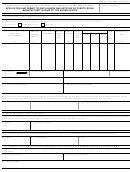

24. DATE

25. CUSTOMS AND BORDER PROTECTION OFFICER 26. AREA PORT DIRECTOR

PART V - CERTIFICATE OF AREA PORT DIRECTOR OF CUSTOMS AND BORDER PROTECTION AT PORT OF ARRIVAL IN

UNITED STATES

I hereby certify that the liquors or articles described in Part I were received and have been inspected and released as follows:

27. DATE

28. PORT OF

29. QUANTITY INSPECTED AND RELEASED

31. Identify separately the quantity lost from each container and the serial number of each container.

1

(a) CONTAINER SERIAL NUMBER

(b) QUANTITY LOST

30. Lost by breakage or otherwise

during transportation to the United

States.

1

32. TOTAL QUANTITY LOST

33. CUSTOMS AND BORDER PROTECTION OFFICER

34. AREA PORT DIRECTOR

1

Identify, as applicable, in terms of "proof gallons" (spirits), "wine gallons" (wine), or "barrels" (beer)

1. GENERAL. The shipper must prepare this form in sextuplet for each

The shipper must then submit the two copies to the Area Port

consignment. A separate TTB F 5170.7 is required for each product

Director in Puerto Rico at least six hours prior to the intended lading

covered by an approved formula. Forms must be serially numbered

of the merchandise.

beginning with "1" each calendar year, and running consecutively

thereafter to the end of the year. The serial number must be prefixed

5. PART IV. The Area Port Director in Puerto Rico, on release of the

by the last two digits of the calendar year, e.g., 07-1."

merchandise for shipment, must execute his/her certificate in Part IV

on all copies, retain one copy for his/her files, mail the original to the

2. PART I. The shipper must prepare Part I. Where the shipment

Director of Customs at the port of arrival in the United States,

covers wine, enter the tax class of the wine in column 2(h) and

dispatch a second copy to said Port Director on the vessel

disregard column 2(i). Where the shipment covers beer, modify the

concerned for the guidance of the inspector who will handle the

heading of column 2(g) to read "barrels" and enter quantity in barrels;

cargo, and return two copies to the shipper. After the shipment has

disregard columns 2(h) and 2(i). After executing his/her application in

been cleared, the shipper must retain one copy of the form and send

Part I, the shipper must deliver all copies of the form to the Internal

one copy, with other shipping documents, to the Area Port Director

Revenue Agent.

at the port of arrival.

3. PART II. After executing his/her certificate in Part ll, the Internal

6. PART V. The Area Port Director at the port of arrival in the United

Revenue Agent must forward all copies of the form to The Secretary of

States, after executing his certificate on all copies of the form

the Treasury of Puerto Rico.

received by him/her, must retain the original for his/her files, and

forward the two remaining copies to the District Director, Puerto Rico

4. PART III. After executing his/her permit to ship on all copies of the

Operations, TTB, Ste 310 Torre Chardon, 350 Carlos Chardon Ave,

form, the Secretary must retain one copy, send the original and two

San Juan, PR 00918.

copies to the Area Port Director in Puerto Rico, and return two copies

to the shipper.

PAPERWORK REDUCTION ACT NOTICE

This request is in accordance with the Paperwork Reduction Act of 1995. This information collection documents transactions of taxable

commodities on which tax has not been paid. TTB uses the information to determine that the transaction is in accordance with laws and

regulations and establish the person responsible for the tax involved in the transaction. Information requested is mandatory by statute

(26 USC 5314 and 7652).

The estimated average burden associated with this collection of information is 30 minutes per respondent or recordkeeper, depending on

individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be

addressed to the Reports Management Officer, Regulations and Rulings Division, Alcohol and Tobacco Tax and Trade Bureau, Washington,

DC 20220.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a current, valid

OMB Control Number.

TTB FORM 5170.7 (09/2013)

1

1 2

2