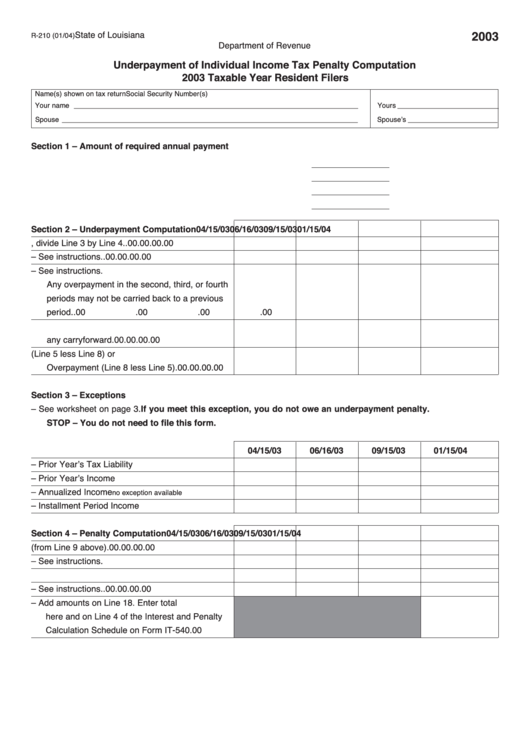

State of Louisiana

2003

R-210 (01/04)

Department of Revenue

Underpayment of Individual Income Tax Penalty Computation

2003 Taxable Year Resident Filers

Name(s) shown on tax return

Social Security Number(s)

Your name _________________________________________________________________________

Yours __________________________

Spouse ____________________________________________________________________________

Spouse’s _______________________

Section 1 – Amount of required annual payment

1. Required amount of 2003 tax liability

.00

2. Required amount of 2002 tax liability

.00

3. Enter the smaller of Line 1 or Line 2

.00

4. Number of payments required for year

Section 2 – Underpayment Computation

04/15/03

06/16/03

09/15/03

01/15/04

5. From Section 1, divide Line 3 by Line 4.

.00

.00

.00

.00

6. Enter amounts paid – See instructions.

.00

.00

.00

.00

7. Overpayment of installment – See instructions.

Any overpayment in the second, third, or fourth

periods may not be carried back to a previous

period.

.00

.00

.00

.00

8. Adjust payments to account for

any carryforward

.00

.00

.00

.00

9. Underpayment (Line 5 less Line 8) or

Overpayment (Line 8 less Line 5)

.00

.00

.00

.00

Section 3 – Exceptions

10. Exception 1 – See worksheet on page 3. If you meet this exception, you do not owe an underpayment penalty.

STOP – You do not need to file this form.

04/15/03

06/16/03

09/15/03

01/15/04

11. Exception 2 – Prior Year’s Tax Liability

12. Exception 3 – Prior Year’s Income

13. Exception 4 – Annualized Income

no exception available

14. Exception 5 – Installment Period Income

Section 4 – Penalty Computation

04/15/03

06/16/03

09/15/03

01/15/04

15. Amount of underpayment (from Line 9 above)

.00

.00

.00

.00

16. Date of Payment – See instructions.

17. Number of days from due date of installment

18. Penalty – See instructions.

.00

.00

.00

.00

19. Penalty – Add amounts on Line 18. Enter total

here and on Line 4 of the Interest and Penalty

Calculation Schedule on Form IT-540

.00

1

1