Instructions For Form 1125-E - Compensation Of Officers - 2016

ADVERTISEMENT

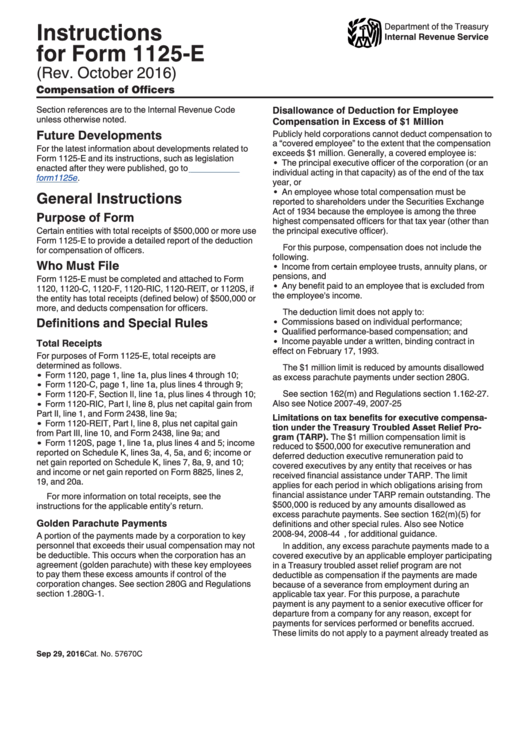

Instructions

Department of the Treasury

Internal Revenue Service

for Form 1125-E

(Rev. October 2016)

Compensation of Officers

Section references are to the Internal Revenue Code

Disallowance of Deduction for Employee

unless otherwise noted.

Compensation in Excess of $1 Million

Future Developments

Publicly held corporations cannot deduct compensation to

a “covered employee” to the extent that the compensation

For the latest information about developments related to

exceeds $1 million. Generally, a covered employee is:

Form 1125-E and its instructions, such as legislation

The principal executive officer of the corporation (or an

enacted after they were published, go to

individual acting in that capacity) as of the end of the tax

form1125e.

year, or

An employee whose total compensation must be

General Instructions

reported to shareholders under the Securities Exchange

Act of 1934 because the employee is among the three

Purpose of Form

highest compensated officers for that tax year (other than

Certain entities with total receipts of $500,000 or more use

the principal executive officer).

Form 1125-E to provide a detailed report of the deduction

For this purpose, compensation does not include the

for compensation of officers.

following.

Who Must File

Income from certain employee trusts, annuity plans, or

pensions, and

Form 1125-E must be completed and attached to Form

Any benefit paid to an employee that is excluded from

1120, 1120-C, 1120-F, 1120-RIC, 1120-REIT, or 1120S, if

the employee's income.

the entity has total receipts (defined below) of $500,000 or

more, and deducts compensation for officers.

The deduction limit does not apply to:

Definitions and Special Rules

Commissions based on individual performance;

Qualified performance-based compensation; and

Income payable under a written, binding contract in

Total Receipts

effect on February 17, 1993.

For purposes of Form 1125-E, total receipts are

determined as follows.

The $1 million limit is reduced by amounts disallowed

Form 1120, page 1, line 1a, plus lines 4 through 10;

as excess parachute payments under section 280G.

Form 1120-C, page 1, line 1a, plus lines 4 through 9;

See section 162(m) and Regulations section 1.162-27.

Form 1120-F, Section II, line 1a, plus lines 4 through 10;

Also see Notice 2007-49, 2007-25 I.R.B. 1429.

Form 1120-RIC, Part I, line 8, plus net capital gain from

Part II, line 1, and Form 2438, line 9a;

Limitations on tax benefits for executive compensa-

Form 1120-REIT, Part I, line 8, plus net capital gain

tion under the Treasury Troubled Asset Relief Pro-

from Part III, line 10, and Form 2438, line 9a; and

gram (TARP). The $1 million compensation limit is

Form 1120S, page 1, line 1a, plus lines 4 and 5; income

reduced to $500,000 for executive remuneration and

reported on Schedule K, lines 3a, 4, 5a, and 6; income or

deferred deduction executive remuneration paid to

net gain reported on Schedule K, lines 7, 8a, 9, and 10;

covered executives by any entity that receives or has

and income or net gain reported on Form 8825, lines 2,

received financial assistance under TARP. The limit

19, and 20a.

applies for each period in which obligations arising from

financial assistance under TARP remain outstanding. The

For more information on total receipts, see the

$500,000 is reduced by any amounts disallowed as

instructions for the applicable entity’s return.

excess parachute payments. See section 162(m)(5) for

Golden Parachute Payments

definitions and other special rules. Also see Notice

2008-94, 2008-44 I.R.B. 1070, for additional guidance.

A portion of the payments made by a corporation to key

personnel that exceeds their usual compensation may not

In addition, any excess parachute payments made to a

be deductible. This occurs when the corporation has an

covered executive by an applicable employer participating

agreement (golden parachute) with these key employees

in a Treasury troubled asset relief program are not

to pay them these excess amounts if control of the

deductible as compensation if the payments are made

corporation changes. See section 280G and Regulations

because of a severance from employment during an

section 1.280G-1.

applicable tax year. For this purpose, a parachute

payment is any payment to a senior executive officer for

departure from a company for any reason, except for

payments for services performed or benefits accrued.

These limits do not apply to a payment already treated as

Sep 29, 2016

Cat. No. 57670C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2