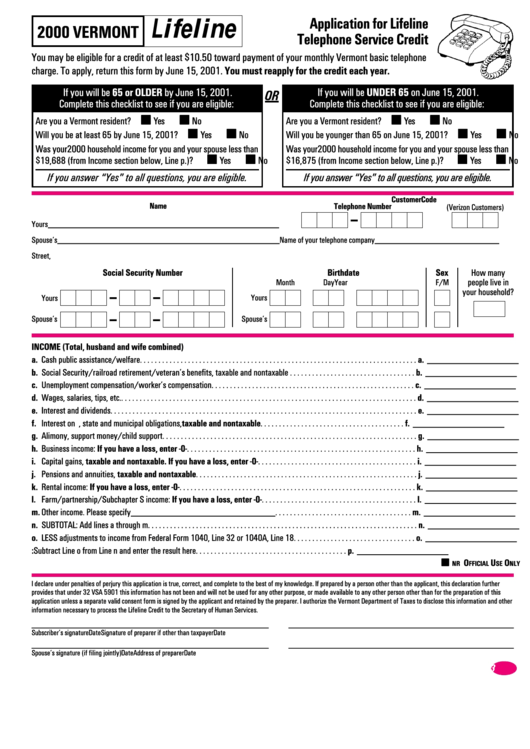

Application For Lifeline Telephone Service Credit - Vermont - 2000

ADVERTISEMENT

Application for Lifeline

Lifeline

2000 VERMONT

Telephone Service Credit

You may be eligible for a credit of at least $10.50 toward payment of your monthly Vermont basic telephone

charge. To apply, return this form by June 15, 2001. You must reapply for the credit each year.

If you will be 65 or OLDER by June 15, 2001.

If you will be UNDER 65 on June 15, 2001.

OR

Complete this checklist to see if you are eligible:

Complete this checklist to see if you are eligible:

Are you a Vermont resident?

Yes

No

Are you a Vermont resident?

Yes

No

Will you be at least 65 by June 15, 2001?

Yes

No

Will you be younger than 65 on June 15, 2001?

Yes

No

Was your2000 household income for you and your spouse less than

Was your 2000 household income for you and your spouse less than

$19,688 (from Income section below, Line p.)?

Yes

No

$16,875 (from Income section below, Line p.)?

Yes

No

If you answer “Yes” to all questions, you are eligible.

If you answer “Yes” to all questions, you are eligible.

Customer Code

Name

Telephone Number

(Verizon Customers)

–

Yours____________________________________________________

Spouse’s__________________________________________________

Name of your telephone company ____________________________

Street, P .O. Box or RD__________________________________________ City _______________________ State ____ Zip Code ___________

Social Security Number

Birthdate

Sex

How many

people live in

Month

Day

Year

F/M

–

–

your household?

Yours

Yours

–

–

Spouse’s

Spouse’s

INCOME (Total, husband and wife combined)

a. Cash public assistance/welfare . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . a. ___________________

b. Social Security/railroad retirement/veteran’s benefits, taxable and nontaxable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . b. ___________________

c. Unemployment compensation/worker’s compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . c. ___________________

d. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . d. ___________________

e. Interest and dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . e. ___________________

f. Interest on U.S., state and municipal obligations, taxable and nontaxable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . f. ___________________

g. Alimony, support money/child support . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . g. ___________________

h. Business income: If you have a loss, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . h. ___________________

i. Capital gains, taxable and nontaxable. If you have a loss, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . i. ___________________

j. Pensions and annuities, taxable and nontaxable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . j. ___________________

k. Rental income: If you have a loss, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . k. ___________________

l. Farm/partnership/Subchapter S income: If you have a loss, enter -0-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . l. ___________________

m. Other income. Please specify______________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . m. ___________________

n. SUBTOTAL: Add lines a through m . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . n. ___________________

o. LESS adjustments to income from Federal Form 1040, Line 32 or 1040A, Line 18. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . o. ___________________

p. TOTAL INCOME: Subtract Line o from Line n and enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . p. ___________________

O

U

O

NR

FFICIAL

SE

NLY

I declare under penalties of perjury this application is true, correct, and complete to the best of my knowledge. If prepared by a person other than the applicant, this declaration further

provides that under 32 VSA 5901 this information has not been and will not be used for any other purpose, or made available to any other person other than for the preparation of this

application unless a separate valid consent form is signed by the applicant and retained by the preparer. I authorize the Vermont Department of Taxes to disclose this information and other

information necessary to process the Lifeline Credit to the Secretary of Human Services.

____________________________________________________________

_________________________________________________________

Subscriber’s signature

Date

Signature of preparer if other than taxpayer

Date

____________________________________________________________

_________________________________________________________

Spouse’s signature (if filing jointly)

Date

Address of preparer

Date

Form ??

53

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1