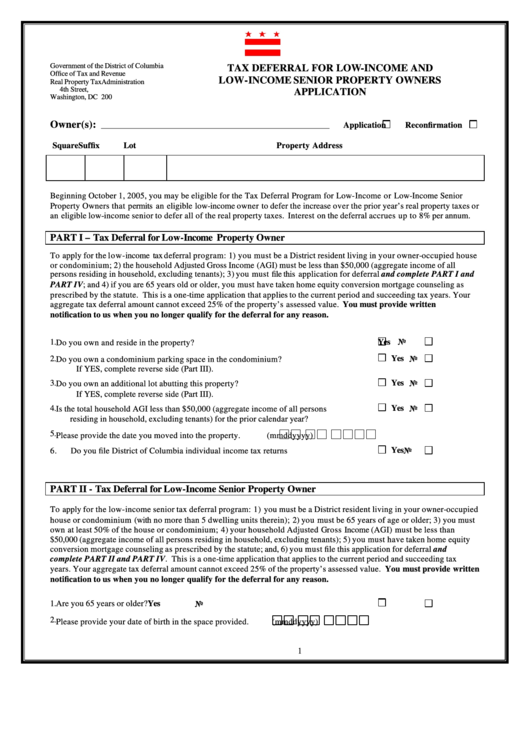

Tax Deferral For Low-Income And Low-Income Senior Property Owners Application - Goverment Of The District Of Columbia

ADVERTISEMENT

Government of the District of Columbia

TAX DEFERRAL FOR LOW-INCOME AND

Office of Tax and Revenue

LOW-INCOME SENIOR PROPERTY OWNERS

Real Property Tax Administration

4th Street,

APPLICATION

Washington, DC 200

Owner(s):

Application

Reconfirmation

________________________________________________________________

Square

Suffix

Lot

Property Address

Beginning October 1, 2005, you may be eligible for the Tax Deferral Program for Low-Income or Low-Income Senior

Property Owners that permits an eligible low-income owner to defer the increase over the prior year’s real property taxes or

an eligible low-income senior to defer all of the real property taxes. Interest on the deferral accrues up to 8% per annum.

PART I – Tax Deferral for Low-Income Property Owner

To apply for the low-income tax deferral program: 1) you must be a District resident living in your owner-occupied house

or condominium ; 2) the household Adjusted Gross Income (AGI) must be less than $50,000 (aggregate income of all

persons residing in household, excluding tenants); 3) you must file this application for deferral and complete PART I and

PART IV; and 4) if you are 65 years old or older, you must have taken home equity conversion mortgage counseling as

prescribed by the statute. This is a one-time application that applies to the current period and succeeding tax years. Your

aggregate tax deferral amount cannot exceed 25% of the property’s assessed value. You must provide written

notification to us when you no longer qualify for the deferral for any reason.

1.

Yes

No

Do you own and reside in the property?

2.

Yes

Do you own a condominium parking space in the condominium?

No

If YES, complete reverse side (Part III).

3.

Yes

Do you own an additional lot abutting this property?

No

If YES, complete reverse side (Part III).

4.

Yes

Is the total household AGI less than $50,000 (aggregate income of all persons

No

residing in household, excluding tenants) for the prior calendar year?

5.

Please provide the date you moved into the property.

(mmddyyyy)

Yes

6.

Do you file District of Columbia individual income tax returns

No

PART II - Tax Deferral for Low-Income Senior Property Owner

To apply for the low-income senior tax deferral program: 1) you must be a District resident living in your owner-occupied

house or condominium (with no more than 5 dwelling units therein); 2) you must be 65 years of age or older; 3) you must

own at least 50% of the house or condominium ; 4) your household Adjusted Gross Income (AGI) must be less than

$50,000 (aggregate income of all persons residing in household, excluding tenants); 5) you must have taken home equity

conversion mortgage counseling as prescribed by the statute; and, 6) you must file this application for deferral and

complete PART II and PART IV. This is a one-time application that applies to the current period and succeeding tax

years. Your aggregate tax deferral amount cannot exceed 25% of the property’s assessed value. You must provide written

notification to us when you no longer qualify for the deferral for any reason.

1.

Are you 65 years or older?

Yes

No

2.

Please provide your date of birth in the space provided.

(mmddyyyy)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3