Instruction For Form 505 - Maryland Nonresident Income Tax Return

ADVERTISEMENT

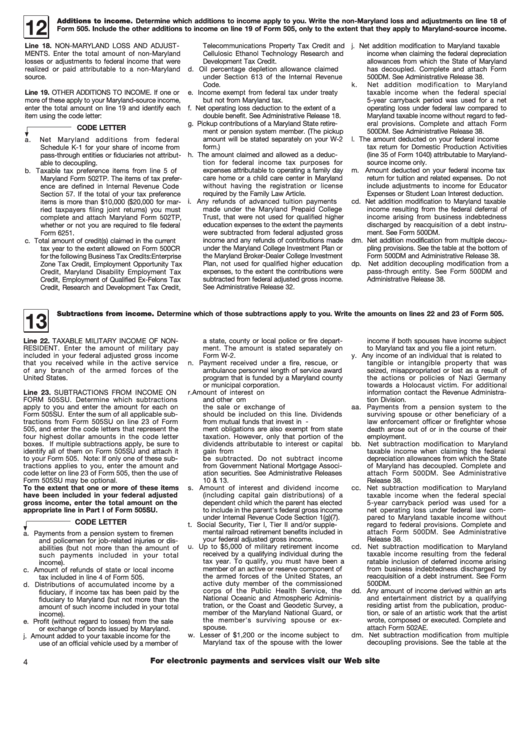

12

Additions to income. Determine which additions to income apply to you. Write the non-Maryland loss and adjustments on line 18 of

Form 505. Include the other additions to income on line 19 of Form 505, only to the extent that they apply to Maryland-source income.

Line 18. NON-MARYLAND LOSS AND ADJUST-

Telecommunications Property Tax Credit and

j.

Net addition modification to Maryland taxable

MENTS. Enter the total amount of non-Maryland

Cellulosic Ethanol Technology Research and

income when claiming the federal depreciation

losses or adjustments to federal income that were

Development Tax Credit.

allowances from which the State of Maryland

realized or paid attributable to a non-Maryland

d.

Oil percentage depletion allowance claimed

has decoupled. Complete and attach Form

source.

under Section 613 of the Internal Revenue

500DM. See Administrative Release 38.

Code.

k.

Net addition modification to Maryland

Line 19. OTHER ADDITIONS TO INCOME. If one or

e.

Income exempt from federal tax under treaty

taxable income when the federal special

more of these apply to your Maryland-source income,

but not from Maryland tax.

5-year carryback period was used for a net

enter the total amount on line 19 and identify each

f.

Net operating loss deduction to the extent of a

operating loss under federal law compared to

item using the code letter:

double benefit. See Administrative Release 18.

Maryland taxable income without regard to fed-

g.

Pickup contributions of a Maryland State retire-

eral provisions. Complete and attach Form

CODE LETTER

ment or pension system member. (The pickup

500DM. See Administrative Release 38.

▼

amount will be stated separately on your W-2

l.

The amount deducted on your federal income

a.

Net Maryland additions from federal

Schedule K-1 for your share of income from

form.)

tax return for Domestic Production Activities

h.

The amount claimed and allowed as a deduc-

(line 35 of Form 1040) attributable to Maryland-

pass-through entities or fiduciaries not attribut-

able to decoupling.

tion for federal income tax purposes for

source income only.

expenses attributable to operating a family day

m.

Amount deducted on your federal income tax

b.

Taxable tax preference items from line 5 of

care home or a child care center in Maryland

return for tuition and related expenses. Do not

Maryland Form 502TP. The items of tax prefer-

without having the registration or license

include adjustments to income for Educator

ence are defined in Internal Revenue Code

required by the Family Law Article.

Expenses or Student Loan Interest deduction.

Section 57. If the total of your tax preference

i.

Any refunds of advanced tuition payments

cd. Net addition modification to Maryland taxable

items is more than $10,000 ($20,000 for mar-

made under the Maryland Prepaid College

income resulting from the federal deferral of

ried taxpayers filing joint returns) you must

complete and attach Maryland Form 502TP,

Trust, that were not used for qualified higher

income arising from business indebtedness

education expenses to the extent the payments

discharged by reacquisition of a debt instru-

whether or not you are required to file federal

Form 6251.

were subtracted from federal adjusted gross

ment. See Form 500DM.

income and any refunds of contributions made

dm. Net addition modification from multiple decou-

c.

Total amount of credit(s) claimed in the current

under the Maryland College Investment Plan or

pling provisions. See the table at the bottom of

tax year to the extent allowed on Form 500CR

the Maryland Broker-Dealer College Investment

Form 500DM and Administrative Release 38.

for the following Business Tax Credits:Enterprise

Plan, not used for qualified higher education

dp. Net addition decoupling modification from a

Zone Tax Credit, Employment Opportunity Tax

expenses, to the extent the contributions were

pass-through entity. See Form 500DM and

Credit, Maryland Disability Employment Tax

subtracted from federal adjusted gross income.

