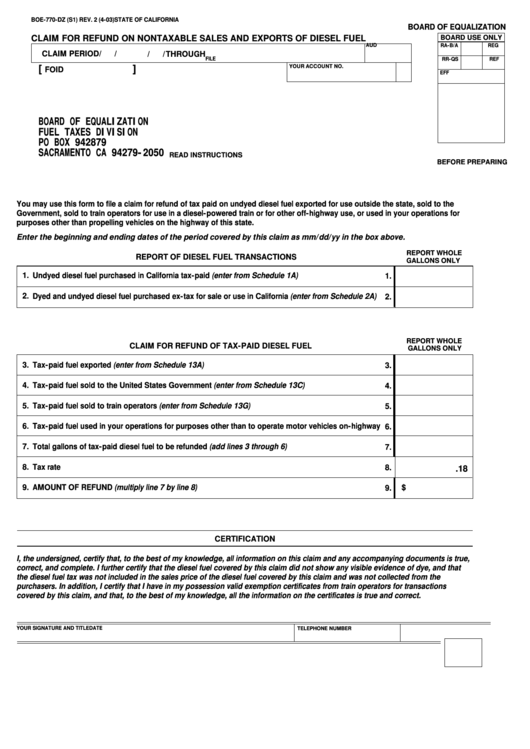

BOE-770-DZ (S1) REV. 2 (4-03)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

CLAIM FOR REFUND ON NONTAXABLE SALES AND EXPORTS OF DIESEL FUEL

BOARD USE ONLY

RA-B/A

AUD

REG

CLAIM PERIOD

/

/

THROUGH

/

/

RR-QS

FILE

REF

[

]

YOUR ACCOUNT NO.

FOID

EFF

BOARD OF EQUALIZATION

FUEL TAXES DIVISION

PO BOX 942879

SACRAMENTO CA 94279-2050

READ INSTRUCTIONS

BEFORE PREPARING

You may use this form to file a claim for refund of tax paid on undyed diesel fuel exported for use outside the state, sold to the U.S.

Government, sold to train operators for use in a diesel-powered train or for other off-highway use, or used in your operations for

purposes other than propelling vehicles on the highway of this state.

Enter the beginning and ending dates of the period covered by this claim as mm/dd/yy in the box above.

REPORT WHOLE

REPORT OF DIESEL FUEL TRANSACTIONS

GALLONS ONLY

1.

Undyed diesel fuel purchased in California tax-paid (enter from Schedule 1A)

1.

2.

Dyed and undyed diesel fuel purchased ex-tax for sale or use in California (enter from Schedule 2A)

2.

REPORT WHOLE

CLAIM FOR REFUND OF TAX-PAID DIESEL FUEL

GALLONS ONLY

3.

Tax-paid fuel exported (enter from Schedule 13A)

3.

4.

Tax-paid fuel sold to the United States Government (enter from Schedule 13C)

4.

5.

Tax-paid fuel sold to train operators (enter from Schedule 13G)

5.

6.

Tax-paid fuel used in your operations for purposes other than to operate motor vehicles on-highway

6.

7.

Total gallons of tax-paid diesel fuel to be refunded (add lines 3 through 6)

7.

8.

Tax rate

8.

.18

9.

AMOUNT OF REFUND (multiply line 7 by line 8)

9.

$

CERTIFICATION

I, the undersigned, certify that, to the best of my knowledge, all information on this claim and any accompanying documents is true,

correct, and complete. I further certify that the diesel fuel covered by this claim did not show any visible evidence of dye, and that

the diesel fuel tax was not included in the sales price of the diesel fuel covered by this claim and was not collected from the

purchasers. In addition, I certify that I have in my possession valid exemption certificates from train operators for transactions

covered by this claim, and that, to the best of my knowledge, all the information on the certificates is true and correct.

YOUR SIGNATURE AND TITLE

DATE

TELEPHONE NUMBER

CONTINUE

1

1 2

2 3

3 4

4 5

5