Application For Tax Abatement Of Revitalized Structures - Fairfax County

ADVERTISEMENT

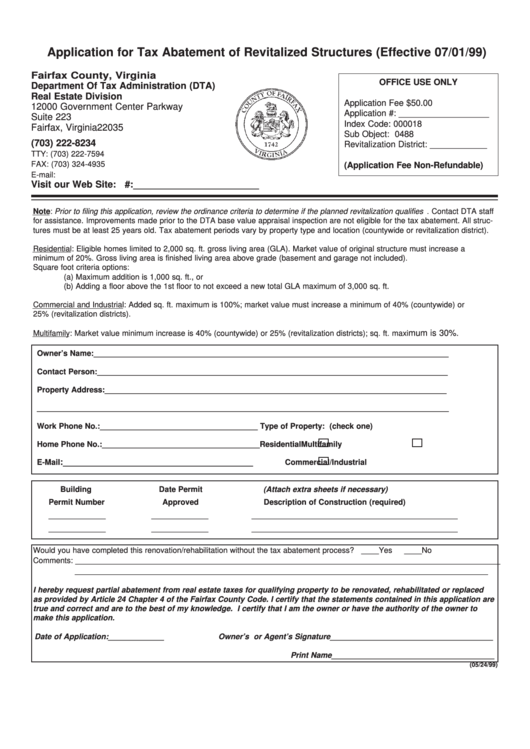

Application for Tax Abatement of Revitalized Structures (Effective 07/01/99)

Fairfax County, Virginia

OFFICE USE ONLY

Department Of Tax Administration (DTA)

Real Estate Division

Application Fee $50.00

12000 Government Center Parkway

Application #: ___________________

Suite 223

Index Code: 000018

Fairfax, Virginia 22035

Sub Object: 0488

(703) 222-8234

Revitalization District: ____________

TTY: (703) 222-7594

FAX: (703) 324-4935

(Application Fee Non-Refundable)

E-mail: dtared@co.fairfax.va.us

Visit our Web Site:

Tax Map Reference #:________________________

Note: Prior to filing this application, review the ordinance criteria to determine if the planned revitalization qualifies . Contact DTA staff

for assistance. Improvements made prior to the DTA base value appraisal inspection are not eligible for the tax abatement. All struc-

tures must be at least 25 years old. Tax abatement periods vary by property type and location (countywide or revitalization district).

Residential: Eligible homes limited to 2,000 sq. ft. gross living area (GLA). Market value of original structure must increase a

minimum of 20%. Gross living area is finished living area above grade (basement and garage not included).

Square foot criteria options:

(a) Maximum addition is 1,000 sq. ft., or

(b) Adding a floor above the 1st floor to not exceed a new total GLA maximum of 3,000 sq. ft.

Commercial and Industrial: Added sq. ft. maximum is 100%; market value must increase a minimum of 40% (countywide) or

25% (revitalization districts).

mum is 30%.

Multifamily: Market value minimum increase is 40% (countywide) or 25% (revitalization districts); sq. ft. maxi

Owner’s Name:_________________________________________________________________________________

Contact Person:________________________________________________________________________________

Property Address:______________________________________________________________________________

______________________________________________________________________________________________

Work Phone No.:____________________________________

Type of Property: (check one)

Home Phone No.:____________________________________

Residential

Multifamily

:________________________________________

E-Mail

Commercial/Industrial

Building

Date Permit

(Attach extra sheets if necessary)

Permit Number

Approved

Description of Construction (required)

_____________

_____________

_______________________________________________

_____________

_____________

_______________________________________________

Would you have completed this renovation/rehabilitation without the tax abatement process? ____Yes

____No

Comments: _________________________________________________________________________________________________

_______________________________________________________________________________________

I hereby request partial abatement from real estate taxes for qualifying property to be renovated, rehabilitated or replaced

as provided by Article 24 Chapter 4 of the Fairfax County Code. I certify that the statements contained in this application are

true and correct and are to the best of my knowledge. I certify that I am the owner or have the authority of the owner to

make this application.

Date of Application:_____________

Owner’s or Agent’s Signature______________________________________

Print Name______________________________________

(05/24/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1