Date

Value

Code

#9

#11 H

Describe your horses and ponies. A $1,000 assessment exemption per animal will be applied. If you are a farmer, the exemption is

ORSES AND PONIES

100% provided Form M-28 is filed with and approved by the Assessor.

Breed

Age

Registered

Sex

Quality:

Value

Breeding/Show/Pleasure/Racing

#11

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6