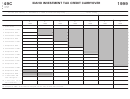

F

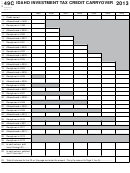

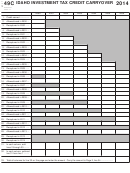

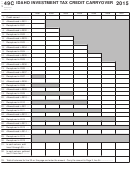

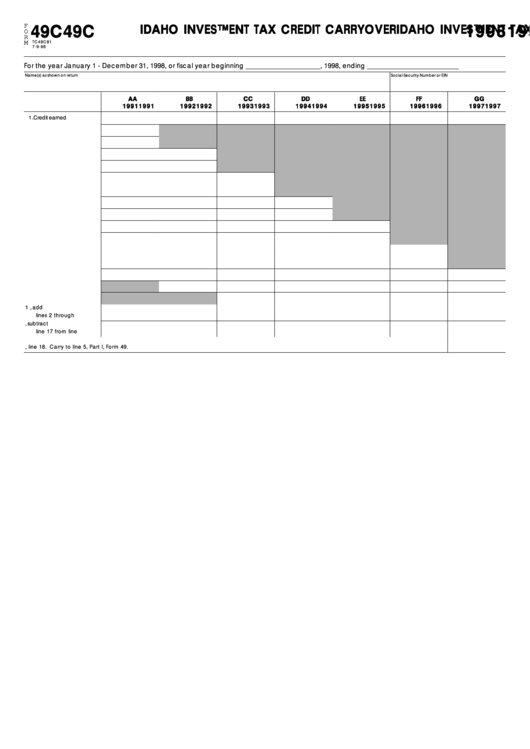

IDAHO INVESTMENT TAX CREDIT CARRYOVER

IDAHO INVESTMENT TAX CREDIT CARRYOVER

49C

49C

49C

IDAHO INVESTMENT TAX CREDIT CARRYOVER

IDAHO INVESTMENT TAX CREDIT CARRYOVER

IDAHO INVESTMENT TAX CREDIT CARRYOVER

1998

1998

1998

49C

49C

1998

1998

O

R

M

TC49C81

7-9-98

For the year January 1 - December 31, 1998, or fiscal year beginning ______________________, 1998, ending ___________________________

Name(s) as shown on return

Social Security Number or EIN

A A A A A

B B B B B

C C C C C

D D D D D

E E E E E

F F F F F

G G G G G

1 9 9 1

1 9 9 1

1 9 9 1

1 9 9 1

1 9 9 1

1 9 9 2

1 9 9 2

1 9 9 2

1 9 9 2

1 9 9 2

1 9 9 3

1 9 9 3

1 9 9 3

1 9 9 3

1 9 9 3

1 9 9 4

1 9 9 4

1 9 9 4

1 9 9 4

1 9 9 4

1 9 9 5

1 9 9 5

1 9 9 5

1 9 9 5

1 9 9 5

1 9 9 6

1 9 9 6

1 9 9 6

1 9 9 6

1 9 9 6

1 9 9 7

1 9 9 7

1 9 9 7

1 9 9 7

1 9 9 7

1 . Credit earned ...................

2 . Allowed/used in 1991 ....

3 . Recaptured in 1991 ........

4 . Allowed/used in 1992 ....

5 . Recaptured in 1992 ........

6 . Allowed/used in 1993 ....

7 . Recaptured in 1993 ........

8 . Allowed/used in 1994 ....

9 . Recaptured in 1994 ........

1 0 . Allowed/used in 1995 ....

1 1 . Recaptured in 1995 ........

1 2 . Allowed/used in 1996 ....

1 3 . Recaptured in 1996 ........

1 4 . Allowed/used in 1997 ....

1 5 . Recaptured in 1997 ........

1 6 . Recaptured in 1998 ........

1 7 . In each column, add

lines 2 through 16. ..........

1 8 . In each column, subtract

line 17 from line 1. ..........

1 9 . Carryover to 1998. Total columns A through G, line 18. Carry to line 5, Part I, Form 49. ...........................................................................................................................

1

1