Form Rt127d - Road Toll Refund Application - Private School Bus Owner - Diesel Only

ADVERTISEMENT

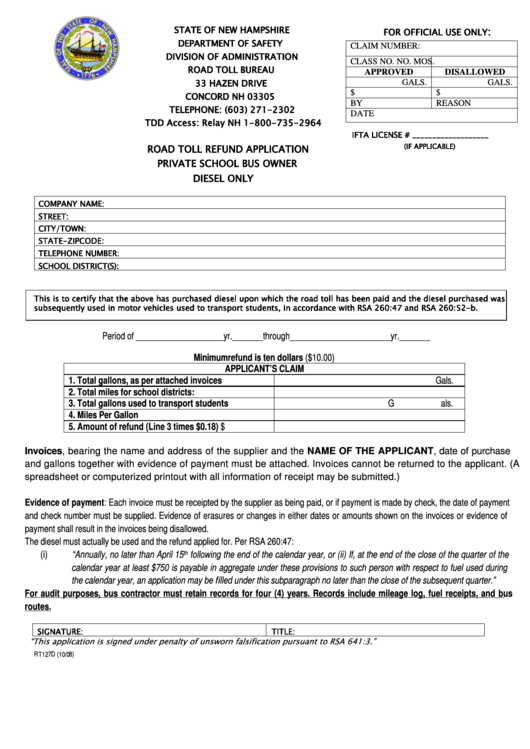

STATE OF NEW HAMPSHIRE

:

FOR OFFICIAL USE ONLY

DEPARTMENT OF SAFETY

CLAIM NUMBER:

DIVISION OF ADMINISTRATION

CLASS NO.

NO. MOS.

ROAD TOLL BUREAU

APPROVED

DISALLOWED

33 HAZEN DRIVE

GALS.

GALS.

$

$

CONCORD NH 03305

BY

REASON NO.

TELEPHONE: (603) 271-2302

DATE

TDD Access: Relay NH 1-800-735-2964

IFTA LICENSE # ___________________

(IF APPLICABLE)

ROAD TOLL REFUND APPLICATION

PRIVATE SCHOOL BUS OWNER

DIESEL ONLY

COMPANY NAME:

STREET:

CITY/TOWN:

STATE-ZIPCODE:

TELEPHONE NUMBER:

SCHOOL DISTRICT(S):

This is to certify that the above has purchased diesel upon which the road toll has been paid and the diesel purchased was

subsequently used in motor vehicles used to transport students, in accordance with RSA 260:47 and RSA 260:52-b.

Period of ____________________yr._______through_______________________yr._______

Minimum refund is ten dollars ($10.00)

APPLICANT’S CLAIM

1. Total gallons, as per attached invoices

Gals.

2. Total miles for school districts:

3. Total gallons used to transport students

Gals.

4. Miles Per Gallon

5. Amount of refund (Line 3 times $0.18)

$

Invoices, bearing the name and address of the supplier and the NAME OF THE APPLICANT, date of purchase

and gallons together with evidence of payment must be attached. Invoices cannot be returned to the applicant. (A

spreadsheet or computerized printout with all information of receipt may be submitted.)

Evidence of payment: Each invoice must be receipted by the supplier as being paid, or if payment is made by check, the date of payment

and check number must be supplied. Evidence of erasures or changes in either dates or amounts shown on the invoices or evidence of

payment shall result in the invoices being disallowed.

The diesel must actually be used and the refund applied for. Per RSA 260:47:

(i)

“Annually, no later than April 15

th

following the end of the calendar year, or (ii) If, at the end of the close of the quarter of the

calendar year at least $750 is payable in aggregate under these provisions to such person with respect to fuel used during

the calendar year, an application may be filled under this subparagraph no later than the close of the subsequent quarter.”

For audit purposes, bus contractor must retain records for four (4) years. Records include mileage log, fuel receipts, and bus

routes.

SIGNATURE:

TITLE:

“This application is signed under penalty of unsworn falsification pursuant to RSA 641:3.”

RT127D (10/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2