Instructions For Form Rut-25-X - Amended Vehicle Use Tax Transaction Return

ADVERTISEMENT

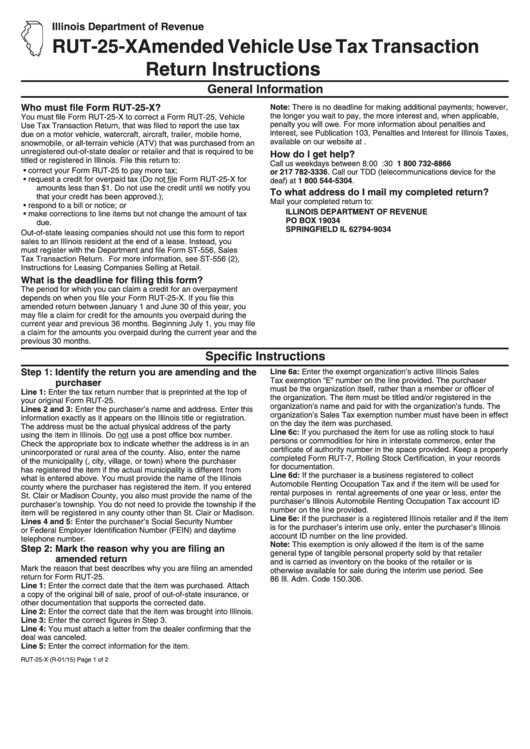

Illinois Department of Revenue

RUT-25-X Amended Vehicle Use Tax Transaction

Return Instructions

General Information

Who must file Form RUT-25-X?

Note: There is no deadline for making additional payments; however,

the longer you wait to pay, the more interest and, when applicable,

You must file Form RUT-25-X to correct a Form RUT-25, Vehicle

penalty you will owe. For more information about penalties and

Use Tax Transaction Return, that was filed to report the use tax

interest, see Publication 103, Penalties and Interest for Illinois Taxes,

due on a motor vehicle, watercraft, aircraft, trailer, mobile home,

available on our website at tax.illinois.gov.

snowmobile, or all-terrain vehicle (ATV) that was purchased from an

unregistered out-of-state dealer or retailer and that is required to be

How do I get help?

titled or registered in Illinois. File this return to:

Call us weekdays between 8:00 a.m. and 4:30 p.m. at 1 800 732-8866

•

correct your Form RUT-25 to pay more tax;

or 217 782-3336. Call our TDD (telecommunications device for the

•

request a credit for overpaid tax (Do not file Form RUT-25-X for

deaf) at 1 800 544-5304.

amounts less than $1. Do not use the credit until we notify you

To what address do I mail my completed return?

that your credit has been approved.);

Mail your completed return to:

•

respond to a bill or notice; or

ILLINOIS DEPARTMENT OF REVENUE

•

make corrections to line items but not change the amount of tax

PO BOX 19034

due.

SPRINGFIELD IL 62794-9034

Out-of-state leasing companies should not use this form to report

sales to an Illinois resident at the end of a lease. Instead, you

must register with the Department and file Form ST-556, Sales

Tax Transaction Return. For more information, see ST-556 (2),

Instructions for Leasing Companies Selling at Retail.

What is the deadline for filing this form?

The period for which you can claim a credit for an overpayment

depends on when you file your Form RUT-25-X. If you file this

amended return between January 1 and June 30 of this year, you

may file a claim for credit for the amounts you overpaid during the

current year and previous 36 months. Beginning July 1, you may file

a claim for the amounts you overpaid during the current year and the

previous 30 months.

Specific Instructions

Step 1: Identify the return you are amending and the

Line 6a: Enter the exempt organization’s active Illinois Sales

Tax exemption “E” number on the line provided. The purchaser

purchaser

must be the organization itself, rather than a member or officer of

Line 1: Enter the tax return number that is preprinted at the top of

the organization. The item must be titled and/or registered in the

your original Form RUT-25.

organization’s name and paid for with the organization’s funds. The

Lines 2 and 3: Enter the purchaser’s name and address. Enter this

organization’s Sales Tax exemption number must have been in effect

information exactly as it appears on the Illinois title or registration.

on the day the item was purchased.

The address must be the actual physical address of the party

Line 6c: If you purchased the item for use as rolling stock to haul

using the item in Illinois. Do not use a post office box number.

persons or commodities for hire in interstate commerce, enter the

Check the appropriate box to indicate whether the address is in an

certificate of authority number in the space provided. Keep a properly

unincorporated or rural area of the county. Also, enter the name

completed Form RUT-7, Rolling Stock Certification, in your records

of the municipality (i.e., city, village, or town) where the purchaser

for documentation.

has registered the item if the actual municipality is different from

Line 6d: If the purchaser is a business registered to collect

what is entered above. You must provide the name of the Illinois

Automobile Renting Occupation Tax and if the item will be used for

county where the purchaser has registered the item. If you entered

rental purposes in rental agreements of one year or less, enter the

St. Clair or Madison County, you also must provide the name of the

purchaser’s Illinois Automobile Renting Occupation Tax account ID

purchaser’s township. You do not need to provide the township if the

number on the line provided.

item will be registered in any county other than St. Clair or Madison.

Line 6e: If the purchaser is a registered Illinois retailer and if the item

Lines 4 and 5: Enter the purchaser’s Social Security Number

is for the purchaser’s interim use only, enter the purchaser’s Illinois

or Federal Employer Identification Number (FEIN) and daytime

account ID number on the line provided.

telephone number.

Note: This exemption is only allowed if the item is of the same

Step 2: Mark the reason why you are filing an

general type of tangible personal property sold by that retailer

amended return

and is carried as inventory on the books of the retailer or is

Mark the reason that best describes why you are filing an amended

otherwise available for sale during the interim use period. See

return for Form RUT-25.

86 Ill. Adm. Code 150.306.

Line 1: Enter the correct date that the item was purchased. Attach

a copy of the original bill of sale, proof of out-of-state insurance, or

other documentation that supports the corrected date.

Line 2: Enter the correct date that the item was brought into Illinois.

Line 3: Enter the correct figures in Step 3.

Line 4: You must attach a letter from the dealer confirming that the

deal was canceled.

Line 5: Enter the correct information for the item.

RUT-25-X (R-01/15)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2