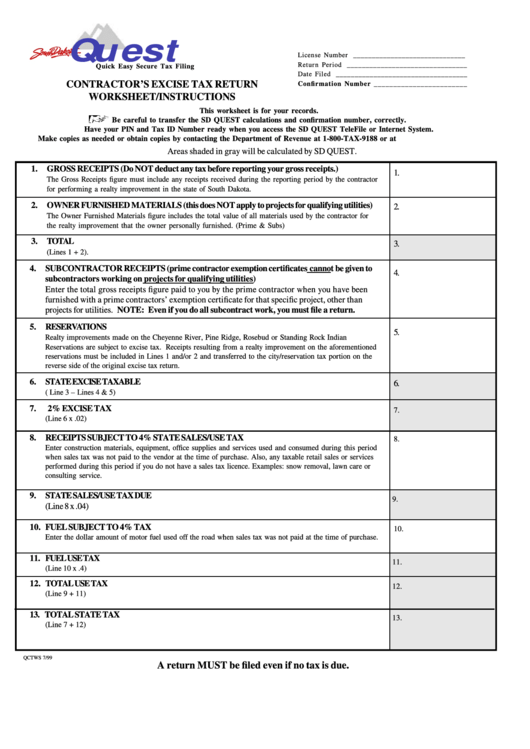

Form Qctws - Contractor'S Excise Tax Return Worksheet/instructions - South Dakota

ADVERTISEMENT

Q u e s t

License Number ______________________________

Return Period ________________________________

Quick Easy Secure Tax Filing

Date Filed ___________________________________

CONTRACTOR’ S EXCISE TAX RETURN

Confirmation Number ________________________

WORKSHEET/INSTRUCTIONS

This worksheet is for your records.

Be careful to transfer the SD QUEST calculations and confirmation number, correctly.

Have your PIN and Tax ID Number ready when you access the SD QUEST TeleFile or Internet System.

Make copies as needed or obtain copies by contacting the Department of Revenue at 1-800-TAX-9188 or at

Areas shaded in gray will be calculated by SD QUEST.

1. GROSS RECEIPTS (Do NOT deduct any tax before reporting your gross receipts.)

1.

The Gross Receipts figure must include any receipts received during the reporting period by the contractor

for performing a realty improvement in the state of South Dakota.

2. OWNER FURNISHED MATERIALS (this does NOT apply to projects for qualifying utilities)

2.

The Owner Furnished Materials figure includes the total value of all materials used by the contractor for

the realty improvement that the owner personally furnished. (Prime & Subs)

3. TOTAL

3.

(Lines 1 + 2).

4. SUBCONTRACTOR RECEIPTS (prime contractor exemption certificates cannot be given to

4.

subcontractors working on projects for qualifying utilities)

Enter the total gross receipts figure paid to you by the prime contractor when you have been

furnished with a prime contractors’ exemption certificate for that specific project, other than

projects for utilities. NOTE: Even if you do all subcontract work, you must file a return.

5. RESERVATIONS

5.

Realty improvements made on the Cheyenne River, Pine Ridge, Rosebud or Standing Rock Indian

Reservations are subject to excise tax. Receipts resulting from a realty improvement on the aforementioned

reservations must be included in Lines 1 and/or 2 and transferred to the city/reservation tax portion on the

reverse side of the original excise tax return.

6. STATE EXCISE TAXABLE

6.

( Line 3 – Lines 4 & 5)

7.

2% EXCISE TAX

7.

(Line 6 x .02)

8. RECEIPTS SUBJECT TO 4% STATE SALES/USE TAX

8.

Enter construction materials, equipment, office supplies and services used and consumed during this period

when sales tax was not paid to the vendor at the time of purchase. Also, any taxable retail sales or services

performed during this period if you do not have a sales tax licence. Examples: snow removal, lawn care or

consulting service.

9. STATE SALES/USE TAX DUE

9.

(Line 8 x .04)

10. FUEL SUBJECT TO 4% TAX

10.

Enter the dollar amount of motor fuel used off the road when sales tax was not paid at the time of purchase.

11. FUEL USE TAX

11.

(Line 10 x .4)

12. TOTAL USE TAX

12.

(Line 9 + 11)

13. TOTAL STATE TAX

13.

(Line 7 + 12)

QCTWS 7/99

A return MUST be filed even if no tax is due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2