Instruction For Form 140 Schedule A Itemized Deduction Adjustments

ADVERTISEMENT

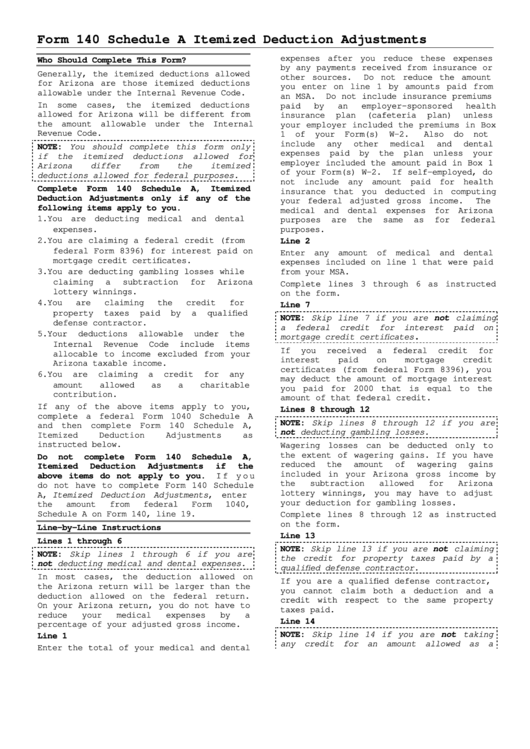

Form 140 Schedule A Itemized Deduction Adjustments

expenses after you reduce these expenses

Who Should Complete This Form?

by any payments received from insurance or

Generally, the itemized deductions allowed

other sources.

Do not reduce the amount

for Arizona are those itemized deductions

you enter on line 1 by amounts paid from

allowable under the Internal Revenue Code.

an MSA.

Do not include insurance premiums

In

some

cases,

the

itemized

deductions

paid

by

an

employer-sponsored

health

allowed for Arizona will be different from

insurance

plan

(cafeteria

plan)

unless

the amount allowable under the Internal

your employer included the premiums in Box

Revenue Code.

1

of

your

Form(s)

W-2.

Also

do

not

include

any

other

medical

and

dental

NOTE: You should complete this form only

expenses

paid

by

the

plan

unless

your

if

the

itemized

deductions

allowed

for

employer included the amount paid in Box 1

Arizona

differ

from

the

itemized

of your Form(s) W-2.

If self-employed, do

deductions allowed for federal purposes.

not include any amount paid for health

Complete

Form

140

Schedule

A,

Itemized

insurance that you deducted in computing

Deduction Adjustments only if any of the

your federal adjusted gross income.

The

following items apply to you.

medical and dental expenses for Arizona

1. You are deducting medical and dental

purposes

are

the

same

as

for

federal

expenses.

purposes.

Line 2

2. You are claiming a federal credit (from

federal Form 8396) for interest paid on

Enter any amount of medical and dental

mortgage credit certificates.

expenses included on line 1 that were paid

from your MSA.

3. You are deducting gambling losses while

claiming

a

subtraction

for

Arizona

Complete lines 3 through 6 as instructed

lottery winnings.

on the form.

4. You

are

claiming

the

credit

for

Line 7

property

taxes

paid

by

a

qualified

NOTE: Skip line 7 if you are not claiming

defense contractor.

a

federal

credit

for

interest

paid

on

5. Your

deductions

allowable

under

the

.

mortgage credit certificates

Internal

Revenue

Code

include

items

If

you

received

a

federal

credit

for

allocable to income excluded from your

interest

paid

on

mortgage

credit

Arizona taxable income.

certificates (from federal Form 8396), you

6. You

are

claiming

a

credit

for

any

may deduct the amount of mortgage interest

amount

allowed

as

a

charitable

you paid for 2000 that is equal to the

contribution.

amount of that federal credit.

If any of the above items apply to you,

Lines 8 through 12

complete a federal Form 1040 Schedule A

NOTE: Skip lines 8 through 12 if you are

and then complete Form 140 Schedule A,

not deducting gambling losses.

Itemized

Deduction

Adjustments

as

instructed below.

Wagering losses can be deducted only to

the extent of wagering gains. If you have

Do

not

complete

Form

140

Schedule

A,

reduced

the

amount

of

wagering

gains

Itemized

Deduction

Adjustments

if

the

included in your Arizona gross income by

above items do not apply to you.

If you

the

subtraction

allowed

for

Arizona

do not have to complete Form 140 Schedule

lottery winnings, you may have to adjust

A, Itemized Deduction Adjustments, enter

your deduction for gambling losses.

the

amount

from

federal

Form

1040,

Schedule A on Form 140, line 19.

Complete lines 8 through 12 as instructed

on the form.

Line-by-Line Instructions

Line 13

Lines 1 through 6

NOTE: Skip line 13 if you are not claiming

NOTE: Skip lines 1 through 6 if you are

the credit for property taxes paid by a

not deducting medical and dental expenses.

qualified defense contractor.

In most cases, the deduction allowed on

If you are a qualified defense contractor,

the Arizona return will be larger than the

you cannot claim both a deduction and a

deduction allowed on the federal return.

credit with respect to the same property

On your Arizona return, you do not have to

taxes paid.

reduce

your

medical

expenses

by

a

Line 14

percentage of your adjusted gross income.

NOTE: Skip line 14 if you are not taking

Line 1

any credit for an amount allowed as a

Enter the total of your medical and dental

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2