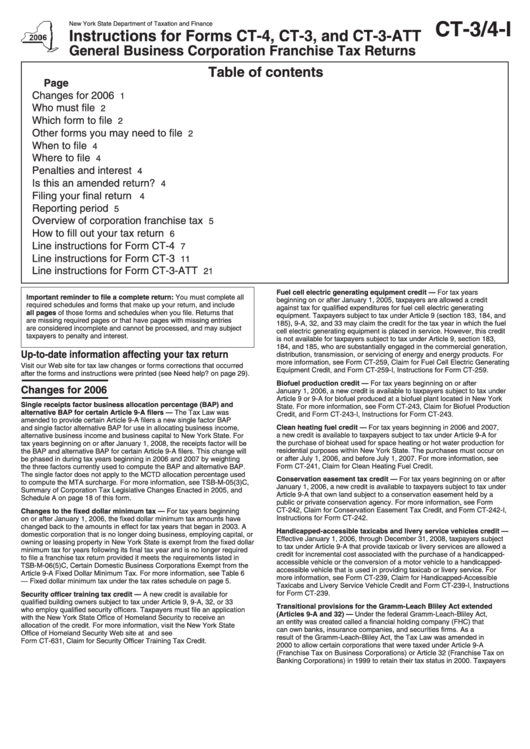

Form Ct-3/4-I - Instructions For Forms Ct-4, Ct-3, And Ct-3-Att - General Business Corporation Franchise Tax Returns - 2006

ADVERTISEMENT

CT-3/4-I

New York State Department of Taxation and Finance

Instructions for Forms CT-4, CT-3, and CT-3-ATT

General Business Corporation Franchise Tax Returns

Table of contents

Page

Changes for 2006 ......................................................................................................................

1

Who must file .............................................................................................................................

2

Which form to file .......................................................................................................................

2

Other forms you may need to file ...............................................................................................

2

When to file ................................................................................................................................

4

Where to file ..............................................................................................................................

4

Penalties and interest ................................................................................................................

4

Is this an amended return? ........................................................................................................

4

Filing your final return ................................................................................................................

4

Reporting period ........................................................................................................................

5

Overview of corporation franchise tax .......................................................................................

5

How to fill out your tax return .....................................................................................................

6

Line instructions for Form CT-4 ..................................................................................................

7

Line instructions for Form CT-3 ..................................................................................................

11

Line instructions for Form CT-3-ATT ..........................................................................................

21

Fuel cell electric generating equipment credit — For tax years

Important reminder to file a complete return: You must complete all

beginning on or after January 1, 2005, taxpayers are allowed a credit

required schedules and forms that make up your return, and include

against tax for qualified expenditures for fuel cell electric generating

all pages of those forms and schedules when you file. Returns that

equipment. Taxpayers subject to tax under Article 9 (section 183, 184, and

are missing required pages or that have pages with missing entries

185), 9-A, 32, and 33 may claim the credit for the tax year in which the fuel

are considered incomplete and cannot be processed, and may subject

cell electric generating equipment is placed in service. However, this credit

taxpayers to penalty and interest.

is not available for taxpayers subject to tax under Article 9, section 183,

184, and 185, who are substantially engaged in the commercial generation,

Up-to-date information affecting your tax return

distribution, transmission, or servicing of energy and energy products. For

more information, see Form CT-259, Claim for Fuel Cell Electric Generating

Visit our Web site for tax law changes or forms corrections that occurred

Equipment Credit, and Form CT-259-I, Instructions for Form CT-259.

after the forms and instructions were printed (see Need help? on page 29).

Biofuel production credit — For tax years beginning on or after

Changes for 2006

January 1, 2006, a new credit is available to taxpayers subject to tax under

Article 9 or 9-A for biofuel produced at a biofuel plant located in New York

Single receipts factor business allocation percentage (BAP) and

State. For more information, see Form CT-243, Claim for Biofuel Production

alternative BAP for certain Article 9-A filers — The Tax Law was

Credit, and Form CT-243-I, Instructions for Form CT-243.

amended to provide certain Article 9-A filers a new single factor BAP

Clean heating fuel credit — For tax years beginning in 2006 and 2007,

and single factor alternative BAP for use in allocating business income,

a new credit is available to taxpayers subject to tax under Article 9-A for

alternative business income and business capital to New York State. For

the purchase of bioheat used for space heating or hot water production for

tax years beginning on or after January 1, 2008, the receipts factor will be

residential purposes within New York State. The purchases must occur on

the BAP and alternative BAP for certain Article 9-A filers. This change will

or after July 1, 2006, and before July 1, 2007. For more information, see

be phased in during tax years beginning in 2006 and 2007 by weighting

Form CT-241, Claim for Clean Heating Fuel Credit.

the three factors currently used to compute the BAP and alternative BAP.

The single factor does not apply to the MCTD allocation percentage used

Conservation easement tax credit — For tax years beginning on or after

to compute the MTA surcharge. For more information, see TSB-M-05(3)C,

January 1, 2006, a new credit is available to taxpayers subject to tax under

Summary of Corporation Tax Legislative Changes Enacted in 2005, and

Article 9-A that own land subject to a conservation easement held by a

Schedule A on page 18 of this form.

public or private conservation agency. For more information, see Form

CT-242, Claim for Conservation Easement Tax Credit, and Form CT-242-I,

Changes to the fixed dollar minimum tax — For tax years beginning

Instructions for Form CT-242.

on or after January 1, 2006, the fixed dollar minimum tax amounts have

changed back to the amounts in effect for tax years that began in 2003. A

Handicapped-accessible taxicabs and livery service vehicles credit —

domestic corporation that is no longer doing business, employing capital, or

Effective January 1, 2006, through December 31, 2008, taxpayers subject

owning or leasing property in New York State is exempt from the fixed dollar

to tax under Article 9-A that provide taxicab or livery services are allowed a

minimum tax for years following its final tax year and is no longer required

credit for incremental cost associated with the purchase of a handicapped-

to file a franchise tax return provided it meets the requirements listed in

accessible vehicle or the conversion of a motor vehicle to a handicapped-

TSB-M-06(5)C, Certain Domestic Business Corporations Exempt from the

accessible vehicle that is used in providing taxicab or livery service. For

Article 9-A Fixed Dollar Minimum Tax. For more information, see Table 6

more information, see Form CT-239, Claim for Handicapped-Accessible

— Fixed dollar minimum tax under the tax rates schedule on page 5.

Taxicabs and Livery Service Vehicle Credit and Form CT-239-I, Instructions

for Form CT-239.

Security officer training tax credit — A new credit is available for

qualified building owners subject to tax under Article 9, 9-A, 32, or 33

Transitional provisions for the Gramm-Leach Bliley Act extended

who employ qualified security officers. Taxpayers must file an application

(Articles 9-A and 32) — Under the federal Gramm-Leach-Bliley Act,

with the New York State Office of Homeland Security to receive an

an entity was created called a financial holding company (FHC) that

allocation of the credit. For more information, visit the New York State

can own banks, insurance companies, and securities firms. As a

Office of Homeland Security Web site at and see

result of the Gramm-Leach-Bliley Act, the Tax Law was amended in

Form CT-631, Claim for Security Officer Training Tax Credit.

2000 to allow certain corporations that were taxed under Article 9-A

(Franchise Tax on Business Corporations) or Article 32 (Franchise Tax on

Banking Corporations) in 1999 to retain their tax status in 2000. Taxpayers

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14