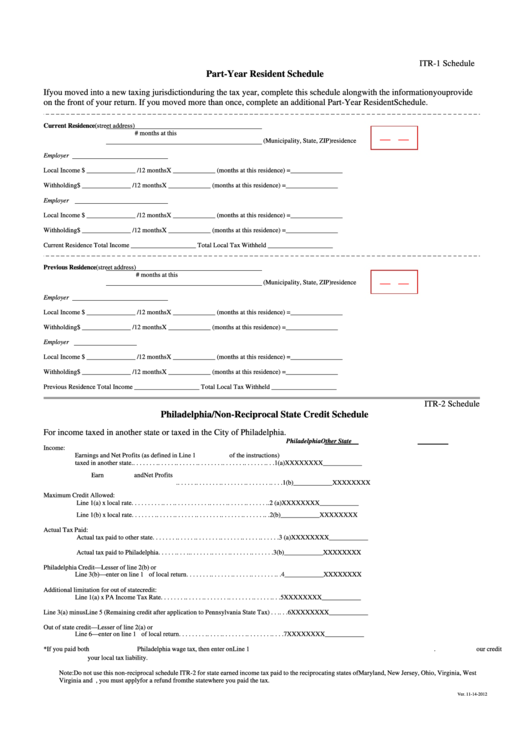

ITR-1 Schedule

Part-Year Resident Schedule

If you moved into a new taxing jurisdiction during the tax year, complete this schedule along with the information you provide

on the front of your return. If you moved more than once, complete an additional Part-Year Resident Schedule.

Current Residence

(street address)

# months at this

__ __

(Municipality, State, ZIP)

residence

Employer

Local Income $ _______________ / 12 months X _____________ (months at this residence) = ________________

Withholding $ _______________ / 12 months X _____________ (months at this residence) = ________________

Employer

Local Income $ _______________ / 12 months X _____________ (months at this residence) = ________________

Withholding $ _______________ / 12 months X _____________ (months at this residence) = ________________

Current Residence Total Income ____________________ Total Local Tax Withheld ____________________

Previous Residence

(street address)

# months at this

__ __

(Municipality, State, ZIP)

residence

Employer

Local Income $ _______________ / 12 months X _____________ (months at this residence) = ________________

Withholding $ _______________ / 12 months X _____________ (months at this residence) = ________________

Employer

Local Income $ _______________ / 12 months X _____________ (months at this residence) = ________________

Withholding $ _______________ / 12 months X _____________ (months at this residence) = ________________

Previous Residence Total Income ____________________ Total Local Tax Withheld ____________________

ITR-2 Schedule

Philadelphia/Non-Reciprocal State Credit Schedule

For income taxed in another state or taxed in the City of Philadelphia.

Philadelphia

Other State

Income:

Earnings and Net Profits (as defined in Line 1 and Line 5 of the instructions)

taxed in another state. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1(a)

XXXXXXXX

____________

Total Earned Income and Net Profits

Reported on Line 8 of Local Return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1(b)

____________

XXXXXXXX

Maximum Credit Allowed:

Line 1(a) x local rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 (a)

XXXXXXXX

____________

Line 1(b) x local rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 (b)

____________

XXXXXXXX

Actual Tax Paid:

Actual tax paid to other state. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 (a)

XXXXXXXX

____________

Actual tax paid to Philadelphia . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3(b)

____________

XXXXXXXX

Philadelphia Credit—Lesser of line 2(b) or

Line 3(b)—enter on line 12 of local return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

____________

XXXXXXXX

Additional limitation for out of state credit:

Line 1(a) x PA Income Tax Rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

XXXXXXXX

____________

Line 3(a) minus Line 5 (Remaining credit after application to Pennsylvania State Tax) . . . . . . 6

XXXXXXXX

____________

Out of state credit—Lesser of line 2(a) or

Line 6—enter on line 12 of local return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

XXXXXXXX

____________

*If you paid both outofstate and Philadelphia wage tax, then enter on Line 12 of the local return the lower of (Line 4 plus Line 7) or Line 2(b). Remember, your credit

cannot exceed your local tax liability.

Note: Do not use this non-reciprocal schedule ITR-2 for state earned income tax paid to the reciprocating states of Maryland, New Jersey, Ohio, Virginia, West

Virginia and Indiana. To recover tax paid to a reciprocating state, you must apply for a refund from the state where you paid the tax.

Ver. 11-14-2012

1

1 2

2