STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

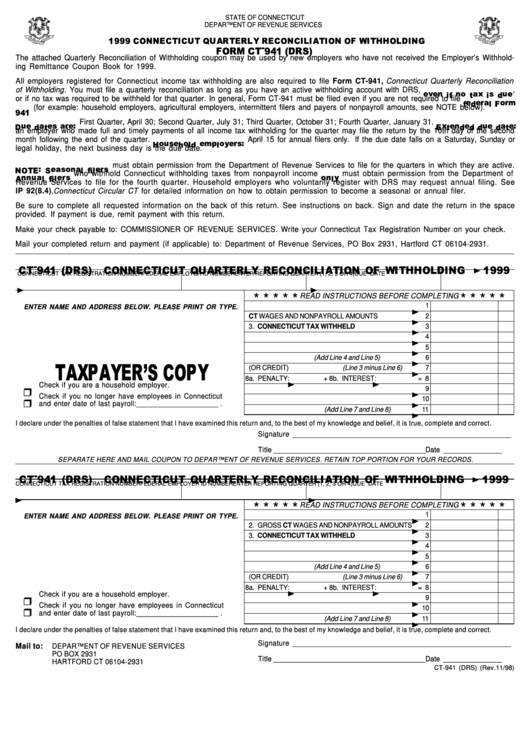

The attached Quarterly Reconciliation of Withholding coupon may be used by new employers who have not received the Employer’s Withhold-

ing Remittance Coupon Book for 1999.

All employers registered for Connecticut income tax withholding are also required to file Form CT-941, Connecticut Quarterly Reconciliation

of Withholding . You must file a quarterly reconciliation as long as you have an active withholding account with DRS,

,

or if no tax was required to be withheld for that quarter. In general, Form CT-941 must be filed even if you are not required to file

(for example: household employers, agricultural employers, intermittent filers and payers of nonpayroll amounts, see NOTE below).

First Quarter, April 30; Second Quarter, July 31; Third Quarter, October 31; Fourth Quarter, January 31.

an employer who made full and timely payments of all income tax withholding for the quarter may file the return by the 10th day of the second

month following the end of the quarter.

April 15 for annual filers only. If the due date falls on a Saturday, Sunday or

legal holiday, the next business day is the due date.

must obtain permission from the Department of Revenue Services to file for the quarters in which they are active.

who withhold Connecticut withholding taxes from nonpayroll income

must obtain permission from the Department of

Revenue Services to file for the fourth quarter. Household employers who voluntarily register with DRS may request annual filing. See

IP 92(8.4), Connecticut Circular CT for detailed information on how to obtain permission to become a seasonal or annual filer.

Be sure to complete all requested information on the back of this return. See instructions on back. Sign and date the return in the space

provided. If payment is due, remit payment with this return.

Make your check payable to: COMMISSIONER OF REVENUE SERVICES. Write your Connecticut Tax Registration Number on your check.

Mail your completed return and payment (if applicable) to: Department of Revenue Services, PO Box 2931, Hartford CT 06104-2931.

CONNECTICUT TAX REGISTRATION NUMBER

FEDERAL EMPLOYER ID NUMBER

ENTER REPORTING QUARTER (1, 2, 3 OR 4)

DUE DATE

* * * * *

READ INSTRUCTIONS BEFORE COMPLETING

* * * * *

1. GROSS WAGES AND NONPAYROLL AMOUNTS

1

ENTER NAME AND ADDRESS BELOW. PLEASE PRINT OR TYPE.

2. GROSS CT WAGES AND NONPAYROLL AMOUNTS

2

3. CONNECTICUT TAX WITHHELD

3

4. CREDIT FROM PRIOR PERIOD

4

5. PAYMENTS MADE FOR THIS QUARTER

5

6. TOTAL DEPOSITS (Add Line 4 and Line 5)

6

7. NET TAX DUE (OR CREDIT) (Line 3 minus Line 6)

7

8a. PENALTY:

+ 8b. INTEREST:

= 8

Check if you are a household employer.

9. AMOUNT APPLIED TO NEXT QUARTER

9

Check if you no longer have employees in Connecticut

10. AMOUNT TO BE REFUNDED

10

and enter date of last payroll: _____________________ .

11. TOTAL AMOUNT DUE (Add Line 7 and Line 8)

11

I declare under the penalties of false statement that I have examined this return and, to the best of my knowledge and belief, it is true, complete and correct.

Signature ________________________________________________________

Title _______________________________________

Date _______________

SEPARATE HERE AND MAIL COUPON TO DEPARTMENT OF REVENUE SERVICES. RETAIN TOP PORTION FOR YOUR RECORDS.

CONNECTICUT TAX REGISTRATION NUMBER

FEDERAL EMPLOYER ID NUMBER

ENTER REPORTING QUARTER (1, 2, 3 OR 4)

DUE DATE

* * * * *

READ INSTRUCTIONS BEFORE COMPLETING

* * * * *

1. GROSS WAGES AND NONPAYROLL AMOUNTS

1

ENTER NAME AND ADDRESS BELOW. PLEASE PRINT OR TYPE.

2. GROSS CT WAGES AND NONPAYROLL AMOUNTS

2

3. CONNECTICUT TAX WITHHELD

3

4. CREDIT FROM PRIOR PERIOD

4

5. PAYMENTS MADE FOR THIS QUARTER

5

6. TOTAL DEPOSITS (Add Line 4 and Line 5)

6

7. NET TAX DUE (OR CREDIT) (Line 3 minus Line 6)

7

8a. PENALTY:

+ 8b. INTEREST:

= 8

Check if you are a household employer.

9. AMOUNT APPLIED TO NEXT QUARTER

9

Check if you no longer have employees in Connecticut

10. AMOUNT TO BE REFUNDED

10

and enter date of last payroll: _____________________ .

11. TOTAL AMOUNT DUE (Add Line 7 and Line 8)

11

I declare under the penalties of false statement that I have examined this return and, to the best of my knowledge and belief, it is true, complete and correct.

Signature ________________________________________________________

Mail to:

DEPARTMENT OF REVENUE SERVICES

PO BOX 2931

Title _______________________________________

Date _______________

HARTFORD CT 06104-2931

CT-941 (DRS) (Rev.11/98)

1

1 2

2