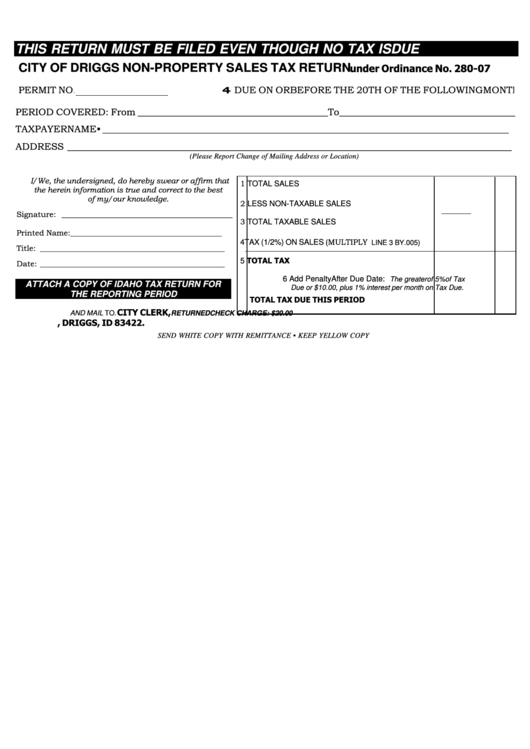

City Of Driggs Non-Property Sales Tax Return

ADVERTISEMENT

THIS RETURN MUST BE FILED EVEN THOUGH NO TAX IS DUE

under Ordinance No. 280-07

CITY OF DRIGGS NON-PROPERTY SALES TAX RETURN

PERMIT NO.

4 DUE ON OR BEFORE THE 20TH OF THE FOLLOWING MONTH

PERIOD COVERED: From ________________________________________ To _____________________________________

TAXPAYER NAME• _____________________________________________________________________________________

ADDRESS _____________________________________________________________________________________________

(Please Report Change of Mailing Address or Location)

I/We, the undersigned, do hereby swear or affirm that

1 TOTAL SALES

the herein information is true and correct to the best

of my/our knowledge.

2 LESS NON-TAXABLE SALES

Signature: ____________________________________________

3 TOTAL TAXABLE SALES

Printed Name: _______________________________________

4 TAX (1/2%) ON SALES (MULTIPLY

LINE 3 BY .005)

Title: _______________________________________________

5 TOTAL TAX

Date: _______________________________________________

6 Add Penalty After Due Date:

The greater of 5% of Tax

ATTACH A COPY OF IDAHO TAX RETURN FOR

Due or $10.00, plus 1% interest per month on Tax Due.

THE REPORTING PERIOD

TOTAL TAX DUE THIS PERIOD

CITY CLERK,

AND MAIL TO.

RETURNED CHECK CHARGE: $20.00

P.O. BOX 48, DRIGGS, ID 83422.

SEND WHITE COPY WITH REMITTANCE • KEEP YELLOW COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1