Administrative Release 38.

Credit, Employment of Qualified Ex-Felons Tax

Credit, Research and Development Tax Credit,

See Administrative Release 32.

13

Subtractions from income. Determine which of those subtractions apply to you. Write the amounts on lines 22 and 23 of Form 505.

Line 22. TAXABLE MILITARY INCOME OF NON-

a state, county or local police or fire depart-

income if both spouses have income subject

RESIDENT. Enter the amount of military pay

ment. The amount is stated separately on

to Maryland tax and you file a joint return.

included in your federal adjusted gross income

Form W-2.

y.

Any income of an individual that is related to

that you received while in the active service

n.

Payment received under a fire, rescue, or

tangible or intangible property that was

of any branch of the armed forces of the

ambulance personnel length of service award

seized, misappropriated or lost as a result of

United States.

program that is funded by a Maryland county

the actions or policies of Nazi Germany

or municipal corporation.

towards a Holocaust victim. For additional

Line 23. SUBTRACTIONS FROM INCOME ON

r.

Amount of interest on U.S. savings bonds

information contact the Revenue Administra-

FORM 505SU. Determine which subtractions

and other U.S. obligations. Capital gains from

tion Division.

apply to you and enter the amount for each on

the sale or exchange of U.S. obligations

aa. Payments from a pension system to the

Form 505SU. Enter the sum of all applicable sub-

should be included on this line. Dividends

surviving spouse or other beneficiary of a

tractions from Form 505SU on line 23 of Form

from mutual funds that invest in U.S. govern-

law enforcement officer or firefighter whose

505, and enter the code letters that represent the

ment obligations are also exempt from state

death arose out of or in the course of their

four highest dollar amounts in the code letter

taxation. However, only that portion of the

employment.

boxes. If multiple subtractions apply, be sure to

dividends attributable to interest or capital

bb. Net subtraction modification to Maryland

identify all of them on Form 505SU and attach it

gain from U.S. government obligations can

taxable income when claiming the federal

to your Form 505. Note: If only one of these sub-

be subtracted. Do not subtract income

depreciation allowances from which the State

tractions applies to you, enter the amount and

from Government National Mortgage Associ-

of Maryland has decoupled. Complete and

code letter on line 23 of Form 505, then the use of

ation securities. See Administrative Releases

attach Form 500DM. See Administrative

Form 505SU may be optional.

10 & 13.

Release 38.

To the extent that one or more of these items

s.

Amount of interest and dividend income

cc. Net subtraction modification to Maryland

have been included in your federal adjusted

(including capital gain distributions) of a

taxable income when the federal special

gross income, enter the total amount on the

dependent child which the parent has elected

5-year carryback period was used for a

appropriate line in Part I of Form 505SU.

to include in the parent's federal gross income

net operating loss under federal law com-

under Internal Revenue Code Section 1(g)(7).

pared to Maryland taxable income without

CODE LETTER

t.

Social Security, Tier I, Tier II and/or supple-

regard to federal provisions. Complete and

▼

mental railroad retirement benefits included in

attach Form 500DM. See Administrative

a.

Payments from a pension system to firemen

your federal adjusted gross income.

Release 38.

and policemen for job-related injuries or dis-

u.

Up to $5,000 of military retirement income

cd. Net subtraction modification to Maryland

abilities (but not more than the amount of

received by a qualifying individual during the

taxable income resulting from the federal

such payments included in your total

tax year. To qualify, you must have been a

ratable inclusion of deferred income arising

income).

member of an active or reserve component of

from business indebtedness discharged by

c.

Amount of refunds of state or local income

the armed forces of the United States, an

reacquisition of a debt instrument. See Form

tax included in line 4 of Form 505.

active duty member of the commissioned

500DM.

d.

Distributions of accumulated income by a

corps of the Public Health Service, the

dd. Any amount of income derived within an arts

fiduciary, if income tax has been paid by the

National Oceanic and Atmospheric Adminis-

and entertainment district by a qualifying

fiduciary to Maryland (but not more than the

tration, or the Coast and Geodetic Survey, a

residing artist from the publication, produc-

amount of such income included in your total

member of the Maryland National Guard, or

tion, or sale of an artistic work that the artist

income).

the member's surviving spouse or ex-

wrote, composed or executed. Complete and

e.

Profit (without regard to losses) from the sale

spouse.

attach Form 502AE.

or exchange of bonds issued by Maryland.

w.

Lesser of $1,200 or the income subject to

dm. Net subtraction modification from multiple

j.

Amount added to your taxable income for the

Maryland tax of the spouse with the lower

decoupling provisions. See the table at the

use of an official vehicle used by a member of

For electronic payments and services visit our Web site

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2