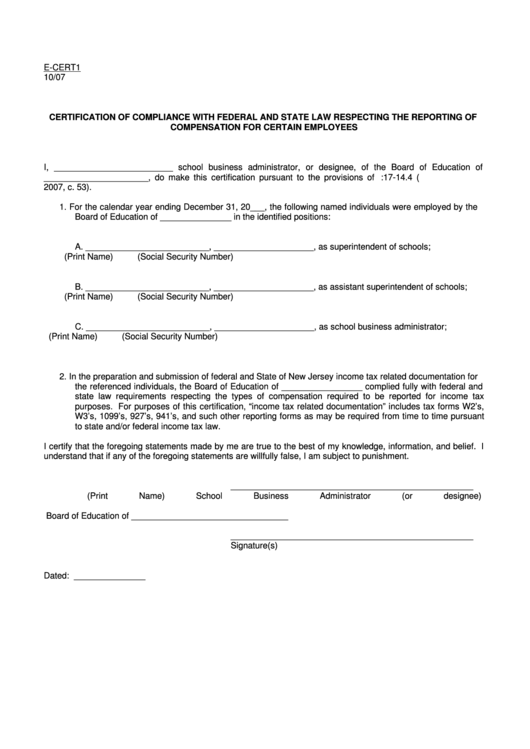

Form E-Cert1 - Certification Of Compliance With Federal And State Law Respecting The Reporting Of Compensation For Certain Employees

Download a blank fillable Form E-Cert1 - Certification Of Compliance With Federal And State Law Respecting The Reporting Of Compensation For Certain Employees in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form E-Cert1 - Certification Of Compliance With Federal And State Law Respecting The Reporting Of Compensation For Certain Employees with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

ADVERTISEMENT

1

1 2

2