Form Op-305 - Application For Tax Amnesty - Connecticut Department Of Revenue Services, 2002

ADVERTISEMENT

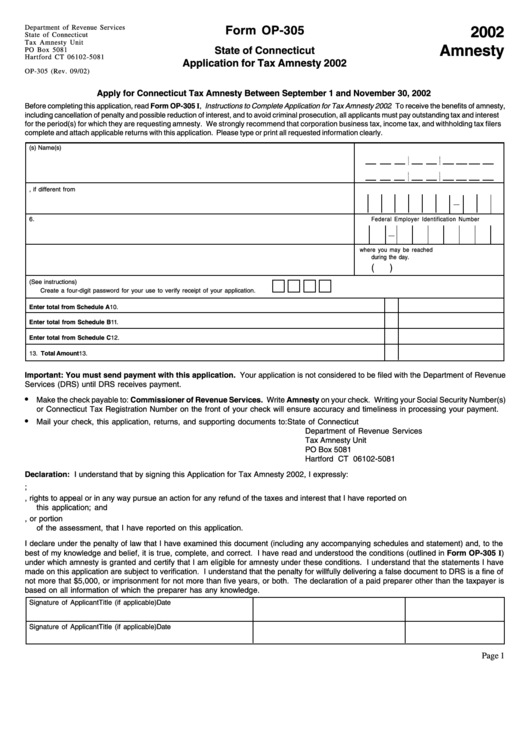

Department of Revenue Services

Form OP-305

2002

State of Connecticut

Tax Amnesty Unit

Amnesty

State of Connecticut

PO Box 5081

Hartford CT 06102-5081

Application for Tax Amnesty 2002

OP-305 (Rev. 09/02)

Apply for Connecticut Tax Amnesty Between September 1 and November 30, 2002

Before completing this application, read Form OP-305 I, Instructions to Complete Application for Tax Amnesty 2002 . To receive the benefits of amnesty,

including cancellation of penalty and possible reduction of interest, and to avoid criminal prosecution, all applicants must pay outstanding tax and interest

for the period(s) for which they are requesting amnesty. We strongly recommend that corporation business tax, income tax, and withholding tax filers

complete and attach applicable returns with this application. Please type or print all requested information clearly.

1. Applicant(s) Name

2.

Social Security Number(s)

3. Trade or Registered Name, if different from above

4.

Connecticut Tax Registration Number

5. Mailing Address

6.

Federal Employer Identification Number

7. City or Town

State

ZIP Code

8 .

Telephone number where you may be reached

during the day.

(

)

9.

Verification Number (See instructions)

Create a four-digit password for your use to verify receipt of your application.

10. Complete Schedule A if you owe tax and have not filed a tax return.

Enter total from Schedule A

10.

11. Complete Schedule B if you underreported tax on a return that was previously filed.

Enter total from Schedule B

11.

12. Complete Schedule C for taxes billed but not paid.

Enter total from Schedule C

12.

13. Total Amount

13.

Important: You must send payment with this application. Your application is not considered to be filed with the Department of Revenue

Services (DRS) until DRS receives payment.

•

Make the check payable to: Commissioner of Revenue Services. Write Amnesty on your check. Writing your Social Security Number(s)

or Connecticut Tax Registration Number on the front of your check will ensure accuracy and timeliness in processing your payment.

•

Mail your check, this application, returns, and supporting documents to:

State of Connecticut

Department of Revenue Services

Tax Amnesty Unit

PO Box 5081

Hartford CT 06102-5081

Declaration: I understand that by signing this Application for Tax Amnesty 2002, I expressly:

1. Concede to being liable for the taxes and interest that I have reported on this application;

2. Waive any and all claims, rights to appeal or in any way pursue an action for any refund of the taxes and interest that I have reported on

this application; and

3. Withdraw and cancel any pending appeal or protest against the Commissioner of Revenue Services for any tax assessment, or portion

of the assessment, that I have reported on this application.

I declare under the penalty of law that I have examined this document (including any accompanying schedules and statement) and, to the

best of my knowledge and belief, it is true, complete, and correct. I have read and understood the conditions (outlined in Form OP-305 I)

under which amnesty is granted and certify that I am eligible for amnesty under these conditions. I understand that the statements I have

made on this application are subject to verification. I understand that the penalty for willfully delivering a false document to DRS is a fine of

not more that $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is

based on all information of which the preparer has any knowledge.

Signature of Applicant

Title (if applicable)

Date

Signature of Applicant

Title (if applicable)

Date

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4