Form St-6ap - Direct Payment Permit Sales And Use Tax Reconciliation Worksheet - Va Department Of Taxation

ADVERTISEMENT

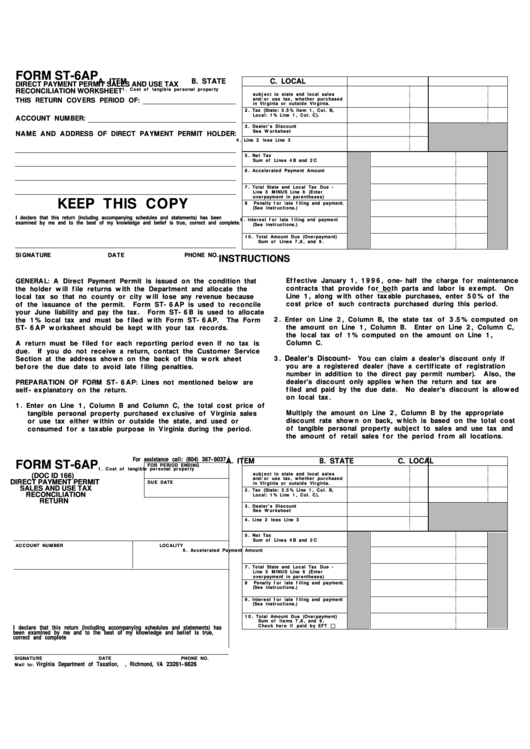

FORM ST-6AP

A. ITEM

B. STATE

C. LOCAL

DIRECT PAYMENT PERMIT SALES AND USE TAX

1. Cost of tangible personal property

RECONCILIATION WORKSHEET

subject to state and local sales

and/or use tax, whether purchased

THIS RETURN COVERS PERIOD OF:

in Virginia or outside Virginia.

2. Tax (State: 3.5% Item 1, Col. B,

Local: 1% Line 1, Col. C).

ACCOUNT NUMBER:

3. Dealer's Discount

See Worksheet

NAME AND ADDRESS OF DIRECT PAYMENT PERMIT HOLDER:

4. Line 2 less Line 3

5. Net Tax

Sum of Lines 4B and 2C

6. Accelerated Payment Amount

7. Total State and Local Tax Due -

Line 5 MINUS Line 6 (Enter

overpayment in parentheses)

KEEP THIS COPY

8

Penalty for late filing and payment.

(See instructions.)

I declare that this return (including accompanying schedules and statements) has been

9. Interest for late filing and payment

examined by me and to the best of my knowledge and belief is true, correct and complete.

(See instructions.)

10. Total Amount Due (Overpayment)

Sum of Lines 7,8, and 9.

SIGNATURE

DATE

PHONE NO.

INSTRUCTIONS

Effective January 1, 1996, one-half the charge for maintenance

GENERAL: A Direct Payment Permit is issued on the condition that

contracts that provide for both parts and labor is exempt.

On

the holder will file returns with the Department and allocate the

Line 1, along with other taxable purchases, enter 50% of the

local tax so that no county or city will lose any revenue because

cost price of such contracts purchased during this period.

of the issuance of the permit.

Form ST-6AP is used to reconcile

your June liability and pay the tax.

Form ST-6B is used to allocate

2. Enter on Line 2, Column B, the state tax of 3.5% computed on

the 1% local tax and must be filed with Form ST-6AP.

The Form

the amount on Line 1, Column B.

Enter on Line 2, Column C,

ST-6AP worksheet should be kept with your tax records.

the local tax of 1% computed on the amount on Line 1,

Column C.

A return must be filed for each reporting period even if no tax is

due.

If you do not receive a return, contact the Customer Service

3.

Dealer's Discount-

You can claim a dealer's discount only if

Section at the address shown on the back of this work sheet

you are a registered dealer (have a certificate of registration

before the due date to avoid late filing penalties.

number in addition to the direct pay permit number).

Also, the

dealer's discount only applies when the return and tax are

PREPARATION OF FORM ST-6AP: Lines not mentioned below are

filed and paid by the due date.

No dealer's discount is allowed

self-explanatory on the return.

on local tax.

1. Enter on Line 1, Column B and Column C, the total cost price of

Multiply the amount on Line 2, Column B by the appropriate

tangible personal property purchased exclusive of Virginia sales

discount rate shown on back, which is based on the total cost

or use tax either within or outside the state, and used or

of tangible personal property subject to sales and use tax and

consumed for a taxable purpose in Virginia during the period.

the amount of retail sales for the period from all locations.

For assistance call: (804) 367-8037

A. ITEM

B. STATE

C. LOCAL

FORM ST-6AP

FOR PERIOD ENDING

1. Cost of tangible personal property

subject to state and local sales

(DOC ID 166)

and/or use tax, whether purchased

DIRECT PAYMENT PERMIT

DUE DATE

in Virginia or outside Virginia.

SALES AND USE TAX

2. Tax (State: 3.5% Line 1, Col. B,

RECONCILIATION

Local: 1% Line 1, Col. C).

RETURN

3. Dealer's Discount

See Worksheet

4. Line 2 less Line 3

5. Net Tax

Sum of Lines 4B and 2C

ACCOUNT NUMBER

LOCALITY

6. Accelerated Payment Amount

7. Total State and Local Tax Due -

Line 5 MINUS Line 6 (Enter

overpayment in parentheses)

8

Penalty for late filing and payment.

(See instructions.)

9. Interest for late filing and payment

(See instructions.)

10. Total Amount Due (Overpayment)

Sum of Items 7,8, and 9.

Check here if paid by EFT

I declare that this return (including accompanying schedules and statements) has

been examined by me and to the best of my knowledge and belief is true,

correct and complete

SIGNATURE

DATE

PHONE NO.

Virginia Department of Taxation, P.O. Box 26626, Richmond, VA 23261-6626

Mail to:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2