Application Form For Refund From The Local Services Tax (Lst) - 2009

ADVERTISEMENT

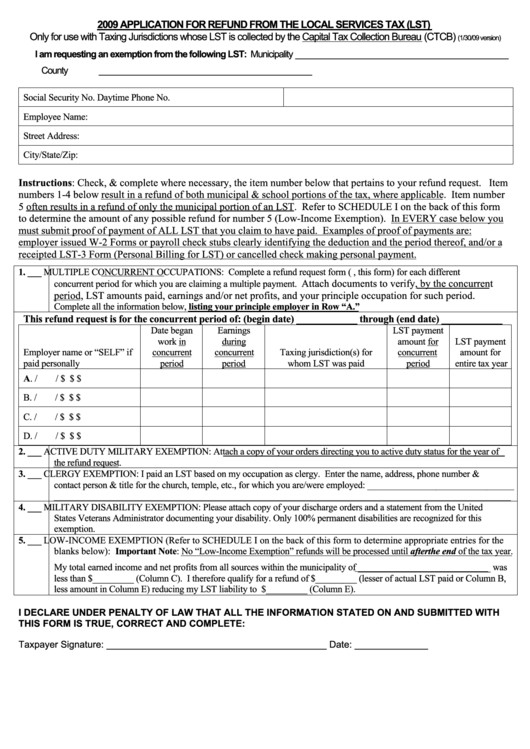

2009 APPLICATION FOR REFUND FROM THE LOCAL SERVICES TAX (LST)

Only for use with Taxing Jurisdictions whose LST is collected by the Capital Tax Collection Bureau (CTCB)

(1/30/09 version)

I am requesting an exemption from the following LST: Municipality ______________________________________________

County ______________________________________________

Social Security No.

Daytime Phone No.

Employee Name:

Street Address:

City/State/Zip:

Instructions: Check, & complete where necessary, the item number below that pertains to your refund request. Item

numbers 1-4 below result in a refund of both municipal & school portions of the tax, where applicable. Item number

5 often results in a refund of only the municipal portion of an LST. Refer to SCHEDULE I on the back of this form

to determine the amount of any possible refund for number 5 (Low-Income Exemption). In EVERY case below you

must submit proof of payment of ALL LST that you claim to have paid. Examples of proof of payments are:

employer issued W-2 Forms or payroll check stubs clearly identifying the deduction and the period thereof, and/or a

receipted LST-3 Form (Personal Billing for LST) or cancelled check making personal payment.

1. ___

MULTIPLE CONCURRENT OCCUPATIONS: Complete a refund request form (i.e., this form) for each different

Attach documents to verify, by the concurrent

concurrent period for which you are claiming a multiple payment.

period, LST amounts paid, earnings and/or net profits, and your principle occupation for such period.

Complete all the information below, listing your principle employer in Row “A.”

This refund request is for the concurrent period of: (begin date) ____________ through (end date) ____________

Date began

Earnings

LST payment

work in

during

amount for

LST payment

Employer name or “SELF” if

concurrent

concurrent

Taxing jurisdiction(s) for

concurrent

amount for

paid personally

period

period

whom LST was paid

period

entire tax year

A.

/

/

$

$

$

B.

/

/

$

$

$

C.

/

/

$

$

$

D.

/

/

$

$

$

2. ___

ACTIVE DUTY MILITARY EXEMPTION: Attach a copy of your orders directing you to active duty status for the year of

the refund request.

3. ___

CLERGY EXEMPTION: I paid an LST based on my occupation as clergy. Enter the name, address, phone number &

contact person & title for the church, temple, etc., for which you are/were employed: ________________________________

____________________________________________________________________________________________________

4. ___

MILITARY DISABILITY EXEMPTION: Please attach copy of your discharge orders and a statement from the United

States Veterans Administrator documenting your disability. Only 100% permanent disabilities are recognized for this

exemption.

5. ___

LOW-INCOME EXEMPTION (Refer to SCHEDULE I on the back of this form to determine appropriate entries for the

blanks below): Important Note: No “Low-Income Exemption” refunds will be processed until after the end of the tax year.

My total earned income and net profits from all sources within the municipality of _____________________________ was

less than $_________ (Column C). I therefore qualify for a refund of $_________ (lesser of actual LST paid or Column B,

less amount in Column E) reducing my LST liability to $_________ (Column E).

I DECLARE UNDER PENALTY OF LAW THAT ALL THE INFORMATION STATED ON AND SUBMITTED WITH

THIS FORM IS TRUE, CORRECT AND COMPLETE:

Taxpayer Signature: __________________________________________ Date: ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1