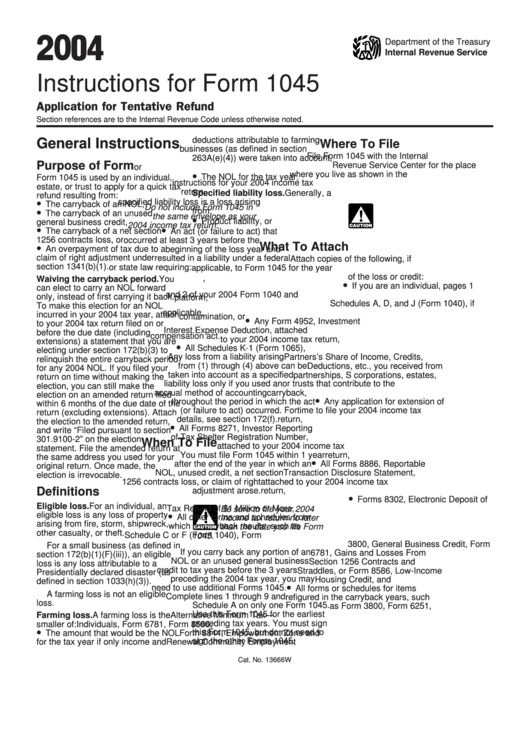

Instructions For Form 1045 - 2004

ADVERTISEMENT

04

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 1045

Application for Tentative Refund

Section references are to the Internal Revenue Code unless otherwise noted.

deductions attributable to farming

General Instructions

Where To File

businesses (as defined in section

File Form 1045 with the Internal

263A(e)(4)) were taken into account,

Purpose of Form

Revenue Service Center for the place

or

•

where you live as shown in the

The NOL for the tax year.

Form 1045 is used by an individual,

instructions for your 2004 income tax

estate, or trust to apply for a quick tax

return.

Specified liability loss. Generally, a

refund resulting from:

•

specified liability loss is a loss arising

The carryback of an NOL,

Do not include Form 1045 in

•

from:

The carryback of an unused

!

the same envelope as your

•

Product liability, or

general business credit,

2004 income tax return.

•

•

CAUTION

The carryback of a net section

An act (or failure to act) that

1256 contracts loss, or

occurred at least 3 years before the

•

What To Attach

An overpayment of tax due to a

beginning of the loss year and

claim of right adjustment under

resulted in a liability under a federal

Attach copies of the following, if

section 1341(b)(1).

or state law requiring:

applicable, to Form 1045 for the year

of the loss or credit:

1. Reclamation of land,

Waiving the carryback period. You

•

If you are an individual, pages 1

can elect to carry an NOL forward

2. Dismantling of a drilling

and 2 of your 2004 Form 1040 and

only, instead of first carrying it back.

platform,

Schedules A, D, and J (Form 1040), if

To make this election for an NOL

3. Remediation of environmental

applicable,

incurred in your 2004 tax year, attach

contamination, or

•

Any Form 4952, Investment

to your 2004 tax return filed on or

4. Payment under any workers

Interest Expense Deduction, attached

before the due date (including

compensation act.

to your 2004 income tax return,

extensions) a statement that you are

•

All Schedules K-1 (Form 1065),

electing under section 172(b)(3) to

Any loss from a liability arising

Partners’s Share of Income, Credits,

relinquish the entire carryback period

from (1) through (4) above can be

Deductions, etc., you received from

for any 2004 NOL. If you filed your

taken into account as a specified

partnerships, S corporations, estates,

return on time without making the

liability loss only if you used an

or trusts that contribute to the

election, you can still make the

accrual method of accounting

carryback,

election on an amended return filed

•

throughout the period in which the act

Any application for extension of

within 6 months of the due date of the

(or failure to act) occurred. For

time to file your 2004 income tax

return (excluding extensions). Attach

details, see section 172(f).

return,

the election to the amended return,

•

All Forms 8271, Investor Reporting

and write “Filed pursuant to section

of Tax Shelter Registration Number,

301.9100-2” on the election

When To File

attached to your 2004 income tax

statement. File the amended return at

You must file Form 1045 within 1 year

return,

the same address you used for your

•

after the end of the year in which an

All Forms 8886, Reportable

original return. Once made, the

NOL, unused credit, a net section

Transaction Disclosure Statement,

election is irrevocable.

1256 contracts loss, or claim of right

attached to your 2004 income tax

Definitions

adjustment arose.

return,

•

Forms 8302, Electronic Deposit of

Eligible loss. For an individual, an

Tax Refund of $1 Million or More,

Be sure to file your 2004

•

eligible loss is any loss of property

!

All other forms and schedules from

income tax return no later

arising from fire, storm, shipwreck,

which a carryback results, such as

than the date you file Form

CAUTION

other casualty, or theft.

Schedule C or F (Form 1040), Form

1045.

3800, General Business Credit, Form

For a small business (as defined in

If you carry back any portion of an

6781, Gains and Losses From

section 172(b)(1)(F)(iii)), an eligible

NOL or an unused general business

Section 1256 Contracts and

loss is any loss attributable to a

credit to tax years before the 3 years

Straddles, or Form 8586, Low-Income

Presidentially declared disaster (as

preceding the 2004 tax year, you may

Housing Credit, and

defined in section 1033(h)(3)).

•

need to use additional Forms 1045.

All forms or schedules for items

A farming loss is not an eligible

Complete lines 1 through 9 and

refigured in the carryback years, such

loss.

Schedule A on only one Form 1045.

as Form 3800, Form 6251,

Use this Form 1045 for the earliest

Farming loss. A farming loss is the

Alternative Minimum Tax —

preceding tax years. You must sign

smaller of:

Individuals, Form 6781, Form 8586,

•

this Form 1045, but do not need to

The amount that would be the NOL

Form 8844, Empowerment Zone and

sign the other Forms 1045.

for the tax year if only income and

Renewal Community Employment

Cat. No. 13666W

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8