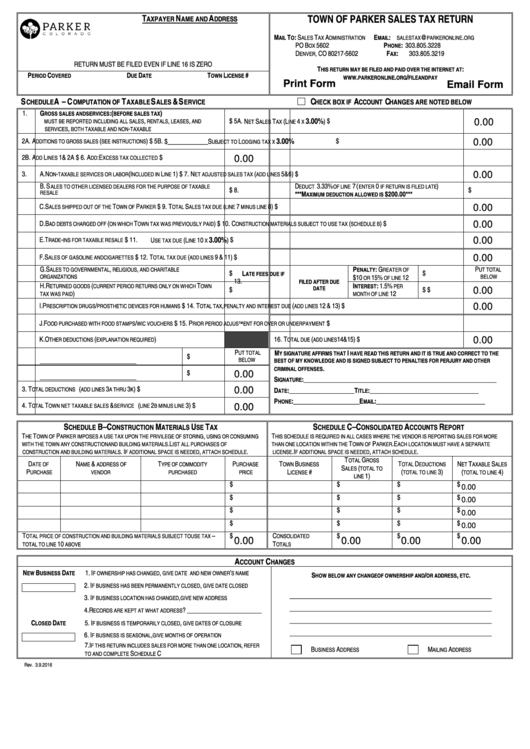

Town Of Parker Sales Tax Return

Download a blank fillable Town Of Parker Sales Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Town Of Parker Sales Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

TOWN OF PARKER SALES TAX RETURN

T

N

A

AXPAYER

AME AND

DDRESS

M

T

: S

T

A

E

:

@

.

AIL

O

ALES

AX

DMINISTRATION

MAIL

SALESTAX

PARKERONLINE

ORG

PO B

5602

P

: 303.805.3228

HONE

OX

F

:

D

, CO 80217-5602

303.805.3219

AX

ENVER

RETURN MUST BE FILED EVEN IF LINE 16 IS ZERO

T

:

HIS RETURN MAY BE FILED AND PAID OVER THE INTERNET AT

P

C

D

D

T

L

#

ERIOD

OVERED

UE

ATE

OWN

ICENSE

.

.

/

WWW

PARKERONLINE

ORG

FILEANDPAY

Print Form

Email Form

S

A – C

T

S

& S

C

A

C

CHEDULE

OMPUTATION OF

AXABLE

ALES

ERVICE

HECK BOX IF

CCOUNT

HANGES ARE NOTED BELOW

1.

G

: (

)

ROSS SALES AND SERVICES

BEFORE SALES TAX

3.00%

,

,

,

$

5A.

$

N

S

T

(L

4

)

MUST BE REPORTED INCLUDING ALL SALES

RENTALS

LEASES

AND

ET

ALES

AX

INE

X

0.00

,

-

SERVICES

BOTH TAXABLE AND NON

TAXABLE

3.00%

2A.

A

(

)

$

5B.

$

$_____________ S

L

DDITIONS TO GROSS SALES

SEE INSTRUCTIONS

UBJECT TO

ODGING TAX X

0.00

2B.

A

L

1 & 2A

$

6.

A

: E

$

DD

INES

DD

XCESS TAX COLLECTED

0.00

3.

A. N

-

(I

L

1)

$

7.

N

(

5&6)

$

ON

TAXABLE SERVICES OR LABOR

NCLUDED IN

INE

ET ADJUSTED SALES TAX

ADD LINES

0.00

B. S

D

3.33%

7 (

0

)

ALES TO OTHER LICENSED DEALERS FOR THE PURPOSE OF TAXABLE

EDUCT

OF LINE

ENTER

IF RETURN IS FILED LATE

$

8.

$

***M

$200.00***

RESALE

AXIMUM DEDUCTION ALLOWED IS

C. S

T

P

$

9.

T

S

(

7

8)

$

ALES SHIPPED OUT OF THE

OWN OF

ARKER

OTAL

ALES TAX DUE

LINE

MINUS LINE

0.00

D. B

(

T

)

$

10.

C

(

)

$

AD DEBTS CHARGED OFF

ON WHICH

OWN TAX WAS PREVIOUSLY PAID

ONSTRUCTION MATERIALS SUBJECT TO USE TAX

SCHEDULE B

0.00

3.00%

E. T

-

$

11.

$

U

(L

10

)

RADE

INS FOR TAXABLE RESALE

SE TAX DUE

INE

X

0.00

F. S

$

12.

T

(

9 & 11)

$

ALES OF GASOLINE AND CIGARETTES

OTAL TAX DUE

ADD LINES

0.00

G. S

,

,

P

: G

P

ENALTY

ALES TO GOVERNMENTAL

RELIGIOUS

AND CHARITABLE

REATER OF

UT TOTAL

$

L

$

ATE FEES DUE IF

$10

15%

12

ORGANIZATIONS

OR

OF LINE

BELOW

13.

