State of California

Franchise Tax Board

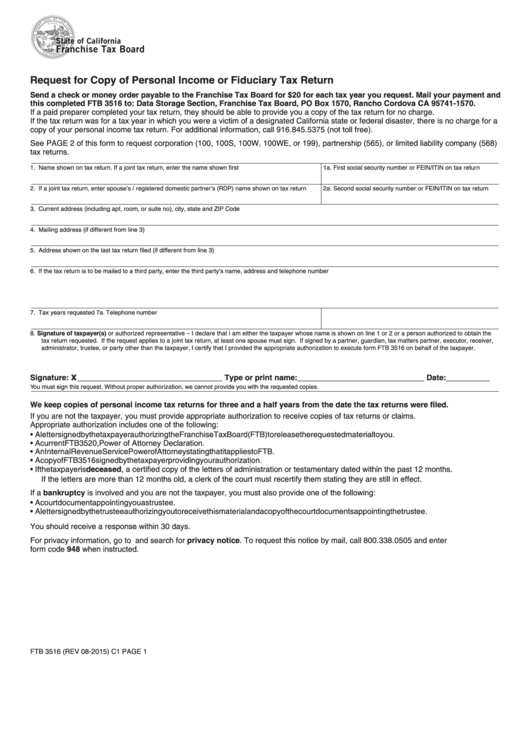

Request for Copy of Personal Income or Fiduciary Tax Return

Send a check or money order payable to the Franchise Tax Board for $20 for each tax year you request. Mail your payment and

this completed FTB 3516 to: Data Storage Section, Franchise Tax Board, PO Box 1570, Rancho Cordova CA 95741-1570.

If a paid preparer completed your tax return, they should be able to provide you a copy of the tax return for no charge.

If the tax return was for a tax year in which you were a victim of a designated California state or federal disaster, there is no charge for a

copy of your personal income tax return. For additional information, call 916.845.5375 (not toll free).

See PAGE 2 of this form to request corporation (100, 100S, 100W, 100WE, or 199), partnership (565), or limited liability company (568)

tax returns.

1. Name shown on tax return. If a joint tax return, enter the name shown first

1a. First social security number or FEIN/ITIN on tax return

2. If a joint tax return, enter spouse’s / registered domestic partner’s (RDP) name shown on tax return

2a. Second social security number or FEIN/ITIN on tax return

3. Current address (including apt, room, or suite no), city, state and ZIP Code

4. Mailing address (if different from line 3)

5. Address shown on the last tax return filed (if different from line 3)

6. If the tax return is to be mailed to a third party, enter the third party’s name, address and telephone number

7. Tax years requested

7a. Telephone number

8. Signature of taxpayer(s) or authorized representative – I declare that I am either the taxpayer whose name is shown on line 1 or 2 or a person authorized to obtain the

tax return requested. If the request applies to a joint tax return, at least one spouse must sign. If signed by a partner, guardian, tax matters partner, executor, receiver,

administrator, trustee, or party other than the taxpayer, I certify that I provided the appropriate authorization to execute form FTB 3516 on behalf of the taxpayer.

x

Signature:

_________________________________ Type or print name:_____________________________ Date:__________

You must sign this request. Without proper authorization, we cannot provide you with the requested copies.

We keep copies of personal income tax returns for three and a half years from the date the tax returns were filed.

If you are not the taxpayer, you must provide appropriate authorization to receive copies of tax returns or claims.

Appropriate authorization includes one of the following:

• A letter signed by the taxpayer authorizing the Franchise Tax Board (FTB) to release the requested material to you.

• A current FTB 3520, Power of Attorney Declaration.

• An Internal Revenue Service Power of Attorney stating that it applies to FTB.

• A copy of FTB 3516 signed by the taxpayer providing your authorization.

• If the taxpayer is deceased, a certified copy of the letters of administration or testamentary dated within the past 12 months.

If the letters are more than 12 months old, a clerk of the court must recertify them stating they are still in effect.

If a bankruptcy is involved and you are not the taxpayer, you must also provide one of the following:

• A court document appointing you as trustee.

• A letter signed by the trustee authorizing you to receive this material and a copy of the court documents appointing the trustee.

You should receive a response within 30 days.

For privacy information, go to ftb.ca.gov and search for privacy notice. To request this notice by mail, call 800.338.0505 and enter

form code 948 when instructed.

FTB 3516 (REV 08-2015) C1 PAGE 1

1

1 2

2