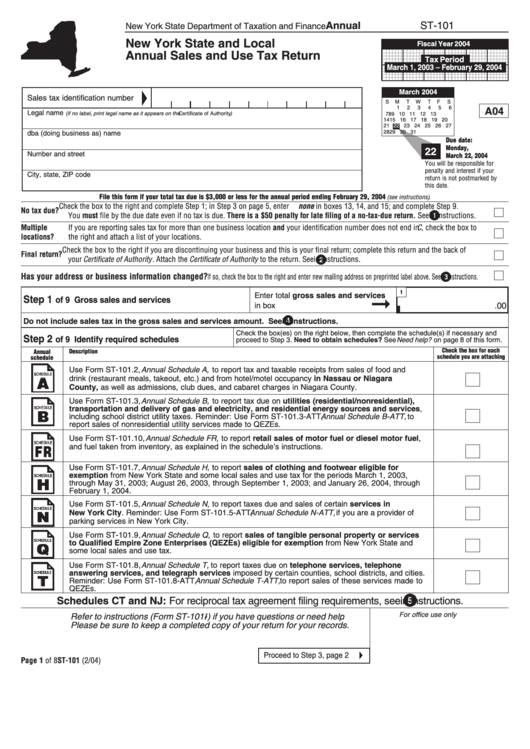

Form St-101 - New York State And Local Annual Sales And Use Tax Return

ADVERTISEMENT

Annual

ST-101

New York State Department of Taxation and Finance

New York State and Local

Fiscal Year 2004

Annual Sales and Use Tax Return

Tax Period

March 1, 2003 – February 29, 2004

March 2004

Sales tax identification number

S

M

T

W

T

F

S

1

2

3

4

5

6

A04

Legal name

(if no label, print legal name as it appears on the Certificate of Authority )

7

8

9 10 11 12 13

14 15 16 17 18 19 20

21

22

23 24 25 26 27

28 29 30 31

dba (doing business as) name

Due date:

Monday,

22

Number and street

March 22, 2004

You will be responsible for

penalty and interest if your

City, state, ZIP code

return is not postmarked by

this date.

File this form if your total tax due is $3,000 or less for the annual period ending February 29, 2004

(see instructions) .

Check the box to the right and complete Step 1; in Step 3 on page 5, enter none in boxes 13, 14, and 15; and complete Step 9.

No tax due?

You must file by the due date even if no tax is due. There is a $50 penalty for late filing of a no-tax-due return. See

in instructions.

Multiple

If you are reporting sales tax for more than one business location and your identification number does not end in C, check the box to

locations?

the right and attach a list of your locations. ....................................................................................................................................................

Check the box to the right if you are discontinuing your business and this is your final return; complete this return and the back of

Final return?

your Certificate of Authority . Attach the Certificate of Authority to the return. See

in instructions. ...........................................................

Has your address or business information changed?

If so, check the box to the right and enter new mailing address on preprinted label above. See

in instructions.

1

Enter total gross sales and services

➞

Step 1

of 9 Gross sales and services

in box 1 ......................................

.00

Do not include sales tax in the gross sales and services amount. See

in instructions.

Check the box(es) on the right below, then complete the schedule(s) if necessary and

Step 2

of 9 Identify required schedules

proceed to Step 3. Need to obtain schedules? See Need help? on page 8 of this form.

Check the box for each

Description

Annual

schedule you are attaching

schedule

Use Form ST-101.2, Annual Schedule A, to report tax and taxable receipts from sales of food and

drink (restaurant meals, takeout, etc.) and from hotel/motel occupancy in Nassau or Niagara

County, as well as admissions, club dues, and cabaret charges in Niagara County.

Use Form ST-101.3, Annual Schedule B, to report tax due on utilities (residential/nonresidential),

transportation and delivery of gas and electricity, and residential energy sources and services,

including school district utility taxes. Reminder: Use Form ST-101.3-ATT, Annual Schedule B-ATT, to

report sales of nonresidential utility services made to QEZEs.

Use Form ST-101.10, Annual Schedule FR, to report retail sales of motor fuel or diesel motor fuel,

and fuel taken from inventory, as explained in the schedule’s instructions.

Use Form ST-101.7, Annual Schedule H, to report sales of clothing and footwear eligible for

exemption from New York State and some local sales and use tax for the periods March 1, 2003,

through May 31, 2003; August 26, 2003, through September 1, 2003; and January 26, 2004, through

February 1, 2004.

Use Form ST-101.5, Annual Schedule N, to report taxes due and sales of certain services in

New York City. Reminder: Use Form ST-101.5-ATT, Annual Schedule N-ATT, if you are a provider of

parking services in New York City.

Use Form ST-101.9, Annual Schedule Q, to report sales of tangible personal property or services

to Qualified Empire Zone Enterprises (QEZEs) eligible for exemption from New York State and

some local sales and use tax.

Use Form ST-101.8, Annual Schedule T, to report taxes due on telephone services, telephone

answering services, and telegraph services imposed by certain counties, school districts, and cities.

Reminder: Use Form ST-101.8-ATT, Annual Schedule T-ATT, to report sales of these services made to

QEZEs.

Schedules CT and NJ: For reciprocal tax agreement filing requirements, see

in instructions.

For office use only

Refer to instructions (Form ST-101- I ) if you have questions or need help .

Please be sure to keep a completed copy of your return for your records.

Proceed to Step 3, page 2

Page 1 of 8 ST-101 (2/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7