Sales And Use Tax Report Form - Lincoln Parish Sales And Use Tax Com M Ission - Louisiana

ADVERTISEMENT

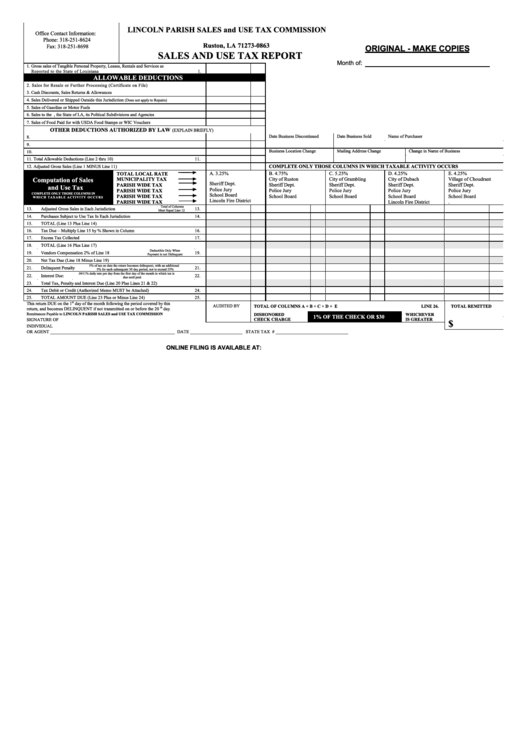

L IN C O L N PA R ISH SA L E S and U SE TA X C O M M ISSIO N

O ffice Contact Information :

P.O . B ox 863

Phone: 318 -251 -8624

R uston, L A 71273-0863

Fax: 318 -251-8698

ORIGINAL - MAKE COPIES

SA L E S A N D U SE T A X R E PO R T

Month of:

1. Gross sales of Tangible Personal Property, Leases, R entals and Services as

R eported to the State of Louisiana

1.

A L L O W A B L E D E D U C T IO N S

2. Sales for R esale or Further Processing (C ertificate on File)

3. C ash Discounts, Sales R eturns & A llowances

4. Sales D elivered or Shipped Outside this Jurisdiction

(D oes not apply to R epairs)

5. Sales of Gasoline or M otor Fuels

6. Sales to the U .S. Govt., the State of LA, its Political Subdivisions and Agencies

7. Sales of Food Paid for with U SD A Food Stam ps or W IC V ouchers

O TH ER D ED U C TIO N S A U TH O R IZE D B Y LA W

(EX P LA IN B R IE FLY )

D ate Business D iscontinued

D ate Business Sold

N am e of Purchaser

8.

9.

B usiness Location Change

M ailing Address C hange

C hange in N am e of B usiness

10.

11. Total Allowable D eductions (Line 2 thru 10)

11.

12. Adjusted Gross Sales (Line 1 M IN U S Line 11)

C O M PLETE O N LY TH O SE C O LU M N S IN W H IC H TA XA B LE A C TIVITY O C C U R S

TO TA L LO C A L R A TE

A.

3.25%

B.

4.75%

C.

5.25%

D .

4.25%

E.

4.25%

C om putation of Sales

M U N IC IPA LITY TA X

City of Ruston

City of Grambling

City of D ubach

V illage of Choudrant

Sheriff D ept.

PA R ISH W ID E TA X

Sheriff D ept.

Sheriff D ept.

Sheriff D ept.

Sheriff D ept.

and U se T ax

Police Jury

PA R ISH W ID E TA X

Police Jury

Police Jury

Police Jury

Police Jury

C O M PL E T E O N L Y T H O SE C O L U M N S IN

School Board

PA R ISH W ID E TA X

School Board

School Board

School Board

School Board

W H IC H T A X A B L E A C T IV IT Y O C C U R S

Lincoln Fire D istrict

PA R ISH W ID E TA X

Lincoln Fire D istrict

.

T otal o f C o lu m ns

13.

Adjusted Gross Sales in Each Jurisdiction

13.

M ust E qual L ine 12

14.

Purchases Subject to U se Tax In Each Jurisdiction

14.

15.

TO TA L (Line 13 Plus Line 14)

16.

Tax D ue – M ultiply Line 15 by % Shown in C olum n

16.

17.

Excess Tax C ollected

17.

18.

TO TA L (Line 16 Plus Line 17)

D eductible O nly W hen

19.

V endors C om pensation 2% of Line 18

19.

Paym ent is no t D elinquent

20.

N et Tax D ue (Line 18 M inus Line 19)

5% o f tax o n date the return beco mes delinquent, w ith an add itio nal

21.

D elinquent Penalty

21.

5% fo r each su bsequent 30 day perio d, no t to exceed 25%

.0411% daily rate per day fro m the first day o f the mo nth in w hich tax is

22.

Interest D ue:

22.

due until paid

23.

Total Tax, Penalty and Interest D ue (Line 20 Plus Lines 21 & 22)

24.

Tax D ebit or C redit (Authorized M em o M U ST be Attached)

24.

25.

TO TA L AM O U N T D U E (Line 23 Plus or M inus Line 24)

25.

st

This return D U E on the 1

day of the m onth following the period covered by this

AU D ITED B Y

T O T AL O F C O L U M N S A + B + C + D + E

L IN E 26.

T O T AL R E M IT TE D

return, and becom es D ELIN Q U EN T if not transm itted on or before the 20

th

day

.

D ISH O N O R E D

W H IC H E V E R

R em ittances Payable to L IN C O L N P A R ISH SA L E S and U SE T A X C O M M ISSIO N

1% O F TH E C H EC K O R $30

C H E C K C H A R G E

IS G R E A TE R

S IG N ATU R E O F

$

IN D IV ID U A L

O R A GEN T _______________________________________________________ D ATE _______________________ STATE TA X I.D . # ________________________________

ONLINE FILING IS AVAILABLE AT:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1