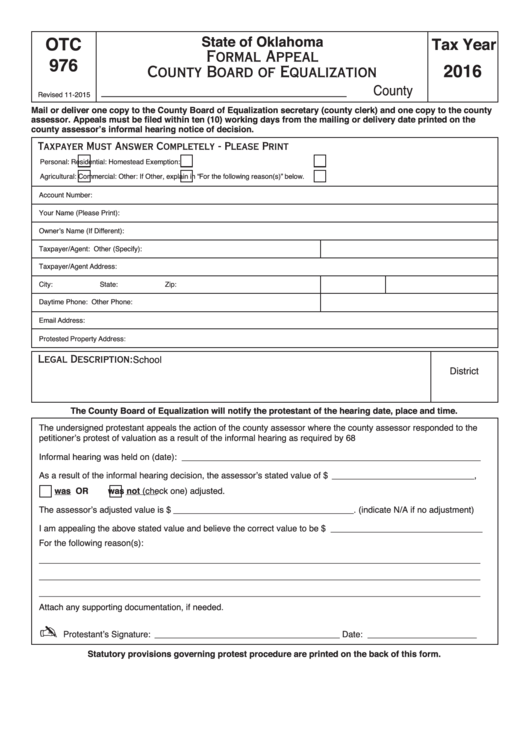

State of Oklahoma

OTC

Tax Year

Formal Appeal

976

2016

County Board of Equalization

________________________________ County

Revised 11-2015

Mail or deliver one copy to the County Board of Equalization secretary (county clerk) and one copy to the county

assessor. Appeals must be filed within ten (10) working days from the mailing or delivery date printed on the

county assessor’s informal hearing notice of decision.

Taxpayer Must Answer Completely - Please Print

Personal:

Residential:

Homestead Exemption:

Agricultural:

Commercial:

Other:

If Other, explain in “For the following reason(s)” below.

Account Number:

Your Name (Please Print):

Owner’s Name (If Different):

Taxpayer/Agent:

Other (Specify):

Taxpayer/Agent Address:

City:

State:

Zip:

Daytime Phone:

Other Phone:

Email Address:

Protested Property Address:

School

Legal Description:

District

The County Board of Equalization will notify the protestant of the hearing date, place and time.

The undersigned protestant appeals the action of the county assessor where the county assessor responded to the

petitioner’s protest of valuation as a result of the informal hearing as required by 68 O.S. Section 2876.

Informal hearing was held on (date): _______________________________________________________________

As a result of the informal hearing decision, the assessor’s stated value of $ ______________________________ ,

was

OR

was not (check one) adjusted.

The assessor’s adjusted value is $ ______________________________________ . (indicate N/A if no adjustment)

I am appealing the above stated value and believe the correct value to be $ ________________________________

For the following reason(s):

_____________________________________________________________________________________________

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Attach any supporting documentation, if needed.

✍

Protestant’s Signature: _______________________________________ Date: _______________________

Statutory provisions governing protest procedure are printed on the back of this form.

1

1 2

2