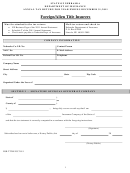

Annual Tax Return - Nebraska Department Of Insurance - 2011 Page 2

ADVERTISEMENT

SECTION II - PREMIUM TAX

NEBRASKA BASIS

STATE OF DOMICILE

BASIS

1.

Gross direct premiums received on Nebraska business

.00

.00

2.

Dividends paid or credited to policyholders

.00

.00

3.

Other deductions applicable to state of domicile (Itemize on a

separate schedule). Documentation such as “other fees” or

“other credits” is not acceptable.

N/A

.00

4.

Net taxable premiums (Line 1 minus Line 2 and Line 3)

.00

.00

5.

Tax rate applicable

.01

6.

Premium tax (Multiply Line 4 by Line 5)

.00

.00

7.

*Franchise tax

N/A

.00

8.

Other tax (Include calculations on a separate schedule)

.00

.00

9.

.00

.00

10.

.00

.00

11.

Total premium tax (Sum of Lines 6 through 10)

.00

.00

SECTION III - FEES

NEBRASKA BASIS

STATE OF DOMICILE

BASIS

12.

Renewal of Certificate of Authority

100.00

.00

13.

Filing Annual Statement

200.00

.00

14.

Insurance Fraud Fee

100.00

.00

15.

Other fees (Itemize)

.00

.00

16.

.00

.00

17.

Total fees (Sum of Lines 12 through 16)

.00

.00

*FRANCHISE TAX – Those companies whose state of domicile imposes a franchise tax in addition to premium tax or in lieu

of a premium tax, attach on a separate schedule the tax form and/or computation of the franchise tax.

FOR TITLE P/C 2011

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4