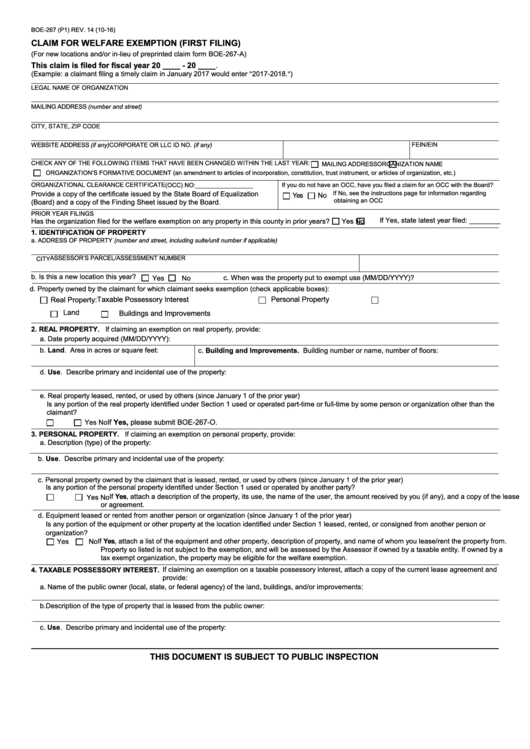

BOE-267 (P1) REV. 14 (10-16)

CLAIM FOR WELFARE EXEMPTION (FIRST FILING)

(For new locations and/or in-lieu of preprinted claim form BOE-267-A)

This claim is filed for fiscal year 20 ____ - 20 ____.

(Example: a claimant filing a timely claim in January 2017 would enter "2017-2018.")

LEGAL NAME OF ORGANIZATION

MAILING ADDRESS (number and street)

CITY, STATE, ZIP CODE

WEBSITE ADDRESS (if any)

CORPORATE OR LLC ID NO. (if any)

FEIN/EIN

CHECK ANY OF THE FOLLOWING ITEMS THAT HAVE BEEN CHANGED WITHIN THE LAST YEAR:

MAILING ADDRESS

ORGANIZATION NAME

ORGANIZATION’S FORMATIVE DOCUMENT (an amendment to articles of incorporation, constitution, trust instrument, or articles of organization, etc.)

ORGANIZATIONAL CLEARANCE CERTIFICATE (OCC) NO:_________________

If you do not have an OCC, have you filed a claim for an OCC with the Board?

Provide a copy of the certificate issued by the State Board of Equalization

If No, see the instructions page for information regarding

Yes

No

obtaining an OCC

(Board) and a copy of the Finding Sheet issued by the Board.

PRIOR YEAR FILINGS

If Yes, state latest year filed: ________

Has the organization filed for the welfare exemption on any property in this county in prior years?

Yes

No

1. IDENTIFICATION OF PROPERTY

a. ADDRESS OF PROPERTY (number and street, including suite/unit number if applicable)

ASSESSOR’S PARCEL/ASSESSMENT NUMBER

CITY

b. Is this a new location this year?

c. When was the property put to exempt use (MM/DD/YYYY)?

Yes

No

d. Property owned by the claimant for which claimant seeks exemption (check applicable boxes):

Taxable Possessory Interest

Real Property:

Personal Property

Land

Buildings and Improvements

2. REAL PROPERTY. If claiming an exemption on real property, provide:

a. Date property acquired (MM/DD/YYYY):

b. Land. Area in acres or square feet:

c. Building and Improvements. Building number or name, number of floors:

d. Use. Describe primary and incidental use of the property:

e. Real property leased, rented, or used by others (since January 1 of the prior year)

Is any portion of the real property identified under Section 1 used or operated part-time or full-time by some person or organization other than the

claimant?

If Yes, please submit BOE-267-O.

Yes

No

3. PERSONAL PROPERTY. If claiming an exemption on personal property, provide:

a. Description (type) of the property:

b. Use. Describe primary and incidental use of the property:

c. Personal property owned by the claimant that is leased, rented, or used by others (since January 1 of the prior year)

Is any portion of the personal property identified under Section 1 used or operated by another party?

No If Yes, attach a description of the property, its use, the name of the user, the amount received by you (if any), and a copy of the lease

Yes

or agreement.

d. Equipment leased or rented from another person or organization (since January 1 of the prior year)

Is any portion of the equipment or other property at the location identified under Section 1 leased, rented, or consigned from another person or

organization?

No If Yes, attach a list of the equipment and other property, description of property, and name of whom you lease/rent the property from.

Yes

Property so listed is not subject to the exemption, and will be assessed by the Assessor if owned by a taxable entity. If owned by a

tax exempt organization, the property may be eligible for the welfare exemption.

4. TAXABLE POSSESSORY INTEREST.

If claiming an exemption on a taxable possessory interest, attach a copy of the current lease agreement and

provide:

a. Name of the public owner (local, state, or federal agency) of the land, buildings, and/or improvements:

b. Description of the type of property that is leased from the public owner:

c. Use. Describe primary and incidental use of the property:

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION

1

1 2

2