Instructions For Form 409 - Articles Of Amendmentfor A Limited Liability Company

ADVERTISEMENT

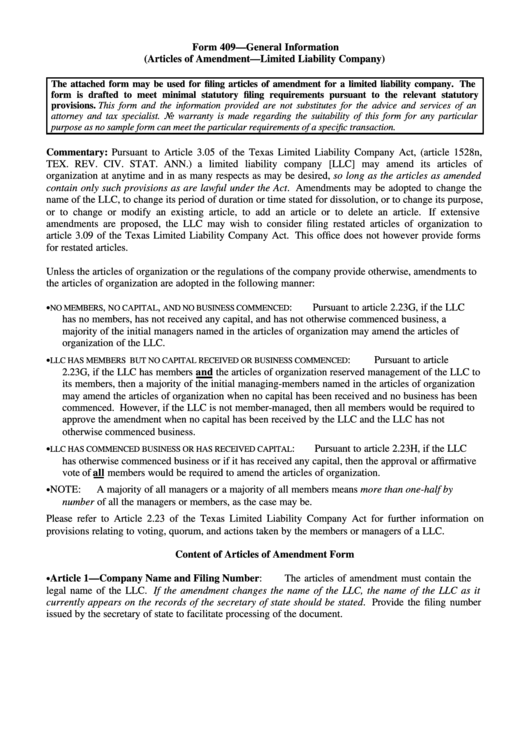

Form 409—General Information

(Articles of Amendment—Limited Liability Company)

The attached form may be used for filing articles of amendment for a limited liability company. The

form is drafted to meet minimal statutory filing requirements pursuant to the relevant statutory

provisions. This form and the information provided are not substitutes for the advice and services of an

attorney and tax specialist. No warranty is made regarding the suitability of this form for any particular

purpose as no sample form can meet the particular requirements of a specific transaction.

Commentary: Pursuant to Article 3.05 of the Texas Limited Liability Company Act, (article 1528n,

TEX. REV. CIV. STAT. ANN.) a limited liability company [LLC] may amend its articles of

organization at anytime and in as many respects as may be desired, so long as the articles as amended

contain only such provisions as are lawful under the Act. Amendments may be adopted to change the

name of the LLC, to change its period of duration or time stated for dissolution, or to change its purpose,

or to change or modify an existing article, to add an article or to delete an article. If extensive

amendments are proposed, the LLC may wish to consider filing restated articles of organization to

article 3.09 of the Texas Limited Liability Company Act. This office does not however provide forms

for restated articles.

Unless the articles of organization or the regulations of the company provide otherwise, amendments to

the articles of organization are adopted in the following manner:

•

,

,

:

Pursuant to article 2.23G, if the LLC

NO MEMBERS

NO CAPITAL

AND NO BUSINESS COMMENCED

has no members, has not received any capital, and has not otherwise commenced business, a

majority of the initial managers named in the articles of organization may amend the articles of

organization of the LLC.

•

:

Pursuant to article

LLC HAS MEMBERS BUT NO CAPITAL RECEIVED OR BUSINESS COMMENCED

2.23G, if the LLC has members and the articles of organization reserved management of the LLC to

its members, then a majority of the initial managing-members named in the articles of organization

may amend the articles of organization when no capital has been received and no business has been

commenced. However, if the LLC is not member-managed, then all members would be required to

approve the amendment when no capital has been received by the LLC and the LLC has not

otherwise commenced business.

•

:

Pursuant to article 2.23H, if the LLC

LLC HAS COMMENCED BUSINESS OR HAS RECEIVED CAPITAL

has otherwise commenced business or if it has received any capital, then the approval or affirmative

vote of all members would be required to amend the articles of organization.

•

NOTE:

A majority of all managers or a majority of all members means more than one-half by

number of all the managers or members, as the case may be.

Please refer to Article 2.23 of the Texas Limited Liability Company Act for further information on

provisions relating to voting, quorum, and actions taken by the members or managers of a LLC.

Content of Articles of Amendment Form

•

Article 1—Company Name and Filing Number:

The articles of amendment must contain the

legal name of the LLC. If the amendment changes the name of the LLC, the name of the LLC as it

currently appears on the records of the secretary of state should be stated. Provide the filing number

issued by the secretary of state to facilitate processing of the document.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3