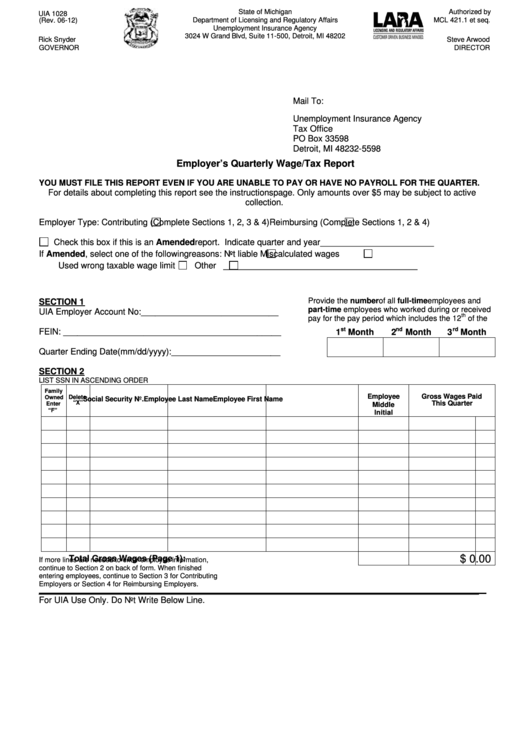

State of Michigan

Authorized by

UIA 1028

Department of Licensing and Regulatory Affairs

MCL 421.1 et seq.

(Rev. 06-12)

Unemployment Insurance Agency

3024 W Grand Blvd, Suite 11-500, Detroit, MI 48202

Rick Snyder

Steve Arwood

GOVERNOR

DIRECTOR

Reset Form

Enter Employer Name and

Mail To:

Address here:

Unemployment Insurance Agency

Tax Office

PO Box 33598

Detroit, MI 48232-5598

Employer’s Quarterly Wage/Tax Report

YOU MUST FILE THIS REPORT EVEN IF YOU ARE UNABLE TO PAY OR HAVE NO PAYROLL FOR THE QUARTER.

For details about completing this report see the instructions page. Only amounts over $5 may be subject to active

collection.

Employer Type: Contributing

(Complete Sections 1, 2, 3 & 4)

Reimbursing

(Complete Sections 1, 2 & 4)

Check this box if this is an Amended report. Indicate quarter and year________________________

If Amended, select one of the following reasons: Not liable

Miscalculated wages

Used wrong taxable wage limit

Other

_________________________________________

Provide the number of all full-time employees and

SECTION 1

part-time employees who worked during or received

UIA Employer Account No: _____________________________

th

pay for the pay period which includes the 12

of the

st

nd

rd

FEIN: ______________________________________________

1

Month

2

Month

3

Month

Quarter Ending Date (mm/dd/yyyy):_______________________

SECTION 2

LIST SSN IN ASCENDING ORDER

Family

Employee

Gross Wages Paid

Delete

Owned

Social Security No.

Employee Last Name

Employee First Name

Enter

“X”

Middle

This Quarter

“F”

Initial

$ 0.00

Total Gross Wages (Page 1):

If more lines are needed to enter employee information,

continue to Section 2 on back of form. When finished

entering employees, continue to Section 3 for Contributing

Employers or Section 4 for Reimbursing Employers.

_____________________________________________________________________________________________

For UIA Use Only. Do Not Write Below Line.

1

1 2

2