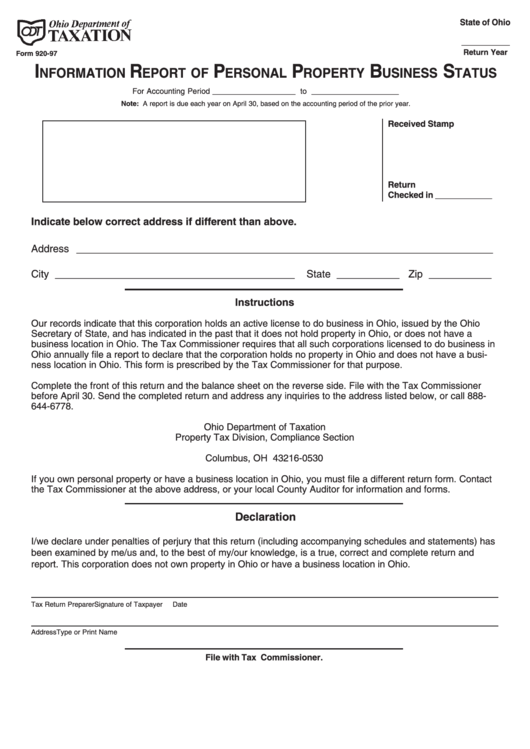

Form 920-97 - Information Report Of Personal Property Business Status

ADVERTISEMENT

State of Ohio

___________

Return Year

Form 920-97

I

R

P

P

B

S

NFORMATION

EPORT OF

ERSONAL

ROPERTY

USINESS

TATUS

For Accounting Period ___________________ to ____________________

Note: A report is due each year on April 30, based on the accounting period of the prior year.

Received Stamp

Return

Checked in ____________

Indicate below correct address if different than above.

Address _________________________________________________________________________

City __________________________________________

State ___________ Zip ___________

Instructions

Our records indicate that this corporation holds an active license to do business in Ohio, issued by the Ohio

Secretary of State, and has indicated in the past that it does not hold property in Ohio, or does not have a

business location in Ohio. The Tax Commissioner requires that all such corporations licensed to do business in

Ohio annually file a report to declare that the corporation holds no property in Ohio and does not have a busi-

ness location in Ohio. This form is prescribed by the Tax Commissioner for that purpose.

Complete the front of this return and the balance sheet on the reverse side. File with the Tax Commissioner

before April 30. Send the completed return and address any inquiries to the address listed below, or call 888-

644-6778.

Ohio Department of Taxation

Property Tax Division, Compliance Section

P.O. Box 530

Columbus, OH 43216-0530

If you own personal property or have a business location in Ohio, you must file a different return form. Contact

the Tax Commissioner at the above address, or your local County Auditor for information and forms.

Declaration

I/we declare under penalties of perjury that this return (including accompanying schedules and statements) has

been examined by me/us and, to the best of my/our knowledge, is a true, correct and complete return and

report. This corporation does not own property in Ohio or have a business location in Ohio.

Tax Return Preparer

Signature of Taxpayer

Date

Address

Type or Print Name

File with Tax Commissioner.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1