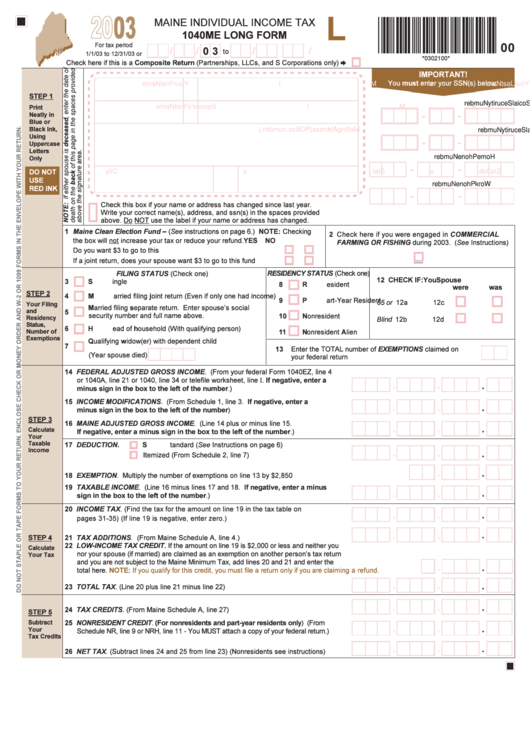

1040me Long Form - Maine Individual Income Tax - 2003

ADVERTISEMENT

*0302100*

L

MAINE INDIVIDUAL INCOME TAX

1040ME LONG FORM

00

For tax period

0 3

/

/

to

/

/

1/1/03 to 12/31/03 or

*0302100*

Check here if this is a Composite Return (Partnerships, LLCs, and S Corporations only)

è

IMPORTANT!

You must enter your SSN(s) below.

Y

o

r u

F

r i

t s

N

a

m

e

M

I

Y

o

r u

L

a

t s

N

a

m

e

STEP 1

o Y

r u

S

c o

l a i

S

c e

r u

y t i

N

u

m

b

r e

Print

S

p

o

s u

e

s '

F

r i

t s

N

a

m

e

M

I

S

p

o

s u

e

s '

L

a

t s

N

a

m

e

Neatly in

-

-

Blue or

Black Ink,

M

i a

n i l

g

A

d

d

e r

s s

P (

O

B

o

, x

n

u

m

b

e

, r

t s

e r

t e

a

n

d

a

p

. t

n

o

) .

S

p

o

u

e s

s '

S

c o

l a i

S

c e

r u

y t i

N

u

m

b

r e

Using

-

-

Uppercase

Letters

H

o

m

e

P

o h

e n

N

u

m

b

r e

Only

-

-

DO NOT

C

y t i

S

a t

e t

Z

p i

C

o

d

e

USE

W

o

k r

P

o h

e n

N

u

m

b

r e

RED INK

-

-

Check this box if your name or address has changed since last year.

Write your correct name(s), address, and ssn(s) in the spaces provided

above. Do NOT use the label if your name or address has changed.

1 Maine Clean Election Fund – (See instructions on page 6.) NOTE: Checking

2 Check here if you were engaged in COMMERCIAL

the box will not increase your tax or reduce your refund.

YES

NO

FARMING OR FISHING during 2003. (See Instructions)

Do you want $3 to go to this fund .......................................................

If a joint return, does your spouse want $3 to go to this fund ............

FILING STATUS (Check one)

RESIDENCY STATUS (Check one)

12 CHECK IF:

You

Spouse

3

Single

8

Resident

were

was

STEP 2

4

Married filing joint return (Even if only one had income)

9

Part-Year Resident

65 or over ............... 12a

12c

Your Filing

Married filing separate return. Enter spouse’s social

and

5

security number and full name above.

10

Nonresident

Residency

Blind ....................... 12b

12d

Status,

6

Head of household (With qualifying person)

Number of

11

Nonresident Alien

Exemptions

Qualifying widow(er) with dependent child

7

13

Enter the TOTAL number of EXEMPTIONS claimed on

(Year spouse died

)

your federal return ...............................................................

14 FEDERAL ADJUSTED GROSS INCOME. (From your federal Form 1040EZ, line 4

or 1040A, line 21 or 1040, line 34 or telefile worksheet, line I. If negative, enter a

.

,

,

minus sign in the box to the left of the number.) ...................................................... 14

15 INCOME MODIFICATIONS. (From Schedule 1, line 3. If negative, enter a

.

,

,

minus sign in the box to the left of the number) ....................................................... 15

STEP 3

16 MAINE ADJUSTED GROSS INCOME. (Line 14 plus or minus line 15.

.

,

,

Calculate

If negative, enter a minus sign in the box to the left of the number.) ..................... 16

Your

Taxable

17 DEDUCTION.

Standard (See Instructions on page 6)

Income

.

,

,

Itemized (From Schedule 2, line 7) .............................................. 17

.

,

18 EXEMPTION. Multiply the number of exemptions on line 13 by $2,850 ..................................................... 18

19 TAXABLE INCOME. (Line 16 minus lines 17 and 18. If negative, enter a minus

.

,

,

sign in the box to the left of the number.) .................................................................. 19

20 INCOME TAX. (Find the tax for the amount on line 19 in the tax table on

.

,

,

pages 31-35) (If line 19 is negative, enter zero.) .......................................................... 20

.

,

,

STEP 4

21 TAX ADDITIONS. (From Maine Schedule A, line 4.) ................................................... 21

22 LOW-INCOME TAX CREDIT. If the amount on line 19 is $2,000 or less and neither you

Calculate

nor your spouse (if married) are claimed as an exemption on another person’s tax return

Your Tax

and you are not subject to the Maine Minimum Tax, add lines 20 and 21 and enter the

.

,

total here.

NOTE: If you qualify for this credit, you must file a return only if you are claiming a refund.

........... 22

.

,

,

23 TOTAL TAX. (Line 20 plus line 21 minus line 22) ......................................................... 23

.

,

,

24 TAX CREDITS. (From Maine Schedule A, line 27) ........................................................ 24

STEP 5

Subtract

25 NONRESIDENT CREDIT. (For nonresidents and part-year residents only) (From

.

,

,

Your

Schedule NR, line 9 or NRH, line 11 - You MUST attach a copy of your federal return.) .... 25

Tax Credits

.

,

,

26 NET TAX. (Subtract lines 24 and 25 from line 23) (Nonresidents see instructions) ...... 26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4