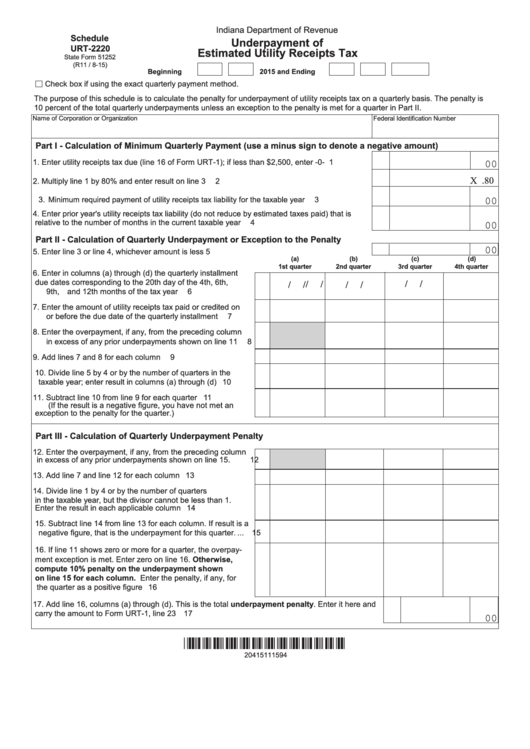

Indiana Department of Revenue

Schedule

Underpayment of

URT-2220

Estimated Utility Receipts Tax

State Form 51252

(R11 / 8-15)

Beginning

2015 and Ending

Check box if using the exact quarterly payment method.

The purpose of this schedule is to calculate the penalty for underpayment of utility receipts tax on a quarterly basis. The penalty is

10 percent of the total quarterly underpayments unless an exception to the penalty is met for a quarter in Part II.

Name of Corporation or Organization

Federal Identification Number

Part I - Calculation of Minimum Quarterly Payment (use a minus sign to denote a negative amount)

00

1. Enter utility receipts tax due (line 16 of Form URT-1); if less than $2,500, enter -0- ..................

1

X .80

2. Multiply line 1 by 80% and enter result on line 3 .........................................................................

2

00

3. Minimum required payment of utility receipts tax liability for the taxable year ................................

3

4. Enter prior year's utility receipts tax liability (do not reduce by estimated taxes paid) that is

relative to the number of months in the current taxable year ......................................................

4

00

Part II - Calculation of Quarterly Underpayment or Exception to the Penalty

00

5. Enter line 3 or line 4, whichever amount is less ..........................................................................

5

(a)

(b)

(c)

(d)

1st quarter

2nd quarter

3rd quarter

4th quarter

6. Enter in columns (a) through (d) the quarterly installment

due dates corresponding to the 20th day of the 4th, 6th,

/

/

/

/

/

/

/

/

9th, and 12th months of the tax year ....................................

6

7. Enter the amount of utility receipts tax paid or credited on

or before the due date of the quarterly installment ...............

7

8. Enter the overpayment, if any, from the preceding column

in excess of any prior underpayments shown on line 11 ......

8

9. Add lines 7 and 8 for each column .......................................

9

10. Divide line 5 by 4 or by the number of quarters in the

taxable year; enter result in columns (a) through (d) ............ 10

11. Subtract line 10 from line 9 for each quarter ........................ 11

(If the result is a negative figure, you have not met an

exception to the penalty for the quarter.)

Part III - Calculation of Quarterly Underpayment Penalty

12. Enter the overpayment, if any, from the preceding column

in excess of any prior underpayments shown on line 15.

12

13. Add line 7 and line 12 for each column ................................ 13

14. Divide line 1 by 4 or by the number of quarters

in the taxable year, but the divisor cannot be less than 1.

Enter the result in each applicable column ........................... 14

15. Subtract line 14 from line 13 for each column. If result is a

negative figure, that is the underpayment for this quarter. ... 15

16. If line 11 shows zero or more for a quarter, the overpay-

ment exception is met. Enter zero on line 16. Otherwise,

compute 10% penalty on the underpayment shown

on line 15 for each column. Enter the penalty, if any, for

the quarter as a positive figure ............................................. 16

17. Add line 16, columns (a) through (d). This is the total underpayment penalty. Enter it here and

carry the amount to Form URT-1, line 23 ........................................................................................ 17

00

*20415111594*

20415111594

1

1