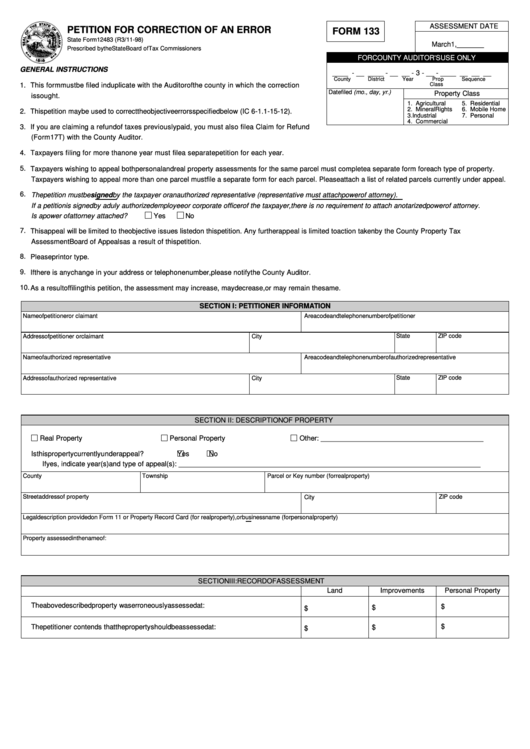

ASSESSMENT DATE

PETITION FOR CORRECTION OF AN ERROR

FORM 133

State Form 12483 (R3 / 11-98)

March 1, _______

Prescribed by the State Board of Tax Commissioners

FOR COUNTY AUDITOR'S USE ONLY

GENERAL INSTRUCTIONS

__ __ - __ __ __ - __ __ - 3 - __ - __ __ __ __ __

County

District

Year

Prop

Sequence

Class

1. This form must be filed in duplicate with the Auditor of the county in which the correction

Date filed (mo., day, yr.)

Property Class

is sought.

1. Agricultural

5. Residential

2. Mineral Rights

6. Mobile Home

2. This petition may be used to correct the objective errors specified below (IC 6-1.1-15-12).

3. Industrial

7. Personal

4. Commercial

3. If you are claiming a refund of taxes previously paid, you must also file a Claim for Refund

(Form 17T) with the County Auditor.

4. Taxpayers filing for more than one year must file a separate petition for each year.

5. Taxpayers wishing to appeal both personal and real property assessments for the same parcel must complete a separate form for each type of property.

Taxpayers wishing to appeal more than one parcel must file a separate form for each parcel. Please attach a list of related parcels currently under appeal.

6.

The petition must be signed by the taxpayer or an authorized representative (representative must attach power of attorney).

If a petition is signed by a duly authorized employee or corporate officer of the taxpayer, there is no requirement to attach a notarized power of attorney.

Is a power of attorney attached?

Yes

No

7. This appeal will be limited to the objective issues listed on this petition. Any further appeal is limited to action taken by the County Property Tax

Assessment Board of Appeals as a result of this petition.

8. Please print or type.

9. If there is any change in your address or telephone number, please notify the County Auditor.

10. As a result of filing this petition, the assessment may increase, may decrease, or may remain the same.

SECTION I: PETITIONER INFORMATION

Name of petitioner or claimant

Area code and telephone number of petitioner

State

ZIP code

Address of petitioner or claimant

City

Name of authorized representative

Area code and telephone number of authorized representative

Address of authorized representative

City

State

ZIP code

SECTION II: DESCRIPTION OF PROPERTY

Real Property

Personal Property

Other: __________________________________________

Is this property currently under appeal?

Yes

No

If yes, indicate year(s) and type of appeal(s): ______________________________________________________________________________

County

Township

Parcel or Key number (for real property)

Street address of property

ZIP code

City

Legal description provided on Form 11 or Property Record Card (for real property), or business name (for personal property)

Property assessed in the name of:

SECTION III: RECORD OF ASSESSMENT

Land

Improvements

Personal Property

The above described property was erroneously assessed at:

$

$

$

$

The petitioner contends that the property should be assessed at:

$

$

1

1 2

2 3

3 4

4