California Form 3539 (Corp) - Payment Voucher For Automatic Extension For Corporations And Exempt Organizations - 2000

ADVERTISEMENT

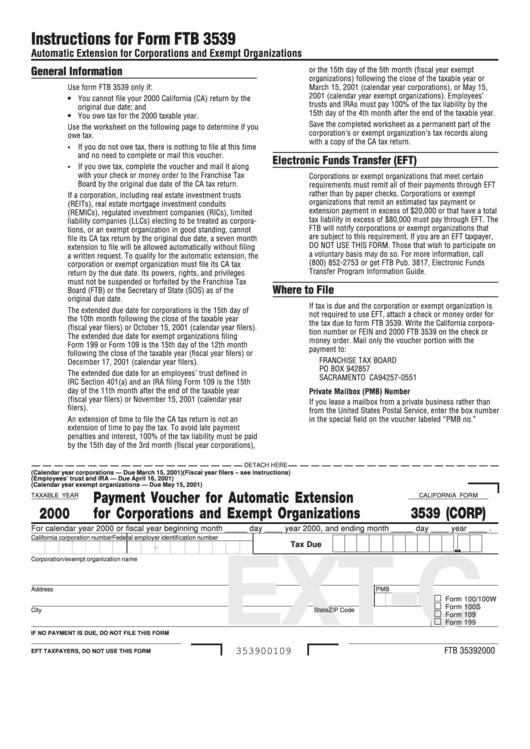

Instructions for Form FTB 3539

Automatic Extension for Corporations and Exempt Organizations

General Information

or the 15th day of the 5th month (fiscal year exempt

organizations) following the close of the taxable year or

Use form FTB 3539 only if:

March 15, 2001 (calendar year corporations), or May 15,

2001 (calendar year exempt organizations). Employees’

• You cannot file your 2000 California (CA) return by the

trusts and IRAs must pay 100% of the tax liability by the

original due date; and

15th day of the 4th month after the end of the taxable year.

• You owe tax for the 2000 taxable year.

Save the completed worksheet as a permanent part of the

Use the worksheet on the following page to determine if you

corporation’s or exempt organization’s tax records along

owe tax.

with a copy of the CA tax return.

• If you do not owe tax, there is nothing to file at this time

and no need to complete or mail this voucher.

Electronic Funds Transfer (EFT)

• If you owe tax, complete the voucher and mail it along

with your check or money order to the Franchise Tax

Corporations or exempt organizations that meet certain

Board by the original due date of the CA tax return.

requirements must remit all of their payments through EFT

rather than by paper checks. Corporations or exempt

If a corporation, including real estate investment trusts

organizations that remit an estimated tax payment or

(REITs), real estate mortgage investment conduits

extension payment in excess of $20,000 or that have a total

(REMICs), regulated investment companies (RICs), limited

tax liability in excess of $80,000 must pay through EFT. The

liability companies (LLCs) electing to be treated as corpora-

FTB will notify corporations or exempt organizations that

tions, or an exempt organization in good standing, cannot

are subject to this requirement. If you are an EFT taxpayer,

file its CA tax return by the original due date, a seven month

DO NOT USE THIS FORM. Those that wish to participate on

extension to file will be allowed automatically without filing

a voluntary basis may do so. For more information, call

a written request. To qualify for the automatic extension, the

(800) 852-2753 or get FTB Pub. 3817, Electronic Funds

corporation or exempt organization must file its CA tax

Transfer Program Information Guide.

return by the due date. Its powers, rights, and privileges

must not be suspended or forfeited by the Franchise Tax

Where to File

Board (FTB) or the Secretary of State (SOS) as of the

original due date.

If tax is due and the corporation or exempt organization is

The extended due date for corporations is the 15th day of

not required to use EFT, attach a check or money order for

the 10th month following the close of the taxable year

the tax due to form FTB 3539. Write the California corpora-

(fiscal year filers) or October 15, 2001 (calendar year filers).

tion number or FEIN and 2000 FTB 3539 on the check or

The extended due date for exempt organizations filing

money order. Mail only the voucher portion with the

Form 199 or Form 109 is the 15th day of the 12th month

payment to:

following the close of the taxable year (fiscal year filers) or

FRANCHISE TAX BOARD

December 17, 2001 (calendar year filers).

PO BOX 942857

The extended due date for an employees’ trust defined in

SACRAMENTO CA 94257-0551

IRC Section 401(a) and an IRA filing Form 109 is the 15th

day of the 11th month after the end of the taxable year

Private Mailbox (PMB) Number

(fiscal year filers) or November 15, 2001 (calendar year

If you lease a mailbox from a private business rather than

filers).

from the United States Postal Service, enter the box number

An extension of time to file the CA tax return is not an

in the special field on the voucher labeled “PMB no.”

extension of time to pay the tax. To avoid late payment

penalties and interest, 100% of the tax liability must be paid

by the 15th day of the 3rd month (fiscal year corporations),

DETACH HERE

(Calendar year corporations — Due March 15, 2001) (Fiscal year filers – see instructions)

(Employees’ trust and IRA — Due April 16, 2001)

(Calendar year exempt organizations — Due May 15, 2001)

Payment Voucher for Automatic Extension

TAXABLE YEAR

CALIFORNIA FORM

2000

for Corporations and Exempt Organizations

3539 (CORP)

For calendar year 2000 or fiscal year beginning month _____ day ____ year 2000, and ending month _____ day ____ year ____ .

California corporation number

Federal employer identification number

-

Tax Due

. . . . .

EXT-C

Corporation/exempt organization name

Address

PMB no.

Type of form filed.

Form 100/100W

Form 100S

City

State

ZIP Code

Form 109

Form 199

IF NO PAYMENT IS DUE, DO NOT FILE THIS FORM

FTB 3539 2000

353900109

EFT TAXPAYERS, DO NOT USE THIS FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2