Form 32-021 - Iowa Check Form

ADVERTISEMENT

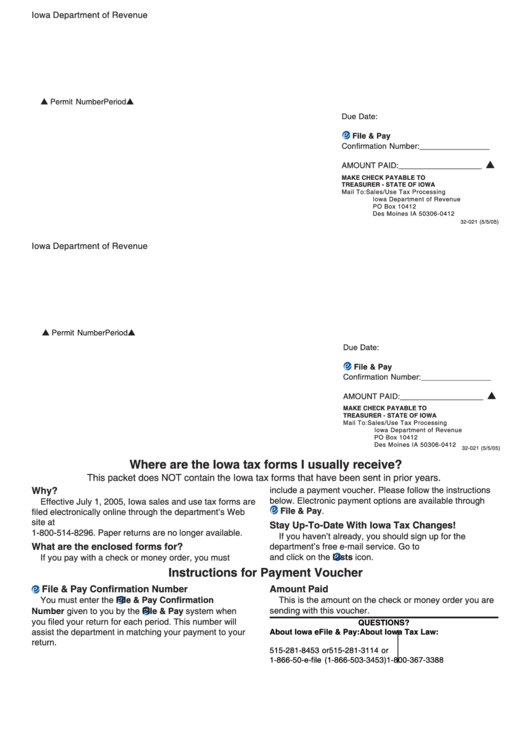

Iowa Department of Revenue

Permit Number

Period

Due Date:

File & Pay

Confirmation Number: ________________

AMOUNT PAID: ___________________

MAKE CHECK PAYABLE TO

TREASURER - STATE OF IOWA

Mail To:

Sales/Use Tax Processing

Iowa Department of Revenue

PO Box 10412

Des Moines IA 50306-0412

32-021 (5/5/05)

Iowa Department of Revenue

Permit Number

Period

Due Date:

File & Pay

Confirmation Number: ________________

AMOUNT PAID: ___________________

MAKE CHECK PAYABLE TO

TREASURER - STATE OF IOWA

Mail To:

Sales/Use Tax Processing

Iowa Department of Revenue

PO Box 10412

Des Moines IA 50306-0412

32-021 (5/5/05)

Where are the Iowa tax forms I usually receive?

This packet does NOT contain the Iowa tax forms that have been sent in prior years.

Why?

include a payment voucher. Please follow the instructions

below. Electronic payment options are available through

Effective July 1, 2005, Iowa sales and use tax forms are

File & Pay.

filed electronically online through the department’s Web

site at or by touch-tone telephone at

Stay Up-To-Date With Iowa Tax Changes!

1-800-514-8296. Paper returns are no longer available.

If you haven’t already, you should sign up for the

What are the enclosed forms for?

department’s free e-mail service. Go to

and click on the

Lists icon.

If you pay with a check or money order, you must

Instructions for Payment Voucher

File & Pay Confirmation Number

Amount Paid

You must enter the

File & Pay Confirmation

This is the amount on the check or money order you are

sending with this voucher.

Number given to you by the

File & Pay system when

you filed your return for each period. This number will

QUESTIONS?

assist the department in matching your payment to your

About Iowa eFile & Pay:

About Iowa Tax Law:

efile@idrf.state.ia.us

idrf@idrf.state.ia.us

return.

515-281-8453 or

515-281-3114 or

1-866-50-e-file (1-866-503-3453)

1-800-367-3388

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1