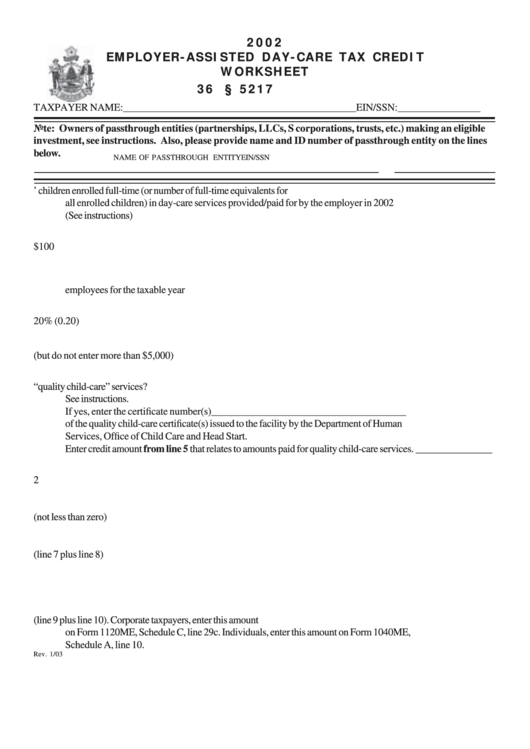

Employer-Assisted Day-Care Tax Credit Worksheet - 2002

ADVERTISEMENT

2002

EMPLOYER-ASSISTED DAY-CARE TAX CREDIT

WORKSHEET

36 M.R.S.A. § 5217

TAXPAYER NAME:_____________________________________________EIN/SSN:________________

Note: Owners of passthrough entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of passthrough entity on the lines

below.

NAME OF PASSTHROUGH ENTITY

EIN/SSN

1.

Number of employees’ children enrolled full-time (or number of full-time equivalents for

all enrolled children) in day-care services provided/paid for by the employer in 2002

(See instructions) ........................................................................................................ _______________

2.

Line 1 x $100 ............................................................................................................. _______________

3.

Actual costs incurred by employer in providing day-care services for children of its

employees for the taxable year .................................................................................... _______________

4.

Line 3 x 20% (0.20) ................................................................................................... _______________

5.

Enter the smaller of line 2 or line 4 (but do not enter more than $5,000) ....................... _______________

6.

Do any of the day-care services provided in 2002 qualify as “quality child-care” services?

See instructions. .......................................................................................................... Yes_____ No____

If yes, enter the certificate number(s)______________________________________

of the quality child-care certificate(s) issued to the facility by the Department of Human

Services, Office of Child Care and Head Start.

Enter credit amount from line 5 that relates to amounts paid for quality child-care services. _______________

7.

Line 6 X 2 .................................................................................................................. _______________

8.

Line 5 minus line 6 (not less than zero) ......................................................................... _______________

9.

Current year credit amount (line 7 plus line 8) .............................................................. _______________

10.

Credit carried forward/back from other tax years. See instructions. .............................. _______________

11.

Total credit available this year (line 9 plus line 10). Corporate taxpayers, enter this amount

on Form 1120ME, Schedule C, line 29c. Individuals, enter this amount on Form 1040ME,

Schedule A, line 10. .................................................................................................... _______________

Rev. 1/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1