FILED AFTER DUE

H. R

(

T

I

: 1.5%

ETURNED GOODS

CURRENT PERIOD RETURNS ONLY ON WHICH

OWN

NTEREST

PER

$

$

$

DATE

0.00

)

12

TAX WAS PAID

MONTH OF LINE

I. P

/

$

14.

T

,

(

12 & 13)

$

RESCRIPTION DRUGS

PROSTHETIC DEVICES FOR HUMANS

OTAL TAX

PENALTY AND INTEREST DUE

ADD LINES

0.00

J. F

/

$

15.

P

$

OOD PURCHASED WITH FOOD STAMPS

WIC VOUCHERS

RIOR PERIOD ADJUSTMENT FOR OVER OR UNDERPAYMENT

K. O

(

)

16.

T

(

14 & 15)

$

THER DEDUCTIONS

EXPLANATION REQUIRED

OTAL DUE

ADD LINES

0.00

M

I

P

UT TOTAL

Y SIGNATURE AFFIRMS THAT

HAVE READ THIS RETURN AND IT IS TRUE AND CORRECT TO THE

$

_______________________________

BELOW

BEST OF MY KNOWLEDGE AND IS SIGNED SUBJECT TO PENALTIES FOR PERJURY AND OTHER

.

CRIMINAL OFFENSES

$

0.00

_______________________________

S

: ______________________________________________________________

IGNATURE

3.

T

(

3

3

)

$

D

: _____________________

T

: ___________________________________

OTAL DEDUCTIONS

ADD LINES

A THRU

K

ATE

ITLE

0.00

P

: _____________________

E

: ___________________________________

HONE

MAIL

4.

T

T

&

(

2

3)

$

OTAL

OWN NET TAXABLE SALES

SERVICE

LINE

B MINUS LINE

0.00

S

B – C

M

U

T

S

C – C

A

R

CHEDULE

ONSTRUCTION

ATERIALS

SE

AX

CHEDULE

ONSOLIDATED

CCOUNTS

EPORT

T

T

P

,

T

HE

OWN OF

ARKER IMPOSES A USE TAX UPON THE PRIVILEGE OF STORING

USING OR CONSUMING

HIS SCHEDULE IS REQUIRED IN ALL CASES WHERE THE VENDOR IS REPORTING SALES FOR MORE

. L

T

P

. E

WITH THE TOWN ANY CONSTRUCTION AND BUILDING MATERIALS

IST ALL PURCHASES OF

THAN ONE LOCATION WITHIN THE

OWN OF

ARKER

ACH LOCATION MUST HAVE A SEPARATE

. I

,

.

. I

,

.

CONSTRUCTION AND BUILDING MATERIALS

F ADDITIONAL SPACE IS NEEDED

ATTACH SCHEDULE

LICENSE

F ADDITIONAL SPACE IS NEEDED

ATTACH SCHEDULE

T

G

OTAL

ROSS

D

N

&

T

P

T

B

T

D

N

T

S

ATE OF

AME

ADDRESS OF

YPE OF COMMODITY

URCHASE

OWN

USINESS

OTAL

EDUCTIONS

ET

AXABLE

ALES

S

(

ALES

TOTAL TO

P

L

#

(

3)

(

4)

URCHASE

VENDOR

PURCHASED

PRICE

ICENSE

TOTAL TO LINE

TOTAL TO LINE

1)

LINE

$

$

$

$

0.00

$

$

$

$

0.00

$

$

$

$

0.00

$

$

$

$

0.00

T

–

$

C

$

$

$

OTAL PRICE OF CONSTRUCTION AND BUILDING MATERIALS SUBJECT TO USE TAX

ONSOLIDATED

0.00

0.00

0.00

0.00

10

T

TOTAL TO LINE

ABOVE

OTALS

A

C

CCOUNT

HANGES

N

B

D

1. I

,

’

EW

USINESS

ATE

F OWNERSHIP HAS CHANGED

GIVE DATE AND NEW OWNER

S NAME

S

/

,

.

HOW BELOW ANY CHANGE OF OWNERSHIP AND

OR ADDRESS

ETC

2. I

,

F BUSINESS HAS BEEN PERMANENTLY CLOSED

GIVE DATE CLOSED

_________________________________________________________________

3. I

,

F BUSINESS LOCATION HAS CHANGED

GIVE NEW ADDRESS

_________________________________________________________________

4. R

? ________________________

ECORDS ARE KEPT AT WHAT ADDRESS

_________________________________________________________________

C

D

5. I

,

LOSED

ATE

F BUSINESS IS TEMPORARILY CLOSED

GIVE DATES OF CLOSURE

_________________________________________________________________

6. I

,

F BUSINESS IS SEASONAL

GIVE MONTHS OF OPERATION

7.I

,

F THIS RETURN INCLUDES SALES FOR MORE THAN ONE LOCATION

REFER

B

A

M

A

USINESS

DDRESS

AILING

DDRESS

S

C

TO AND COMPLETE

CHEDULE

Rev. 3.9.2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1