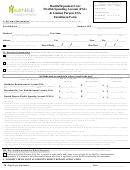

HCA FLEXIBLE SPENDING ACCOUNT

HEALTH CARE EXPENSE CLAIM FORM

1

FAX TO: 303-221-2785

PAGE

OF ________

IT IS NOT NECESSARY TO INCLUDE A COVER SHEET

PLAN & EMPLOYEE INFORMATION

Check here if you have an address or name change

_____________________________

_______________________________

FIRST NAME:

LAST NAME:

3 - 4 HCA ID:

____________________________________________________

________________________________

_______

___________

ADDRESS:

CITY:

STATE:

ZIP:

_______________________

___________________________________________________

______/______/______

DAYTIME PHONE:

E-MAIL¹:

DATE OF BIRTH:

____________________________________________________________________________________

____________________

FACILITY NAME:

PLAN YEAR:

HEALTH CARE EXPENSES

*****PLEASE DO NOT INCLUDE FSA BENEFITS CARD TRANSACTIONS ON THIS FORM*****

*****PLEASE DO NOT HIGHLIGHT RECEIPTS OR ITEMS ON THIS FORM IF YOU WILL BE FAXING*****

START

END

WHO INCURRED

SERVICE PROVIDER

SERVICE DESCRIPTION

AMOUNT

DATE

DATE

EXPENSE

*TOTAL

* The approved amount of your claim may be reduced by unresolved card transactions that required substantiation.

EXPENSES

st

th

Your employer has adopted the grace period per IRB 2005-42. Expenses incurred during that period (January 1

– March 15

) are eligible for reimbursement from either the

current or the previous FSA plan year. If you are seeking reimbursement for expenses incurred within that period, please mark one of the boxes below to indicate the plan year

from which you would like to be reimbursed. If you do not mark one of the boxes, the previous plan year’s balance will be exhausted.

Reimburse from previous plan year

Reimburse from current plan year

REIMBURSEMENT INFORMATION

Planned Benefit Systems, Inc. will process your reimbursement according to the banking method we currently have on file, either check or direct deposit. If you would like to make

a change, you must submit a completed Reimbursement Authorization Agreement, which can be found on our website at Click on Forms & Legal Notices

and then Forms. Your reimbursement method will remain in effect until an updated authorization form has been received and processed by PBS, which may take up to 10

business days. To ensure your claim is paid using the method of your choice, it is advisable to submit changes well before submitting a request for reimbursement.

Direct deposits normally take 2 business days from the date of initiation. Bank holidays/weekends may affect when the deposit is credited to your account. Please contact your

bank to verify all deposits are received. If you provide us with your email address we will inform you each time a Direct Deposit is initiated. Direct Deposits cannot be posted to

debit or credit cards. Any direct deposit remitted by Planned Benefit Systems, Inc. and not rejected by your bank is deemed a valid reimbursement and will not be adjusted.

EMPLOYEE AUTHORIZATION

To the best of my knowledge and belief, the expenses listed above are accurate, complete and are eligible for reimbursement under the Plan. I certify that these expenses will not

be claimed again when filing IRS form 1040 and that they were incurred for me or my eligible dependents. I certify that these health care expenses have not been reimbursed and

are not reimbursable under any other coverage or employer plans. I certify that if my employer incurs a liability for failure to withhold Federal, State or local, or Social Security

Taxes on one or more of my payments or reimbursements that are not Qualifying Expenses, I will indemnify and reimburse the employer that liability on demand. I further certify

that the over-the-counter expenses claimed above are to alleviate or treat injuries or illnesses and will not be used for cosmetic purposes or for general good health.

PLANNED BENEFIT SYSTEMS CANNOT PROCESS THIS CLAIM WITHOUT A SIGNATURE BELOW

_________________________________________________________

SIGNATURE:

DATE: _____________________________

Planned Benefit Systems, Inc. •

P.O. Box 4594, Greenwood Village, CO 80155-4594

Customer Service 877-888-3539

Fax 303-221-2785

HCA_CF_M_020110

1

1 2

2