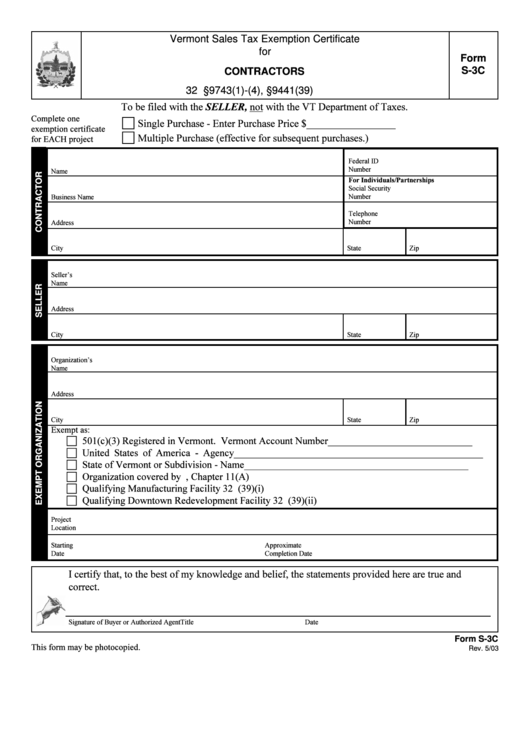

Form S-3c - Vermont Sales Tax Exemption Certificate For Contractors

ADVERTISEMENT

Vermont Sales Tax Exemption Certificate

for

Form

S-3C

CONTRACTORS

32 V.S.A. §9743(1)-(4), §9441(39)

To be filed with the SELLER, not with the VT Department of Taxes.

Complete one

c

Single Purchase - Enter Purchase Price $ _________________

exemption certificate

c

Multiple Purchase (effective for subsequent purchases.)

for EACH project

Federal ID

Number

Name

For Individuals/Partnerships

Social Security

Business Name

Number

Telephone

Number

Address

City

State

Zip

Seller’s

Name

Address

City

State

Zip

Organization’s

Name

Address

City

State

Zip

Exempt as:

c 501(c)(3) Registered in Vermont. Vermont Account Number _____________________________

c United States of America - Agency __________________________________________________

c State of Vermont or Subdivision - Name _____________________________________________

c Organization covered by V.S.A. Title 10, Chapter 11(A)

c Qualifying Manufacturing Facility 32 V.S.A. 9741(39)(i)

c Qualifying Downtown Redevelopment Facility 32 V.S.A. 9741(39)(ii)

Project

Location

Starting

Approximate

Date

Completion Date

I certify that, to the best of my knowledge and belief, the statements provided here are true and

correct.

Signature of Buyer or Authorized Agent

Title

Date

Form S-3C

This form may be photocopied.

Rev. 5/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2