Gambling Winnings And Your Maryland Tax Obligations

ADVERTISEMENT

Gambling Winnings and your Maryland tax obligations

Who must pay Maryland income taxes on their winnings?

Anyone who receives winnings from lottery games, racetrack betting or gambling must pay income tax on the prize

money. Both residents and nonresidents of Maryland are subject to Maryland income tax on their winnings.

I won more than $5,000 from pari-mutuel wagering (horseracing) and the payoff was less. Why is that?

Income tax will automatically be withheld if the proceeds from the wager exceed $5,000 and are at least 300 times as

large as the amount of the original wager.

I won more than $5,000 in the lottery, but my check was for less than that amount. Why was that?

Income tax will automatically be withheld, just as it is from your paycheck, if your winnings total more than $5,000.

According to Maryland law, prize winnings of more than $5,000 are subject to withholding for both federal and state

income tax purposes.

My winnings were more than $500. Does this mean I have to file an extra state tax form?

Yes. If your prize money is between $500 and $5,000, you must file Form 502D, Declaration of Estimated Tax and pay

the tax on that income within 60 days of the time you receive the prize money. You claim a credit for taxes paid with the

502D on your annual income tax return. Failure to pay the estimated tax due or report the income could result in penalty

and interest charges.

Do I have to pay income tax if my winnings are less than $500?

Yes. If your winnings are less than $500, you still must report that amount on your annual state income tax return and

pay tax on it. However, payment of estimated tax is not required.

How much tax do I have to pay with the 502D?

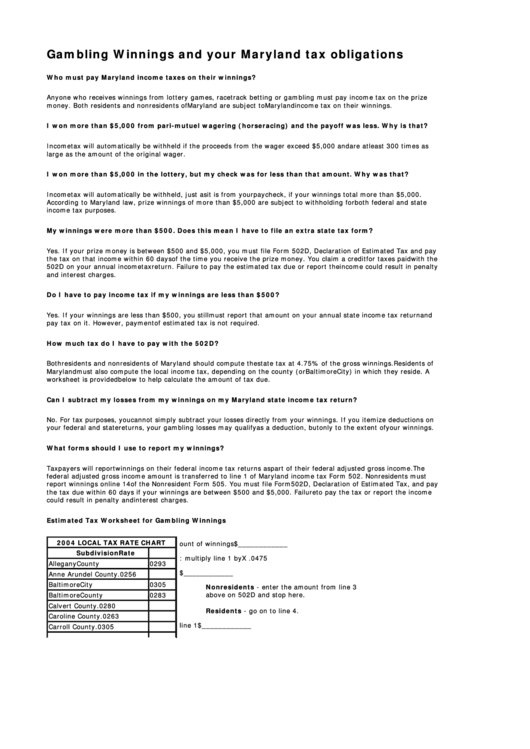

Both residents and nonresidents of Maryland should compute the state tax at 4.75% of the gross winnings. Residents of

Maryland must also compute the local income tax, depending on the county (or Baltimore City) in which they reside. A

worksheet is provided below to help calculate the amount of tax due.

Can I subtract my losses from my winnings on my Maryland state income tax return?

No. For tax purposes, you cannot simply subtract your losses directly from your winnings. If you itemize deductions on

your federal and state returns, your gambling losses may qualify as a deduction, but only to the extent of your winnings.

What forms should I use to report my winnings?

Taxpayers will report winnings on their federal income tax returns as part of their federal adjusted gross income. The

federal adjusted gross income amount is transferred to line 1 of Maryland income tax Form 502. Nonresidents must

report winnings on line 14 of the Nonresident Form 505. You must file Form 502D, Declaration of Estimated Tax, and pay

the tax due within 60 days if your winnings are between $500 and $5,000. Failure to pay the tax or report the income

could result in penalty and interest charges.

Estimated Tax Worksheet for Gambling Winnings

2004 LOCAL TAX RATE CHART

1.

Enter the amount of winnings

$____________

Subdivision

Rate

2.

State tax rate: multiply line 1 by

X .0475

Allegany County

.0293

3.

State tax

$____________

Anne Arundel County

.0256

Baltimore City

.0305

Nonresidents - enter the amount from line 3

Baltimore County

.0283

above on 502D and stop here.

Calvert County

.0280

Residents - go on to line 4.

Caroline County

.0263

4.

Enter amount from line 1

$____________

Carroll County

.0305

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2