Form Cba-1 - Notice Of Business Activities Report By A Foreign Corporation - New Jersey Division Of Taxation

ADVERTISEMENT

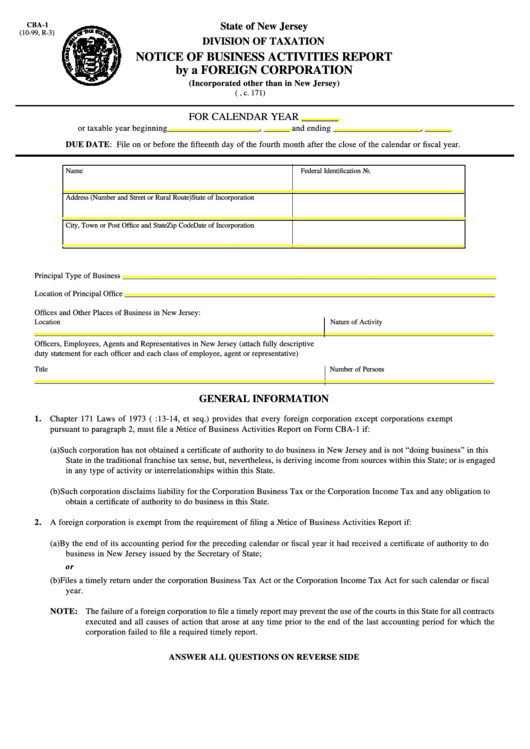

CBA-1

State of New Jersey

(10-99, R-3)

DIVISION OF TAXATION

NOTICE OF BUSINESS ACTIVITIES REPORT

by a FOREIGN CORPORATION

(Incorporated other than in New Jersey)

(P.L. 1973, c. 171)

FOR CALENDAR YEAR _______

or taxable year beginning _____________________, ______ and ending ____________________, ______

DUE DATE: File on or before the fifteenth day of the fourth month after the close of the calendar or fiscal year.

Name

Federal Identification No.

Address (Number and Street or Rural Route)

State of Incorporation

City, Town or Post Office and State

Zip Code

Date of Incorporation

Principal Type of Business ________________________________________________________________________________________________

Location of Principal Office _______________________________________________________________________________________________

Offices and Other Places of Business in New Jersey:

Location

Nature of Activity

______________________________________________________________________________________________________________________

Officers, Employees, Agents and Representatives in New Jersey (attach fully descriptive

duty statement for each officer and each class of employee, agent or representative)

Title

Number of Persons

______________________________________________________________________________________________________________________

GENERAL INFORMATION

1. Chapter 171 Laws of 1973 (N.J.S.A. 14A:13-14, et seq.) provides that every foreign corporation except corporations exempt

pursuant to paragraph 2, must file a Notice of Business Activities Report on Form CBA-1 if:

(a) Such corporation has not obtained a certificate of authority to do business in New Jersey and is not “doing business” in this

State in the traditional franchise tax sense, but, nevertheless, is deriving income from sources within this State; or is engaged

in any type of activity or interrelationships within this State.

(b) Such corporation disclaims liability for the Corporation Business Tax or the Corporation Income Tax and any obligation to

obtain a certificate of authority to do business in this State.

2. A foreign corporation is exempt from the requirement of filing a Notice of Business Activities Report if:

(a) By the end of its accounting period for the preceding calendar or fiscal year it had received a certificate of authority to do

business in New Jersey issued by the Secretary of State;

or

(b) Files a timely return under the corporation Business Tax Act or the Corporation Income Tax Act for such calendar or fiscal

year.

NOTE: The failure of a foreign corporation to file a timely report may prevent the use of the courts in this State for all contracts

executed and all causes of action that arose at any time prior to the end of the last accounting period for which the

corporation failed to file a required timely report.

ANSWER ALL QUESTIONS ON REVERSE SIDE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2