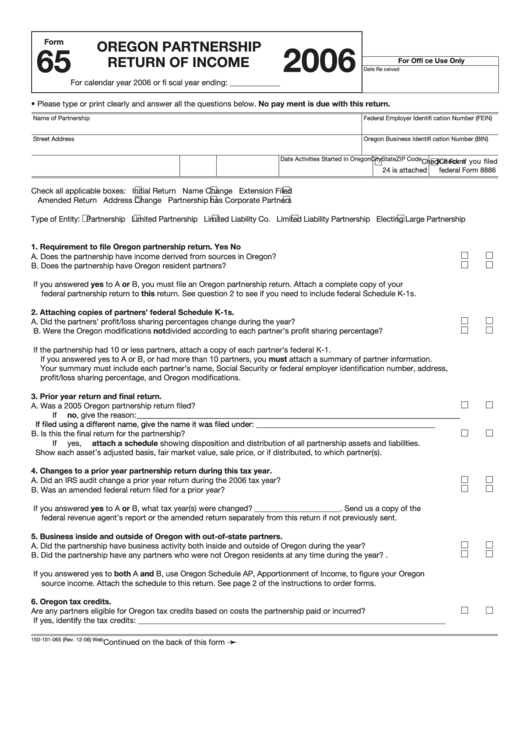

Clear Form

Form

OREGON PARTNERSHIP

2006

65

RETURN OF INCOME

For Offi ce Use Only

Date Re ceived

For calendar year 2006 or fi scal year ending: _____________

• Please type or print clearly and answer all the questions below. No pay ment is due with this return.

Name of Partnership

Federal Employer Identifi cation Number (FEIN)

Street Address

Oregon Business Identifi cation Number (BIN)

City

State

ZIP Code

Date Activities Started In Oregon

Check if Form

Check if you filed

24 is attached

federal Form 8886

Check all applicable boxes:

Initial Return

Name Change

Extension Filed

Amended Return

Address Change

Partnership has Corporate Partners

Type of Entity:

Partnership

Limited Partnership

Limited Liability Co.

Limited Liability Partnership

Electing Large Partnership

1. Requirement to file Oregon partnership return.

Yes

No

A. Does the partnership have income derived from sources in Oregon? ............................................................................

B. Does the partnership have Oregon resident partners? ...................................................................................................

If you answered yes to A or B, you must file an Oregon partnership return. Attach a complete copy of your

federal partnership return to this return. See question 2 to see if you need to include federal Schedule K-1s.

2. Attaching copies of partners’ federal Schedule K-1s.

A. Did the partners’ profit/loss sharing percentages change during the year? ....................................................................

B. Were the Oregon modifications not divided according to each partner’s profit sharing percentage? ............................

If the partnership had 10 or less partners, attach a copy of each partner’s federal K-1.

If you answered yes to A or B, or had more than 10 partners, you must attach a summary of partner information.

Your summary must include each partner’s name, Social Security or federal employer identification number, address,

profit/loss sharing percentage, and Oregon modifications.

3. Prior year return and final return.

A. Was a 2005 Oregon partnership return filed? ..................................................................................................................

If no, give the reason:

___________________________________________________________________________________

If filed using a different name, give the name it was filed under: ______________________________________________

B. Is this the final return for the partnership? .......................................................................................................................

If yes, attach a schedule showing disposition and distribution of all partnership assets and liabilities.

Show each asset’s adjusted basis, fair market value, sale price, or if distributed, to which partner(s).

4. Changes to a prior year partnership return during this tax year.

A. Did an IRS audit change a prior year return during the 2006 tax year? ..........................................................................

B. Was an amended federal return filed for a prior year?.....................................................................................................

If you answered yes to A or B, what tax year(s) were changed? ______________________. Send us a copy of the

federal revenue agent’s report or the amended return separately from this return if not previously sent.

5. Business inside and outside of Oregon with out-of-state partners.

A. Did the partnership have business activity both inside and outside of Oregon during the year? ...................................

B. Did the partnership have any partners who were not Oregon residents at any time during the year?............................

If you answered yes to both A and B, use Oregon Schedule AP, Apportionment of Income, to figure your Oregon

source income. Attach the schedule to this return. See page 2 of the instructions to order forms.

6. Oregon tax credits.

Are any partners eligible for Oregon tax credits based on costs the partnership paid or incurred? ...................................

If yes, identify the tax credits: _______________________________________________________________________________

➛

150-101-065 (Rev. 12-06) Web

Continued on the back of this form

1

1 2

2 3

3