Gross Sales And Service Form - City Of Wheat Ridge

ADVERTISEMENT

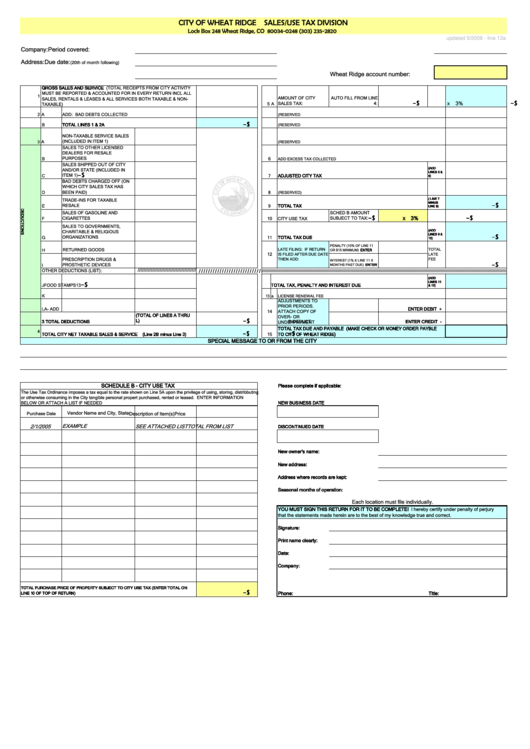

CITY OF WHEAT RIDGE SALES/USE TAX DIVISION

Lock Box 248 Wheat Ridge, CO 80034-0248 (303) 235-2820

updated 5/2008 - line 13a

Company:

Period covered:

Address:

Due date:

(20th of month following)

Wheat Ridge account number:

GROSS SALES AND SERVICE (TOTAL RECEIPTS FROM CITY ACTIVITY

MUST BE REPORTED & ACCOUNTED FOR IN EVERY RETURN INCL ALL

1

AMOUNT OF CITY

AUTO FILL FROM LINE

SALES, RENTALS & LEASES & ALL SERVICES BOTH TAXABLE & NON-

$

-

$

-

3%

SALES TAX:

4:

TAXABLE)

5 A

X

2 A

ADD: BAD DEBTS COLLECTED

(RESERVED

$

-

B

TOTAL LINES 1 & 2A

(RESERVED

NON-TAXABLE SERVICE SALES

(INCLUDED IN ITEM 1)

A

3

(RESERVED

SALES TO OTHER LICENSED

DEALERS FOR RESALE

PURPOSES

B

6

ADD EXCESS TAX COLLECTED

SALES SHIPPED OUT OF CITY

(ADD

AND/OR STATE (INCLUDED IN

LINES 5 &

$

-

C

ITEM 1)

7

ADJUSTED CITY TAX

6)

BAD DEBTS CHARGED OFF (ON

WHICH CITY SALES TAX HAS

BEEN PAID)

D

8

(RESERVED)

( LINE 7

TRADE-INS FOR TAXABLE

MINUS

$

-

RESALE

E

9

TOTAL TAX

LINE 8)

SALES OF GASOLINE AND

SCHED B AMOUNT

$

-

$

-

3%

CIGARETTES

SUBJECT TO TAX:

F

10

CITY USE TAX

X

SALES TO GOVERNMENTS,

(ADD

CHARITABLE & RELIGIOUS

LINES 9 &

$

-

ORGANIZATIONS

G

11

TOTAL TAX DUE

10)

PENALTY (10% OF LINE 11

RETURNED GOODS

LATE FILING: IF RETURN

TOTAL

H

OR $15 MINIMUM) ENTER

12

IS FILED AFTER DUE DATE

LATE

PRESCRIPTION DRUGS &

THEN ADD:

FEE

INTEREST (1% X LINE 11 X

$

-

PROSTHETIC DEVICES

I

MONTHS PAST DUE) ENTER

/////////////////////////////////////////

////////////////////////////

OTHER DEDUCTIONS (LIST):

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

(ADD

LINES 11

$

-

J

FOOD STAMPS

13

TOTAL TAX, PENALTY AND INTEREST DUE

& 12)

K

13 a

LICENSE RENEWAL FEE

ADJUSTMENTS TO

PRIOR PERIODS.

L

A- ADD

ENTER DEBIT +

14

ATTACH COPY OF

(TOTAL OF LINES A THRU

OVER- OR

$

-

L)

3 TOTAL DEDUCTIONS

B-DEDUCT

ENTER CREDIT -

UNDERPAYMENT

TOTAL TAX DUE AND PAYABLE (MAKE CHECK OR MONEY ORDER PAYBLE

4

$

-

$

-

TOTAL CITY NET TAXABLE SALES & SERVICE

(Line 2B minus Line 3)

15

TO CITY OF WHEAT RIDGE)

SPECIAL MESSAGE TO OR FROM THE CITY

SCHEDULE B - CITY USE TAX

Please complete if applicable:

The Use Tax Ordinance imposes a tax equal to the rate shown on Line 5A upon the privilege of using, storing, distribbuting

or otherwise consuming in the City tangible personal propert purchased, rented or leased. ENTER INFORMATION

BELOW OR ATTACH A LIST IF NEEDED

NEW BUSINESS DATE

Vendor Name and City, State

Purchase Date

Description of Item(s)

Price

2/1/2005

EXAMPLE

SEE ATTACHED LIST

TOTAL FROM LIST

DISCONTINUED DATE

New owner's name:

New address:

Address where records are kept:

Seasonal months of operation:

Each location must file individually.

YOU MUST SIGN THIS RETURN FOR IT TO BE COMPLETE!

I hereby certify under penalty of perjury

that the statements made herein are to the best of my knowledge true and correct.

Signature:

Print name clearly:

Date:

Company:

TOTAL PURCHASE PRICE OF PROPERTY SUBJECT TO CITY USE TAX (ENTER TOTAL ON

$

-

LINE 10 OF TOP OF RETURN)

Phone:

Title:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1