Form Tc-96r - Utah Employer'S Income Withholding Reconciliation Return

ADVERTISEMENT

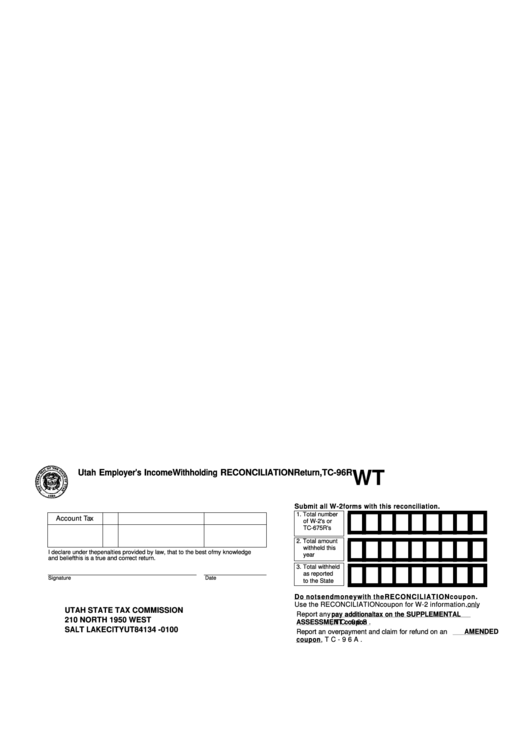

Utah Employer's Income Withholding RECONCILIATION Return, TC-96R

WT

Submit all W-2 forms with this reconciliation.

1. Total number

Account No.

Tax

Tax Period

Due Date

of W-2's or

TC-675R's

2. Total amount

withheld this

I declare under the penalties provided by law, that to the best of my knowledge

year

and belief this is a true and correct return.

3. Total withheld

as reported

Signature

Date

to the State

Do not send money with the RECONCILIATION coupon.

Use the RECONCILIATION coupon for W-2 information

only

.

UTAH STATE TAX COMMISSION

Report any

pay additional tax on the SUPPLEMENTAL

210 NORTH 1950 WEST

ASSESSMENT coupon

, TC-96S.

SALT LAKE CITY UT 84134 - 0100

Report an overpayment and claim for refund on an

AMENDED

coupon

, TC-96A.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1