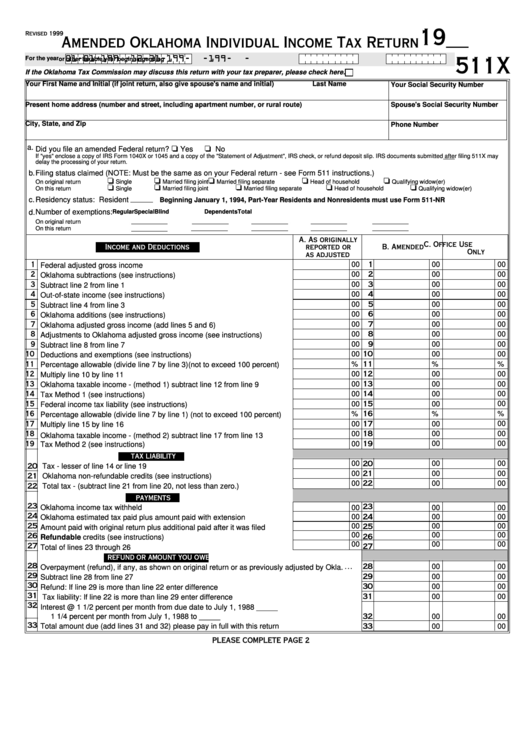

Form 511x - Amended Oklahoma Individual Income Tax Return

ADVERTISEMENT

Revised 1999

19__

Amended Oklahoma Individual Income Tax Return

For the year

01-01-199 -12-31-199

-

-199

-

-

or other taxable year beginning

ending

511X

If the Oklahoma Tax Commission may discuss this return with your tax preparer, please check here.

Your First Name and Initial (if joint return, also give spouse's name and initial)

Last Name

Your Social Security Number

Present home address (number and street, including apartment number, or rural route)

Spouse's Social Security Number

City, State, and Zip

Phone Number

a.

Did you file an amended Federal return?

Yes

No

If "yes" enclose a copy of IRS Form 1040X or 1045 and a copy of the "Statement of Adjustment", IRS check, or refund deposit slip. IRS documents submitted after filing 511X may

delay the processing of your return.

b.

Filing status claimed (NOTE: Must be the same as on your Federal return - see Form 511 instructions.)

On original return

Single

Married filing joint

Married filing separate

Head of household

Qualifying widow(er)

On this return

Single

Married filing joint

Married filing separate

Head of household

Qualifying widow(er)

c.

Residency status: Resident

Beginning January 1, 1994, Part-Year Residents and Nonresidents must use Form 511-NR

d.

Number of exemptions:

Regular

Special

Blind

Dependents

Total

On original return

On this return

A. As originally

C. Office Use

Income and Deductions

reported or

B. Amended

Only

as adjusted

00

00

00

1

Federal adjusted gross income

1

.....................................................................................

00

00

00

2

Oklahoma subtractions (see instructions)

2

................................................................................

00

00

00

3

Subtract line 2 from line 1

3

..........................................................................

00

00

00

4

Out-of-state income (see instructions)

4

....................................................

00

00

00

5

Subtract line 4 from line 3

5

.........................................................................

00

00

00

6

Oklahoma additions (see instructions)

6

....................................................

00

00

00

7

Oklahoma adjusted gross income (add lines 5 and 6)

7

...............................................

00

00

00

8

Adjustments to Oklahoma adjusted gross income (see instructions)

8

.............

00

00

00

9

Subtract line 8 from line 7

9

.........................................................................

00

00

00

10

Deductions and exemptions (see instructions)

10

..................................................................

%

%

%

11

Percentage allowable (divide line 7 by line 3)(not to exceed 100 percent)

11

00

00

00

12

Multiply line 10 by line 11

12

.........................................................................

00

00

00

13

Oklahoma taxable income - (method 1) subtract line 12 from line 9

13

...........

00

00

00

14

Tax Method 1 (see instructions)

14

.........................................................................

00

00

00

15

Federal income tax liability (see instructions)

15

.....................................................................

%

%

%

16

Percentage allowable (divide line 7 by line 1) (not to exceed 100 percent)

16

00

00

00

17

Multiply line 15 by line 16

17

.........................................................................

00

00

00

18

18

..........

Oklahoma taxable income - (method 2) subtract line 17 from line 13

00

00

00

19

Tax Method 2 (see instructions)

19

.........................................................................

TAX LIABILITY

00

00

00

20

Tax - lesser of line 14 or line 19

.........................................................................

20

00

00

00

21

Oklahoma non-refundable credits (see instructions)

.................................................

21

00

00

00

22

Total tax - (subtract line 21 from line 20, not less than zero.)

...........................

22

PAYMENTS

23

.........................................................................

Oklahoma income tax withheld

00

23

00

00

24

00

00

00

......................

Oklahoma estimated tax paid plus amount paid with extension

24

00

00

00

25

.......

Amount paid with original return plus additional paid after it was filed

25

00

00

00

26

.........................................................................

Refundable credits (see instructions)

26

00

00

00

27

.........................................................................

Total of lines 23 through 26

27

REFUND OR AMOUNT YOU OWE

28

...

00

00

Overpayment (refund), if any, as shown on original return or as previously adjusted by Okla.

28

29

......................................................................................

00

00

Subtract line 28 from line 27

29

30

00

00

Refund: If line 29 is more than line 22 enter difference

.........................................................................

30

31

00

00

Tax liability: If line 22 is more than line 29 enter difference

.........................................................................

31

32

Interest @ 1 1/2 percent per month from due date to July 1, 1988 _____

1 1/4 percent per month from July 1, 1988 to _____

.........................................................................

00

00

32

33

Total amount due (add lines 31 and 32) please pay in full with this return

....................................................

00

00

33

PLEASE COMPLETE PAGE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2